How to verify VAT Number in EU?

This post is also available in: Español|中文|Deutsch

Verify VAT number in EU using VIES.

VAT valdiation for the whole of EU is made available under a single roof by the European Union via a tool called VAT VIES.

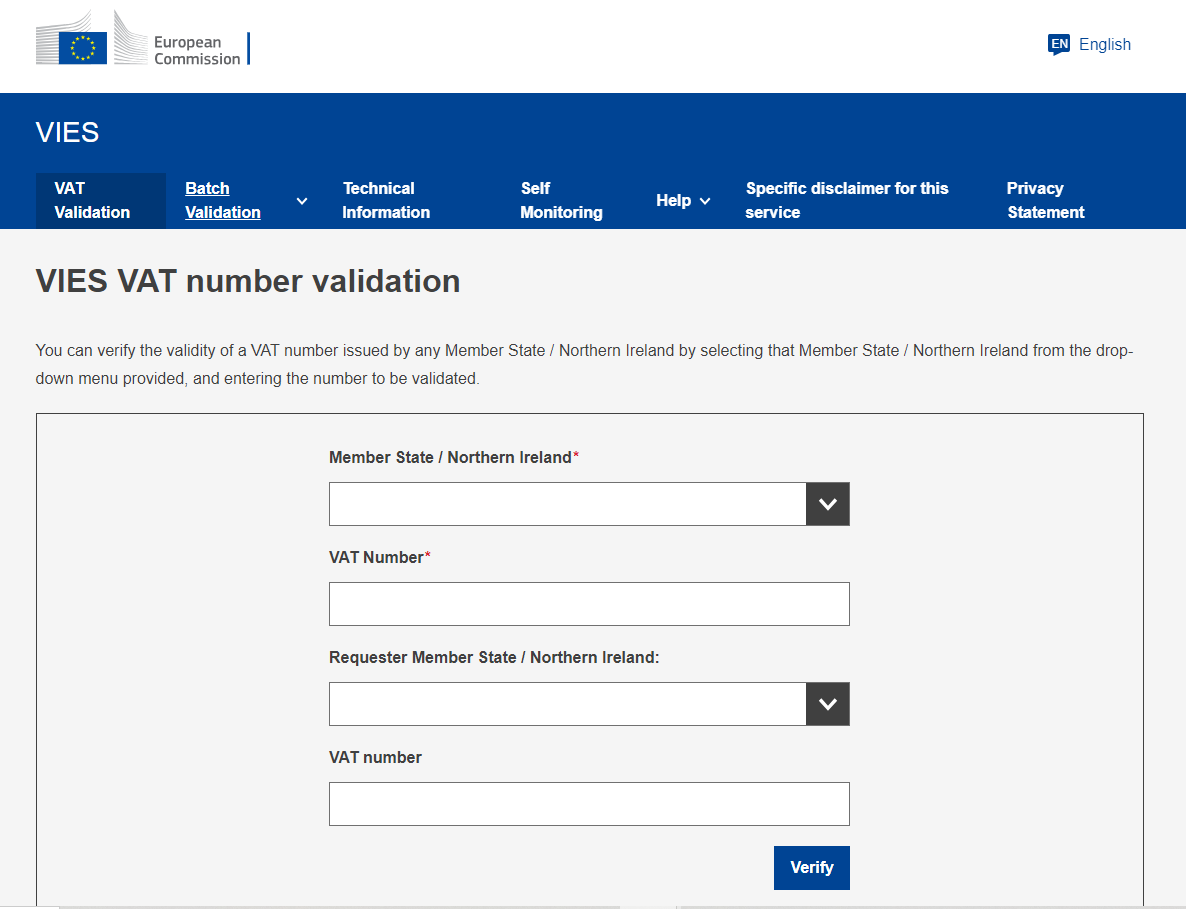

VIES (VAT Information Exchange System) functions as a search engine rather than a database, under the ownership of the European Commission. Information is sourced from national VAT databases each time a query is initiated through the VIES tool. You can check the validity of an VAT number from the VIES Website for free. You can access the VIES VAT lookup service here. You should submit your VAT number along with the number you wish to verify in case you wish to get an acknowledgement number

