· Compliance · 22 min read

The Complete Guide to Business Tax Compliance: Essential Requirements Every Business Must Know in 2026

Essential guide to 2026 business tax compliance covering registration, thresholds, customer validation, and e-invoicing mandates.

Managing tax compliance has become increasingly complex for businesses operating in today’s regulatory environment. With compliance costs reaching over $133 billion annually according to IRS estimates, understanding and implementing proper tax compliance systems isn’t just about avoiding penalties anymore—it’s about building a sustainable foundation for business growth. The landscape has shifted dramatically, with new regulations taking effect throughout 2025 and 2026 that fundamentally change how businesses handle everything from invoice formatting to customer validation.

The good news is that tax compliance, when properly understood and systematically implemented, becomes a manageable rhythm rather than a constant source of stress. This guide walks you through the essential compliance touchpoints that every business needs to master, breaking down complex requirements into actionable steps that protect your business while supporting operational efficiency.

Understanding the Core Compliance Framework

Tax compliance operates through several interconnected systems that create natural checkpoints throughout your business operations. Think of these touchpoints as safety mechanisms that ensure accuracy while building a clear record of your financial activities. Each element serves a specific purpose, and together they form a comprehensive compliance structure that tax authorities use to verify your obligations.

The framework addresses everything from how you register your business initially to how you format invoices, validate customer exemptions, calculate regional taxes, and maintain records for potential audits. Missing or mishandling any single element can trigger penalties, but more importantly, it can create cascading problems that affect your entire operation. Understanding how these pieces fit together transforms compliance from a reactive scramble into a proactive strategy.

Tax Registration: Establishing Your Compliance Foundation

Every business’s compliance journey begins with proper tax registration. This foundational step establishes your legal relationship with tax authorities and determines how you’ll interact with various compliance requirements going forward. The registration process assigns your business an Employer Identification Number from the IRS, which becomes your primary identifier for all federal tax matters.

Beyond federal registration, most businesses also need to register with state and sometimes local tax authorities. Each jurisdiction where you have a physical presence or meet economic nexus thresholds requires separate registration. Economic nexus has fundamentally changed the registration landscape since the South Dakota v. Wayfair decision—many businesses that never thought they’d need multistate registration now find themselves managing obligations across dozens of jurisdictions.

The registration process involves more than just filling out forms. You’re making decisions about your business structure, tax classification, and reporting schedules that will affect your obligations for years to come. S-corporations face different requirements than C-corporations, which differ again from LLCs or partnerships. Getting this right from the start prevents costly restructuring later. Many businesses discover during their first audit that their registration doesn’t align with their actual operations, creating unnecessary complications and potential liabilities.

Registration isn’t a one-time event either. Business changes like opening new locations, reaching sales thresholds in new states, or changing your business structure all trigger new registration requirements. Staying on top of these evolving obligations requires ongoing monitoring of where your business operates and how those jurisdictions define nexus. Some states count a single sale as sufficient for creating nexus, while others have specific dollar or transaction thresholds.

Threshold Monitoring: Staying Ahead of Registration Requirements

Threshold monitoring has become one of the most critical—and often overlooked—aspects of modern tax compliance. Every state with a sales tax now has economic nexus rules, and these thresholds vary significantly. Some states use $100,000 in sales as their trigger, while others might set it at $500,000 or base it on transaction counts rather than dollar amounts. Missing these thresholds doesn’t eliminate your obligation; it just means you’re operating without proper registration, which can result in significant penalties when discovered.

The complexity multiplies when you consider that these thresholds don’t necessarily align with calendar years. You might cross a threshold in September, creating immediate registration obligations even though you haven’t hit the limit for the full year. Some states provide grace periods, allowing businesses a month or quarter to register after crossing the threshold, while others expect registration within days.

Effective threshold monitoring requires real-time tracking of sales by jurisdiction. This goes beyond simple geographic tracking you need to understand each state’s sourcing rules. Where is the sale considered to have occurred? The answer varies by state and product type, affecting which thresholds count toward your nexus obligations. Software solutions have become almost essential for businesses selling across multiple states, as manual tracking simply can’t keep pace with the volume and complexity of transactions.

The 2025-2026 period has seen additional complications with new reporting thresholds. Changes to Form 1099 requirements mean businesses now need to track different thresholds for different reporting purposes. The recent increase in the 1099 reporting threshold to $2,000 (effective for 2026 payments) provides some relief, but you still need systems that can track these amounts accurately across all vendors and contractors.

