Romania TIN number guide

Personal Identification Number (CNP)

Natural persons in Romania are assigned a Personal Identification Number (CNP) by the Ministry of Internal Affairs, which also functions as a Tax Identification Number (TIN) utilized by the tax administration. It is also known as Cod Numeric Personal.

CNP Format CNP consists of 1 block of 13 digits

Structure: TIN Format [C1, C2, C3, C4, C5, C6, C7, C8, C9, C10, C11, C12, C13] Where C1 to C13 represent characters. Structure: Range C1, C2, C3, C4, C5, C6, C7, C8, C9, C10, C11, C12, C13 All are numeric. Structure: Rules for C1: Within the range 1 to 9:

- 1 is assigned to males born between 1900 and 1999.

- 2 is assigned to females born between 1900 and 1999.

- 3 is for males born between 1800 and 1899.

- 4 is for females born between 1800 and 1899.

- 5 is for males born between 2000 and 2099.

- 6 is for females born between 2000 and 2099.

- 7 is for foreign males with temporary residence in Romania.

- 8 is for foreign females with temporary residence in Romania.

- 9 is for foreign citizens. C2, C3: Represent the last two digits of the year (00 to 99). C4, C5: Indicate the month (1 to 12). C6, C7: Represent the day of the month (1 to 31, depending on the month and year). C8, C9: County or district code (ranging from 01 to 47, and 51 to 52). Structure: Sample TIN: 8001011234567

|

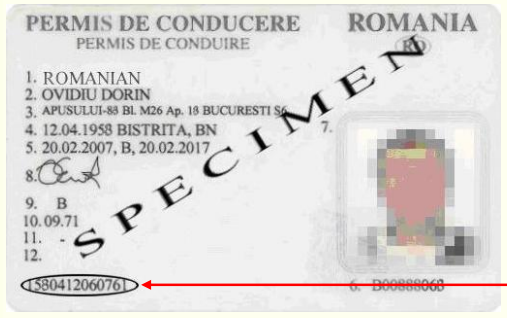

| CNP on ID card |

|

| Driving license |

Codul de înregistrare fiscală (CIF)

Tax Identification Number (TIN) for non-resident taxpayers in Romania is exclusively issued by the Tax Administration for tax-related matters. It is known as Codul de înregistrare fiscală(CIF).

|

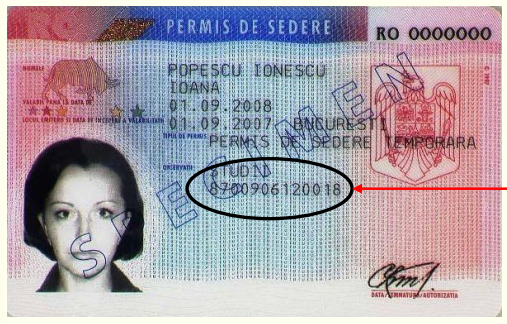

| CIF on Certificate for Tax Registration |

|

| Residence Permit |

Official database CIF search

Tax Identification Number (TIN)

The Tax Administration issues the Tax Identification Number (TIN) for non-natural entities in Romania. Its format comprises a single block of digits, ranging from 2 to 10 numerals.

TIN Format Structure: TIN2 Format [C1, C2, C3, C4, C5, C6, C7, C8, C9, C10, C11, C12, C13] Where C1 to C13 represent characters. Structure: Range C1, C2, C3, C4, C5, C6, C7, C8, C9, C10, C11, C12, C13 All are numeric. Structure: Rules for TIN2: C1: 9 C2: 0 C3: 0 C4: 0 C5 to C12: Each can take a value between 0 to 9. Structure: Sample TIN2: 900012345678.

Codul unic de identificare (CUI)

Until 2007, the term CUI (Unique Registration Code) was employed, after which the term CIF (Fiscal Registration Code) became prevalent. The distinction lies in the purpose for which this code is solicited. The legal entity providing the tax certificate determines whether the code is designated as CUI or CIF. The Romanian Codul Unic de Înregistrare (CUI) consists of 8 digits in the format NNN NNN NN, optionally preceded by the prefix RO. It is allocated to companies mandated to register with the Romanian Trade Register.

Official database CUI Search

How Lookuptax can help you in VAT validation?

Lookuptax VAT validation revolutionizes VAT number validation with its robust platform, empowering businesses to seamlessly verify VAT numbers across over 100 countries. Our cutting-edge technology ensures accurate and efficient validation, reducing errors and enhancing compliance.