|

| VAT verification on VIES website |

|  |

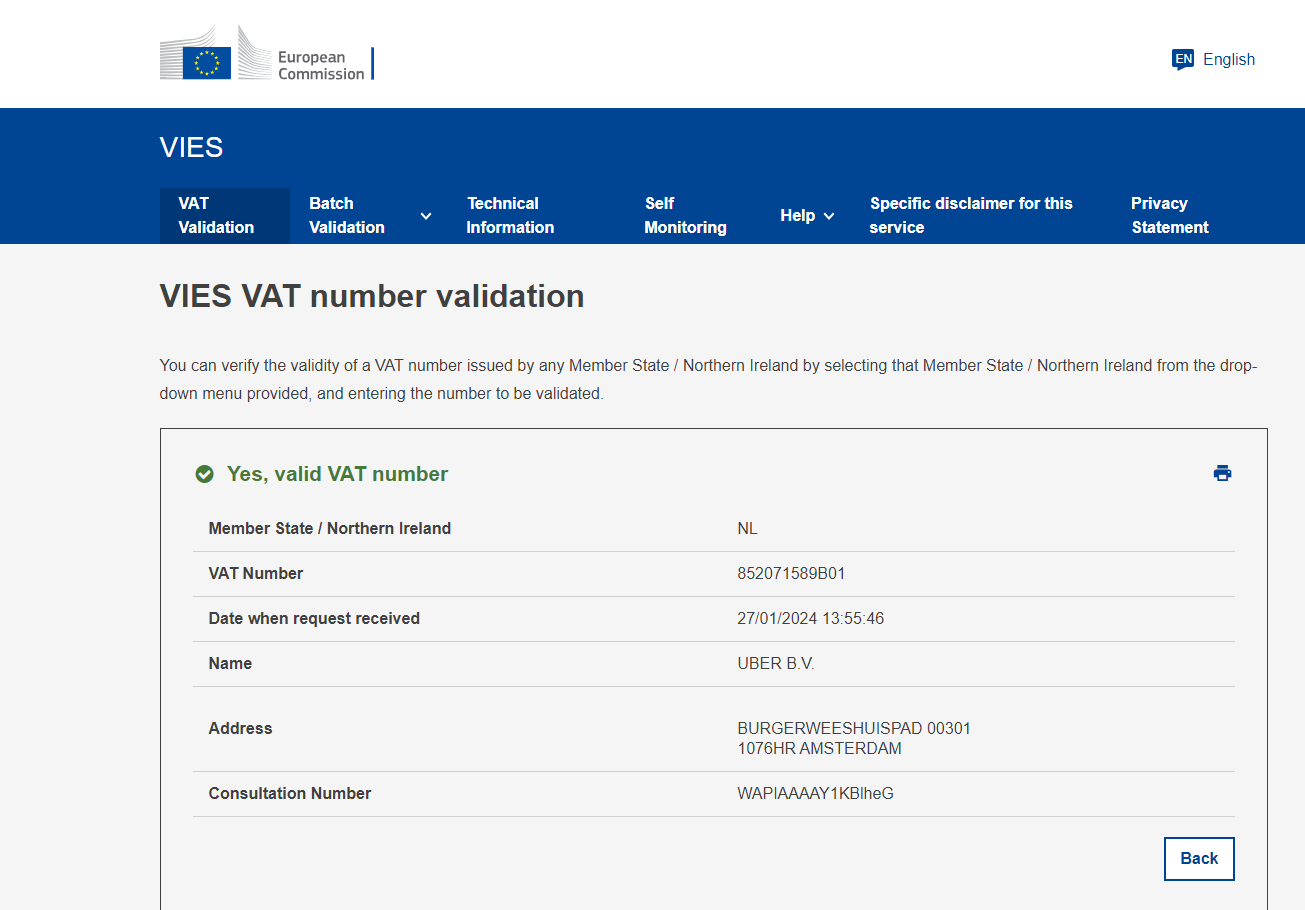

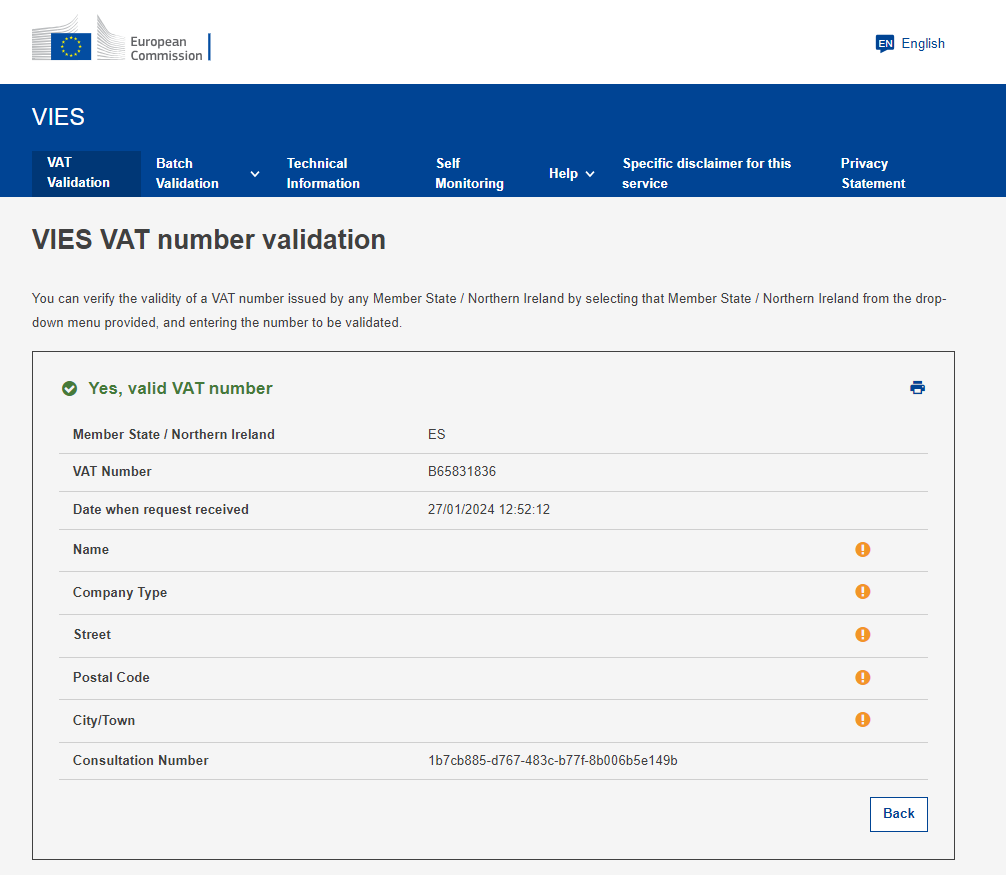

| Status of a Netherland VAT | Status of a Spain VAT number |

A successful vat number verification on the EU VIES site usually returns the following details. But some of the details may not be available depending on the country as you can see from the above example

- Status of the vat number

- Time of validation

- Details of the business

- Name of the business

- Registered address including zipcode

- Consultation number which acts as the proof of the verification.

How Lookuptax can help you in VAT validation?

Lookuptax VAT validation revolutionizes VAT number validation with its robust platform, empowering businesses to seamlessly verify VAT numbers across over 100 countries. Our cutting-edge technology ensures accurate and efficient validation, reducing errors and enhancing compliance.