Customer Validation: Verifying Who You’re Selling To

Customer validation might not seem like a tax issue at first glance, but it’s become increasingly important for compliance. Tax authorities want to know who you’re selling to because it affects what taxes apply, what rates to charge, and whether exemptions are valid. Selling to a government entity, nonprofit organization, or reseller creates different tax obligations than selling to a typical consumer.

The validation process starts with collecting accurate customer information at the point of sale. This includes not just names and addresses but also tax identification numbers for business customers, exemption certificate numbers for tax-exempt organizations, and proper documentation of the customer’s intended use of your products. Many businesses lose significant money during audits because they can’t substantiate that their exempt sales were actually legitimate.

Customer validation extends beyond initial collection to ongoing verification. Business customers change status a nonprofit might lose its exemption, or a reseller might go out of business. If you continue making exempt sales to customers whose status has changed, you become liable for the uncollected tax. Smart validation systems automatically reverify customer status periodically, flagging accounts that need updated documentation.

The digital economy has made customer validation more complex. When customers are located in different jurisdictions than your business, determining the correct tax treatment requires understanding both your customer’s location and status. A single sale might involve customer validation, location verification, product taxability determination, and exemption certificate checking—all before you can accurately calculate what tax to charge. Getting any of these elements wrong doesn’t just affect that sale; it creates audit exposure that could affect your entire customer relationship.

Managing Customer Tax Exemptions: Documentation That Protects Your Business

Tax exemption management deserves special attention because it’s one of the areas where businesses face the most audit scrutiny. When you make a sale without collecting tax, you need documentation proving that exemption was valid. Without proper documentation, you’re liable for the uncollected tax plus penalties and interest, even if the customer was legitimately exempt.

The challenge lies in the sheer variety of exemption scenarios and requirements. There are more than a thousand different exemption certificates in circulation across various states. Each state has preferences about which certificates they accept, and using the wrong form can invalidate your exemption claim. While multistate certificates from the Multistate Tax Commission and Streamlined Sales Tax initiative have helped, they don’t eliminate the need for state specific forms in many situations.

Exemption certificates aren’t permanent documents that you collect once and forget about. Many states require renewal every one to three years, while others have certificates that remain valid indefinitely until circumstances change. Florida requires annual renewal, Connecticut certificates last three years, and Colorado certificates might remain valid until specifically canceled or revoked. Tracking these various expiration timelines across hundreds or thousands of customers requires systematic management.

The validation process itself has become more rigorous. It’s not enough to simply collect a certificate—you need to verify it’s complete, properly signed, dated, and contains all required information. Many states provide online verification tools where you can confirm tax ID numbers are valid. For larger or unusual orders, additional verification steps might be warranted. Remember that accepting a fraudulent or invalid certificate doesn’t protect you from liability; you’re still on the hook for the uncollected tax if the exemption turns out to be invalid.

Best practices for exemption management include collecting certificates at the point of sale rather than trying to obtain them later, immediately reviewing each certificate for completeness, maintaining secure digital storage with easy retrieval systems, and implementing automated renewal tracking. The businesses that handle this well treat exemption certificate management as a core business process, not an afterthought when audit season arrives.

Tax Calculation Based on Regional Settings: Getting the Math Right

Calculating the correct tax amount might seem straightforward, but regional variations create significant complexity. The United States doesn’t have a simple national sales tax instead, we have a patchwork of state, county, city, and special district taxes that can vary from one street to the next. Some locations have combined rates exceeding ten percent, while others have no sales tax at all.

The calculation process requires understanding multiple variables. You need to know the correct tax rate for your customer’s location, which products or services are taxable in that jurisdiction, whether any exemptions apply, and how to handle bundled transactions that might include both taxable and exempt items. Many states have different rates for different product categories a lower rate for groceries than general merchandise, for example.

Sourcing rules add another layer of complexity. Where is a sale considered to have occurred for tax purposes? Origin-based states say the sale occurs where the seller is located, while destination-based states say it occurs where the customer receives the product. Some states use different sourcing rules for different types of products or transactions. When selling across state lines, you need to understand the rules in every jurisdiction involved.

Regional settings extend beyond just rates and rules. Some jurisdictions have specific calculation methodologies for things like rounding, handling discounts, or dealing with promotional pricing. These might seem like minor details, but during an audit, even small calculation errors repeated across thousands of transactions can result in significant assessments.

