Peru TIN number guide

This post is also available in: Español

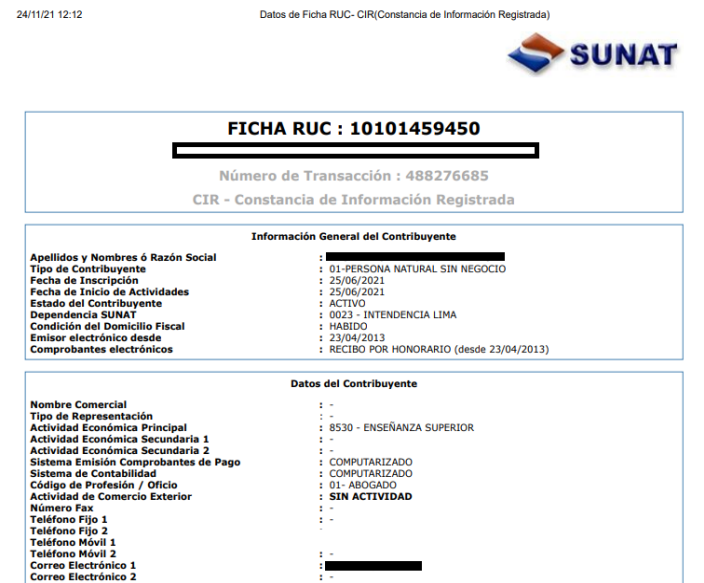

Registro Único del Contribuyente (RUC)

In Peru, individuals, legal entities, and other entities adhere to the guidelines set by the Single Taxpayers' Registry Law, specifically Legislative Decree 943 (governed by Superintendence Resolution No. 210-2004/SUNAT). Registration in the Single Taxpayers' Registry (RUC) is a mandatory step for obtaining tax registration. The National Superintendence of Customs and Tax Administration (SUNAT) is responsible for overseeing and managing this registry.

RUC Format The RUC in Peru is an 11-digit identifier, organized into distinct structures: a) For individuals using DNI for identification: Prefix 10 + DNI + verification digit. b) Individuals using other identity documents: Prefix 15 + random number + verification digit. c) Legal entities: Prefix 20 + random number + verification digit.

|

| Registered Information Voucher (CIR) |

Official Database RUC Search

How Lookuptax can help you in VAT validation?

Lookuptax VAT validation revolutionizes VAT number validation with its robust platform, empowering businesses to seamlessly verify VAT numbers across over 100 countries. Our cutting-edge technology ensures accurate and efficient validation, reducing errors and enhancing compliance.