Indonesia TIN number guide

Nomor Pokok Wajib Pajak (NPWP)

The Tax Identification Number (TIN) in Indonesia is referred to as Nomor Pokok Wajib Pajak (NPWP), and it encompasses the following details:

A. NPWP serves as the taxpayer's unique identifier, utilized for personal identification and recognition of the taxpayer's rights and obligations in the realm of taxation.

B. Eligible taxpayers, meeting the subjective and objective criteria outlined in tax laws and regulations, receive an NPWP.

C. Since July 14, 2022:

- Indonesian resident individual taxpayers must utilize their national identity number (Nomor Induk Kependudukan/NIK).

- Non-Indonesian resident individual taxpayers, corporate taxpayers, and government agency taxpayers must use a sixteen-digit NPWP issued by the Directorate General of Taxes.

Individuals and entities are required to undergo taxpayer registration once they meet the subjective and objective criteria outlined in Article 2, paragraph (1) of the General Provision and Tax Procedure Law (GPTPL). This legal obligation ensures that taxpayers comply with the established standards before engaging in taxation matters.

In cases where a married woman typically uses her husband's NPWP for tax-related activities, she can opt for separate taxation if certain conditions are met. This includes living separately based on a judge's decision, submitting a written request supported by an income and assets separation agreement, or having the intention to independently exercise her tax rights and obligations. Additionally, the Director General of Taxes holds the authority to issue NPWP on an ex-officio basis to taxpayers who fulfill the necessary criteria but neglect the self-registration obligation, as specified in Article 2, paragraph (4) of the GPTPL.

Format

For Individual Taxpayers who are Indonesian Residents:

- Effective from July 14, 2022, the NPWP structure now consists of a 16-digit numerical format.

- This 16-digit NPWP corresponds to the individual taxpayer's national identity number (Nomor Induk Kependudukan/NIK) issued by the Government of the Republic of Indonesia.

- The previous 15-digit NPWP format remains valid until December 31, 2023.

|  |

| NPWP the National Identity Card | |

For Individual Taxpayers not residing in Indonesia, Corporate Taxpayers, and Government Agency Taxpayers:

- As of July 14, 2022, the NPWP structure is composed of a 16-digit numerical sequence.

- The 16-digit NPWP is a unique identifier issued by the Directorate General of Taxes.

- Those registered before July 14, 2022, will have the 16-digit NPWP starting with "0" (zero), followed by the previous 15-digit NPWP format.

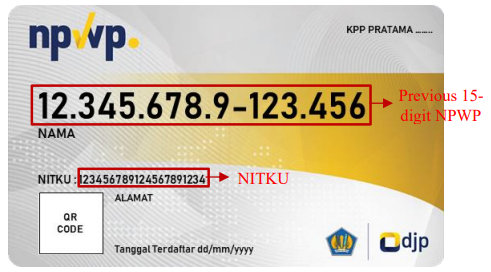

|  |

| NPWP card for individuals and enities | |

For Branch-Status Taxpayers:

- Effective from July 14, 2022, the NPWP structure now includes numerals only.

- The NPWP corresponds to the Place of Business Identity Number (Nomor Identitas Tempat Kegiatan Usaha/NITKU) issued by the Directorate General of Taxes.

- The previous 15-digit NPWP format remains valid until December 31, 2023.

|

| Nomor Identitas Tempat Kegiatan Usaha or NITKU on NPWP card |

How Lookuptax can help you in VAT validation?

Lookuptax VAT validation revolutionizes VAT number validation with its robust platform, empowering businesses to seamlessly verify VAT numbers across over 100 countries. Our cutting-edge technology ensures accurate and efficient validation, reducing errors and enhancing compliance.