The good news is that modern tax calculation engines can handle most of this complexity automatically, but they require accurate input data. Your systems need to correctly capture customer locations, properly categorize products, and apply the right sourcing rules. Many businesses implement these tools only to discover that garbage in produces garbage out—their product categorization or location data wasn’t accurate enough to produce reliable calculations.

Invoice Formatting as Per Regional Compliance: Meeting Documentation Standards

Invoice formatting requirements have become more stringent and varied as governments worldwide implement electronic invoicing mandates. An invoice isn’t just a bill anymore it’s a compliance document that must meet specific technical and content requirements to be valid. Getting invoice formatting wrong can result in delays, rejections, lost payments, and even penalties in some jurisdictions.

The basic requirements include standard elements like seller and buyer information, unique invoice numbers, dates, itemized descriptions, quantities, prices, and tax amounts. But regional compliance adds layers of complexity. European countries implementing e-invoicing mandates require invoices in specific structured formats like XML. Germany requires formats compliant with EN 16931 standards such as XRechnung or ZUGFeRD. Italy mandates its FatturaPA format. Poland requires submission through the KSeF platform starting in early 2026.

The format requirements aren’t arbitrary—they’re designed to enable automated processing and real-time reporting to tax authorities. Traditional PDF invoices, even if sent electronically, don’t meet these requirements because they’re not machine-readable in the structured way tax authorities now demand. True e-invoicing uses standardized data formats that systems can process automatically without human intervention.

Regional compliance also dictates specific data elements beyond basic invoice information. Some jurisdictions require specific tax identification numbers in specific formats, detailed product codes, payment terms, banking information, or digital signatures. Missing any required element can make the entire invoice invalid for tax purposes.

The timeline for implementation varies significantly. Belgium implemented mandatory B2B e-invoicing on January 1, 2026, though with a grace period through March 31 for businesses showing good faith compliance efforts. France is implementing its system in phases starting September 2026. Poland’s mandatory compliance for large taxpayers begins in February 2026. Even within the United States, requirements vary for government contractors and specific industries.

For businesses operating internationally or dealing with international customers, this means maintaining multiple invoice formats and potentially using different systems for different markets. The complexity has driven many businesses toward comprehensive e-invoicing platforms that can handle multi-jurisdictional requirements automatically.

