Pakistan TIN number guide

CNIC

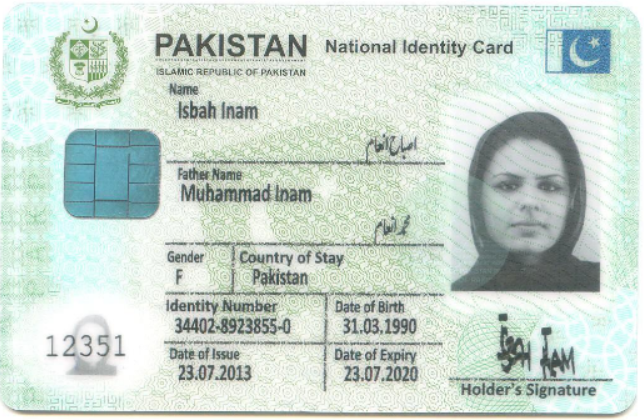

The Computerized National Identity Card (CNIC) provides individuals with official identification as Pakistani citizens

CNIC Format

The CNIC number, a 13-digit identifier in the format XXXXX-XXXXXX-X, holds valuable information when broken down as follows:

a. 1st digit: The initial digit denotes the province of the CNIC holder. For example, in the format 3XXXXX-XXXXXX-X, the '3' indicates the holder belongs to the Punjab province. i. 1 for KPK ii. 2 for FATA iii. 3 for Punjab iv. 4 for Sindh v. 5 for Balochistan vi. 6 for Islamabad vii. 7 for Gilgit Baltistan

b. 2nd digit: Represents the division.

c. 3rd digit: Indicates the district of the division.

d. 4th digit: Designates the tehsil (sub-district).

e. 5th digit: Assigned for the union council number.

f. Next 7 digits: These seven digits (between the two dashes) constitute the family number, unique for each family. All family members, linked by blood relationships, share the same middle code, forming a family tree.

g. Last digit: The final digit, ranging from 1 to 9, holds gender information. Odd numbers (1, 3, 5, 7, 9) signify the holder is male, while even numbers (2, 4, 6, 8) indicate the holder is female.

|

| CNIC Card |

National Tax Number or Registration Number(NTN)

In Pakistan, the individuals possessing the Computerized National Identity Card (CNIC) issued by the National Database and Registration Authority are assigned the CNIC number as their National Tax Number or Registration Number. For companies and associations of persons (AOP), the allocation of a National Tax Number or Registration Number occurs when they electronically enroll on the FBR Iris portal. Non-resident individuals without a CNIC are identified by their passport number, which serves as their NTN or Registration Number.

NTN format

NTN or Registration Number for AOP and Company is the 7 digits NTN received after e-enrollment.

|

| Registration Certificate |

Official database - Taxpayer verification

How Lookuptax can help you in VAT validation?

Lookuptax VAT validation revolutionizes VAT number validation with its robust platform, empowering businesses to seamlessly verify VAT numbers across over 100 countries. Our cutting-edge technology ensures accurate and efficient validation, reducing errors and enhancing compliance.