Switzerland TIN number guide

Unternehmens-Identifikationsnummer (UID-number)

In the context of the Federal Act on International Automatic Exchange of Information in Tax Matters, the Swiss "Unternehmens-Identifikationsnummer" (UID-number) serves as the tax identification number for entities, as per Article 2, paragraph 1, letter g.

Introduced in 2011, the UID-number is a centralized and unique identification number at the federal level. It is not only utilized for tax purposes but also serves other functions, such as a trade register number and for custom purposes. Governed by the Swiss Federal Act on the UID and the Swiss Ordinance on the UID, entities assigned a UID-number include those registered in the commercial register, individuals and legal entities subject to federal tax collection, individuals engaged in commercial activities, partnerships without legal personality, and foreign or international legal entities operating in Switzerland.

The UID-number is automatically assigned to entities upon registration in the administrative register connected to the UID-system. Entities without an assigned UID can request registration through the Swiss Federal Statistical Office. The UID-register, part of which is publicly accessible, enables users to look up the entity associated with a specific UID-number or search for a UID-number using the entity's name, VAT-number, or commercial register number. Publicly available information includes status, address, and commercial register data.

For comprehensive data on companies registered for commercial purposes, the Central Business Names Index "Zefix" serves as the primary database. This register, accessible to the public, offers search functions similar to the UID-register. Explore the UID-system through the UID-register (https://www.uid.admin.ch) and access Zefix via its web interface (http://www.zefix.ch/).

Official Database - UID Search

Format

The UID-number is structured as follows: CHE-999.999.99C, consisting of nine randomly assigned non-descriptive digits.

To signify its Swiss origin, the prefix "CHE" is included, aligning with the alpha-3 variant of ISO 3166-1. The last digit (C) acts as a check digit, calculated using a standard modulo 11 calculation. Enhancing readability, a hyphen is introduced between the prefix and the numeric part, which is divided into three blocks of three digits, separated by dots for clarity.

Where to find UID?

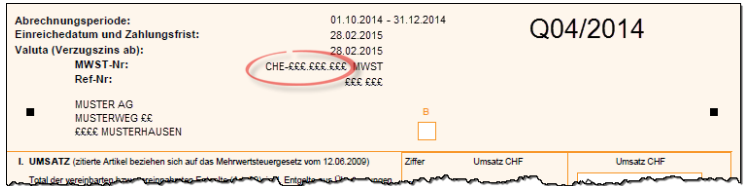

The UID-number is not featured on an official card or any other official document. Nevertheless, it may be found on the front page of a VAT return. If an entity is unaware of its UID-number, it can utilize the UID-register for identification. By entering the entity's legal name, VAT number, or commercial register number, the UID-register enables the discovery of the corresponding UID-number, provided the entity is registered in the UID-register.

|

| UID on VAT return |

Old-age and Survivors’ Insurance Number (OASI Number)

Article 2, paragraph 1, letter f of the Swiss Federal Act on International Automatic Exchange of Information in Tax Matters designates the Old-age and Survivors’ Insurance Number (OASI Number) as the tax identification number for individuals in the context of AEOI. The OASI Number, centrally managed by the Central Compensation Office (CCO), serves as a unique identifier for social security purposes and is occasionally used for tax matters, military administration, and education.

Legally governed by the Swiss Federal Act on Old-age and Survivors’ Insurance and its respective Ordinance, the OASI Number is assigned to residents and individuals with their habitual abode in Switzerland at the time of birth registration in the "Infostar" data bank or when relevant information is provided by the State Secretariat for Migration to the CCO.

OASI is also known as AHV-Versichertennummer; numéro d’assuré AVS; numero d’assicurato AVS.

Format

Introduced in 2008, the current OASI Number features a structured format. It includes an initial 3-digit country code (Switzerland = 756), a 9-digit randomly assigned number providing a lifelong, unique, and anonymous identification for each individual, and a final check digit. The OASI Number is presented in a reader-friendly manner, with each block separated by a dot. The format can be represented as follows: 756.1234.5678.97.

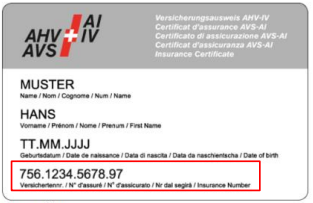

|

| OASI on Insurance Certificate |

Intra-Community VAT Number

The Swiss company identification number (UID) and the EU VAT identification number share the abbreviation UID, yet they are unrelated.

The VAT identification number is specifically necessary for intra-Community transactions, involving the delivery of goods from one EU country to another or the provision of services to a recipient in a different EU country. To facilitate tax-free services, customers must furnish their VAT identification number to the supplier or service provider.

Swiss companies not engaged in EU services do not possess a VAT identification number. Nevertheless, they don't require one, as EU-based companies can deliver tax-free goods to Switzerland or provide services to recipients in Switzerland without needing a VAT identification number from the customer (Article 146 of the Value Added Tax System Directive, November 28, 2006).

How Lookuptax can help you ?

Lookuptax VAT validation revolutionizes VAT number validation with its robust platform, empowering businesses to seamlessly verify VAT numbers across over 100 countries. Our cutting-edge technology ensures accurate and efficient validation, reducing errors and enhancing compliance.