Sending E-Invoices When Necessary: Meeting Electronic Submission Requirements

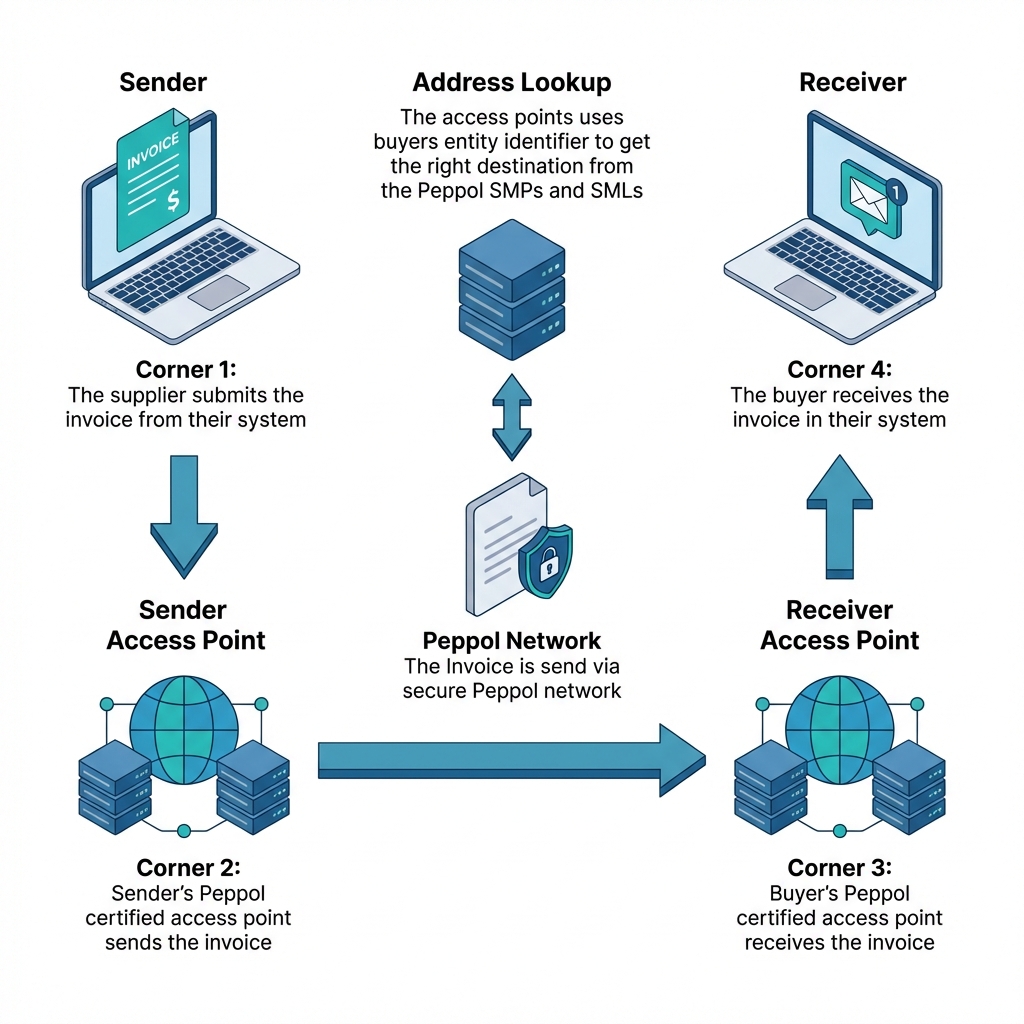

E-invoicing requirements go beyond just formatting they often require submitting invoices through specific channels or platforms. Many countries now operate continuous transaction control systems where every invoice must be validated in real-time against tax rules and business registries before it’s considered valid.

Italy pioneered this approach in Europe with its Sistema di Interscambio platform, requiring all B2B invoices to flow through the central system. Poland’s KSeF platform follows a similar model. These aren’t optional systems businesses physically cannot complete transactions without proper electronic submission. The tax authority validates each invoice as it’s created, checking tax calculations, verifying business registration status, and ensuring all required data elements are present.

The shift to mandatory e-invoicing is accelerating globally. Belgium, France, Germany, Poland, Romania, and multiple other European countries have implemented or are implementing mandatory systems in 2026. Malaysia updated its guidelines to require compliance for most businesses as of January 2026. The Philippines extended its deadline to December 2026. Middle Eastern and African countries are increasingly tying VAT credit eligibility to e-invoicing compliance, effectively making it mandatory even where technically voluntary.

For businesses, this means investing in systems that can generate invoices in the required formats and submit them through the required channels. You can’t just create an invoice in your accounting system and email it to your customer anymore you need to send it through the government clearance platform, receive validation, and potentially wait for approval before the transaction is complete.

The implementation challenges are substantial. Legacy ERP systems weren’t designed for real-time government validation. Many businesses are discovering they need significant system upgrades or entirely new platforms to meet these requirements. Training staff, coordinating with trading partners, and testing systems all require time and resources that many businesses underestimated.

Some jurisdictions are providing soft landing periods, recognizing the complexity of implementing these systems. Spain delayed its Veri*factu requirement by a full year. Belgium suspended penalties through March 2026 for businesses showing compliance intent. Slovenia granted a two year reprieve. However, these delays are temporary breathing room, not policy reversals. The direction is clear e-invoicing is becoming mandatory globally, and businesses need to prepare.

Retaining Information on Invoices for Extended Periods: Meeting Archival Requirements

Tax authorities don’t just want to see current invoices—they want access to historical records going back years or even decades. Retention requirements vary by jurisdiction and document type, but most jurisdictions require invoice records for at least three to seven years. Some require retention until any related audit or legal matter is fully resolved, which could extend well beyond standard timeframes.

The retention requirements extend beyond just keeping the documents. Invoices must remain accessible, readable, and verifiable throughout the retention period. This creates challenges in our digital age as file formats change, systems get upgraded, and storage media evolves. An invoice stored in a proprietary format might become unreadable if the software vendor discontinues support or your business migrates to a new system.

Electronic records must maintain their integrity—you need to prove they haven’t been altered since creation. Many jurisdictions require digital signatures, timestamps, or other security measures to ensure electronic records remain tamper-proof. Simply scanning paper invoices to PDF doesn’t necessarily meet these requirements if the PDFs can be easily edited.

The volume of records creates practical storage and retrieval challenges. A medium-sized business might generate hundreds of thousands of invoices over a seven year retention period. You need systems that can store this volume cost effectively while still providing quick retrieval when needed. Audit requests typically demand specific invoices within days or weeks, not months of searching through archival storage.

