Saint Kitts and Nevis TIN number guide

Tax Identification Number (TIN)

A Tax Identification Number (TIN) is exclusively issued by the Saint Christopher and Nevis Inland Revenue Department (SKNIRD), the jurisdiction's Tax Administration. Individuals, legal persons, or entities become eligible for a TIN upon registration if they are subject to the licenses and taxes administered by the SKNIRD.

Issued TINs are permanent and remain unchanged under any circumstances. Many tax documents issued by the SKNIRD, including Remittance/Tax Return Forms, Statements, and Demand Notices, prominently display the TIN and/or a Tax Account. The Tax Account is a fusion of the TIN and the tax type number, with the last two digits representing the tax type number and the preceding digits representing the TIN. For example, if a taxpayer's TIN is 99999, Corporate Income Tax documents will display 9999904; Value Added Tax documents will display 9999945, and Withholding Tax documents will display 9999936.

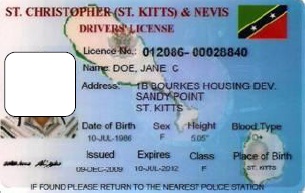

The Tax Identification Numbers (TINs) are prominently featured on St. Christopher (St. Kitts) & Nevis Driver’s Licences, appearing as the initial sequence of digits in the Licence No. before the hyphen. Additionally, the VAT TIN consists of the fundamental TIN number, with an additional numeric digit ranging from 1 to 9 appended at the end.

List of all vat registrants are published on the SKNIRD site. You can check the list here

|

| Driving License |

How Lookuptax can help you in VAT validation?

Lookuptax VAT validation revolutionizes VAT number validation with its robust platform, empowering businesses to seamlessly verify VAT numbers across over 100 countries. Our cutting-edge technology ensures accurate and efficient validation, reducing errors and enhancing compliance.