Onboard Verified Sellers in Seconds, Not Days

A Global KYB (Know Your Business) solution. Verify tax status and business existence before you make a single payout.

The Manual Onboarding Bottleneck

Manual document collection slows down seller activation. Fake merchants risk your platform's reputation and banking relationships. Traditional verification takes 3-7 days, losing you sellers to competitors.

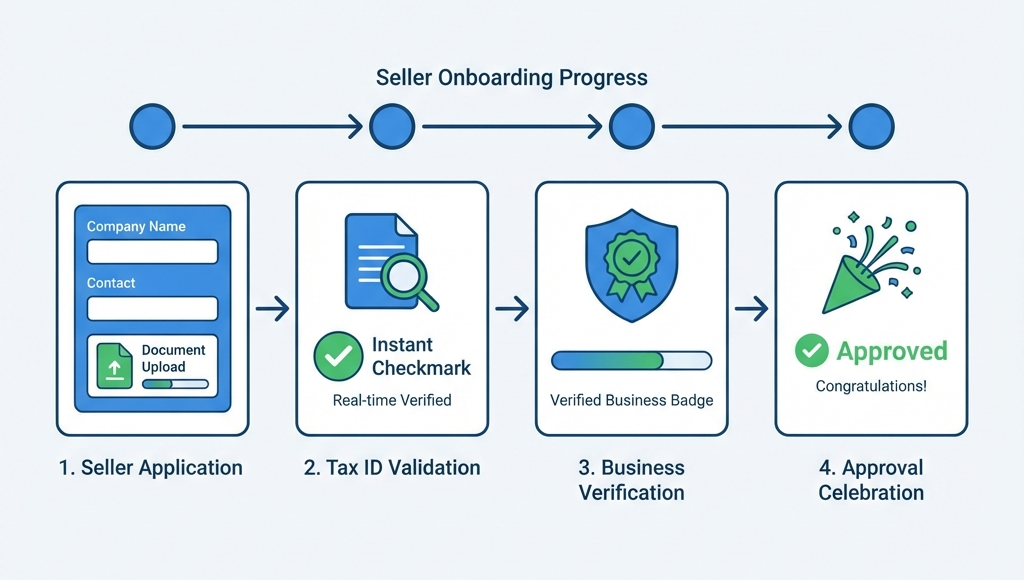

How It Works

Seller Enters Tax ID

During sign-up, seller provides their business Tax ID (EIN, VAT, GSTIN, etc.)

Real-Time Validation

Lookuptax pings the government database in <1 second

Status Confirmation

Receive Active/Inactive status and additional business details

Instant Approval

Approve seller for payouts automatically or flag for manual review

Smart Verification Features

Built-in intelligence for accurate seller verification:

Instant Tax ID validation against official government databases

Support for 100+ countries (VAT, EIN, GSTIN, ABN, and more)

Returns registered business name where available from public official sources

Batch processing for onboarding multiple sellers at once

Audit trail for compliance documentation

Business Impact

Onboarding Speed

From days of manual checks to instant validation

Countries Covered

Global seller verification from one API

API Response

Real-time validation against official sources

Compliance

Automated audit trail for regulators

Built For These Industries

Learn More

Ready to Implement This Solution?

Start validating Tax IDs in under 10 minutes. Free plan available.