Many businesses are implementing enterprise content management systems designed specifically for tax document retention. These systems automatically apply retention policies, prevent premature deletion, flag documents approaching end of retention periods, maintain security and access controls, and provide audit trails showing who accessed what documents when. The investment in proper document management pays for itself by avoiding penalties during audits and reducing the time spent responding to audit requests.

Regional mandates are increasing retention requirements further. E-invoicing mandates often specify how and where electronic invoices must be stored. Some jurisdictions require storage within specific geographic regions or using specific technical standards. As retention requirements become more prescriptive, businesses need to ensure their storage solutions meet not just their current obligations but anticipated future requirements.

Making Information Easily Available for Audits: Building Audit-Ready Systems

The phrase “audit-ready” describes systems designed from the ground up to facilitate audit requests rather than merely survive them. When auditors request information, they’re testing your compliance, but they’re also evaluating your systems and controls. Businesses that can quickly produce accurate, complete, well-organized records typically face shorter audits and fewer additional requests than businesses that struggle to respond.

Building audit-ready systems starts with understanding what auditors want to see. They’ll request transaction details, supporting documentation, evidence of proper calculations, proof of exemption validations, reconciliations between systems, and documentation of your internal controls. Producing these materials shouldn’t require weeks of scrambling through multiple systems and spreadsheets—it should be a routine export from your existing systems.

The key is integration. When your order management, accounting, tax calculation, and document storage systems all talk to each other, you can trace any transaction from initial order through final payment, showing all tax determinations and documentation along the way. Disconnected systems require manual work to piece together complete pictures of individual transactions, creating both time pressure and error risk during audits.

Documentation of your tax processes and policies provides crucial context for auditors. Why did you apply a particular tax treatment? What procedures do you follow for validating exemptions? How do you ensure rates stay current? Written policies and procedures demonstrate that you have thoughtful, systematic approaches to compliance rather than just reacting to situations as they arise. This documentation doesn’t have to be lengthy—clear, concise explanations of your key processes often suffice.

Sample testing is common in audits, where auditors examine a sample of transactions to evaluate whether your systems and processes work correctly. If your sample performs poorly—showing missing exemption certificates, calculation errors, or incomplete documentation—auditors will expand their examination. Conversely, clean sample results often lead to limited additional testing. Performing your own periodic self-audits helps identify and correct problems before official audits discover them.

The shift toward electronic data analytics in audits has changed the landscape. Many tax authorities now use automated tools to analyze complete datasets rather than just samples. They can identify patterns, outliers, and anomalies that might indicate problems. Businesses that maintain clean, well-structured data typically fare better in these analytical reviews than businesses with messy or inconsistent data.

Filing Tax Returns on a Timely Basis: Meeting Critical Deadlines

Tax return deadlines might be the most familiar compliance requirement, but familiarity doesn’t make them less critical. Missing deadlines triggers penalties that compound quickly. Late filing penalties typically run 5% of the unpaid tax per month, capped at 25%. Late payment penalties add another 0.5% per month, also capped at 25%. Interest accrues on top of these penalties at the federal short-term rate plus 3%, compounding the total cost of late payments.

The deadline landscape is complex because different tax types have different filing frequencies and due dates. Federal income tax for S-corporations and partnerships is due March 15, while C-corporations file by April 15. However, businesses making estimated tax payments must file quarterly on April 15, June 15, September 15, and January 15. State income tax returns might align with federal deadlines or use different schedules entirely.

Sales tax return frequencies vary by state and by business size. High volume businesses might file monthly, while smaller businesses file quarterly or annually. Some states assign filing frequencies based on your tax liability, potentially changing your schedule if your sales volume changes significantly. Tracking all these varying deadlines across multiple jurisdictions requires robust calendar systems and often specialized software.

Payroll tax returns add another layer, with federal Form 941 due quarterly but many states requiring monthly deposits or returns. Year-end reporting adds W-2 and 1099 forms due January 31 (or the next business day), with electronic filing to the SSA and IRS due by early February. The new tip income and overtime reporting requirements starting in 2026 add additional complexity to payroll compliance.

Extensions can provide breathing room but don’t eliminate all obligations. Extension requests must be filed by the original deadline, and they typically extend only the time to file, not the time to pay. You still need to estimate your liability and pay it by the original deadline to avoid late payment penalties. Extensions are best used when you need more time to finalize complex returns, not as a substitute for proper tax planning and preparation.

The penalty structure makes timely filing a business imperative. Many businesses find that investing in preparation early closing books quickly, reconciling accounts promptly, and addressing questions as they arise rather than waiting until deadline week reduces stress and ensures deadlines are met comfortably rather than barely.

Following Standard Practices in Managing Invoice Data: Industry Best Practices

Standard practices in invoice data management have evolved significantly, driven by both regulatory requirements and business efficiency needs. Following these practices protects your compliance position while improving operational performance. The practices span data quality, security, workflow efficiency, and system integration.

Data quality starts at the point of capture. Invoices with accurate, complete, consistent data enable everything downstream—correct tax calculations, smooth payment processing, reliable reporting, and efficient audits. Poor data quality forces manual intervention, creates errors, and generates compliance risk. Standard practices include data validation at entry, standardized coding schemes, automated quality checks, and regular data cleansing.

Security practices protect sensitive financial and customer information on invoices. This includes access controls limiting who can view, create, modify, or delete invoice data, encryption protecting data in transit and at rest, audit trails tracking all access and changes, and backup systems ensuring data isn’t lost. Many jurisdictions now have data privacy regulations that affect how long you can retain customer information and how you must protect it.

Workflow efficiency practices ensure invoices move smoothly through your processes. This includes automated routing sending invoices to appropriate approvers, exception handling flagging unusual transactions, integration with purchasing and receiving systems to validate invoices match orders, and automated matching of payments to invoices. Efficient workflows reduce the time from invoice creation to payment while maintaining control over the process.

System integration practices ensure invoice data flows seamlessly between your various business systems. Your invoicing system should communicate with accounting, tax calculation, payment processing, and document storage systems without requiring manual data entry or file transfers. Modern APIs and integration platforms enable this seamless communication, reducing errors and improving efficiency.

Documentation of your practices provides valuable evidence during audits. Auditors want to see that you have systematic approaches to managing invoice data, not ad hoc procedures that vary by person or situation. Written procedures, training materials, and process documentation demonstrate your commitment to proper invoice data management.

The businesses that excel at invoice data management treat it as a strategic capability, not just an operational necessity. They invest in modern systems, train staff properly, continuously monitor and improve processes, and stay current with evolving requirements. This investment pays returns in reduced errors, faster processing, better audit outcomes, and improved cash flow.

Building Your Compliance Strategy for 2026 and Beyond

Tax compliance in 2026 requires a comprehensive, integrated approach that addresses all these touchpoints systematically. The days of treating each compliance element separately are gone—modern requirements demand coordinated systems that handle registration, customer validation, exemption management, tax calculation, invoice formatting, electronic submission, data retention, and reporting as interconnected elements of a unified compliance framework.

The investment required might seem daunting, but the cost of non-compliance is far higher. Penalties, interest, audit costs, and reputational damage from compliance failures quickly exceed the cost of proper systems and processes. More importantly, good compliance systems deliver business benefits beyond avoiding penalties they improve data quality, enhance customer service, streamline operations, and provide better visibility into business performance.

Technology plays a critical role in modern compliance. Manual processes simply can’t keep pace with the volume, complexity, and speed requirements of current regulations. Cloud-based tax compliance platforms, automated calculation engines, electronic invoicing systems, and digital document management solutions have become essential tools for businesses of all sizes.

However, technology alone isn’t sufficient. Successful compliance also requires knowledgeable people, clear processes, ongoing training, regular monitoring, and continuous improvement. The businesses that handle compliance best treat it as a core business competency deserving ongoing attention and investment, not a back-office function to be minimized.

As we move through 2026, regulatory complexity will likely continue increasing. E-invoicing mandates are spreading globally, economic nexus thresholds are proliferating, reporting requirements are expanding, and enforcement is intensifying. The businesses that thrive will be those that view compliance not as a burden to be minimized but as a foundation for sustainable growth—protecting the business while enabling efficient operations and providing reliable data for strategic decisions.

Tax compliance done right becomes almost invisible operating smoothly in the background while you focus on growing your business. Getting there requires understanding the requirements, implementing proper systems, training your people, and maintaining vigilance as regulations evolve. The roadmap provided in this guide offers a starting point for building that comprehensive compliance capability, addressing each essential touchpoint that keeps your business operating within the bounds of an increasingly complex regulatory environment.