France TIN number guide

Numéro d’identification fiscale (NIF)

The tax authorities in France assign a tax identification number (TIN) to individuals fulfilling their tax obligations. This unique and perpetual TIN is allocated during an individual's registration in the French tax administration databases. Referred to as numéro fiscal de référence or numéro SPI in French, this identifier ensures reliability and permanence. Stay informed about the numéro fiscal de référence or numéro SPI, vital for individuals navigating the French tax system. Understanding this distinctive identifier is essential for seamless compliance with tax obligations in France.

Format

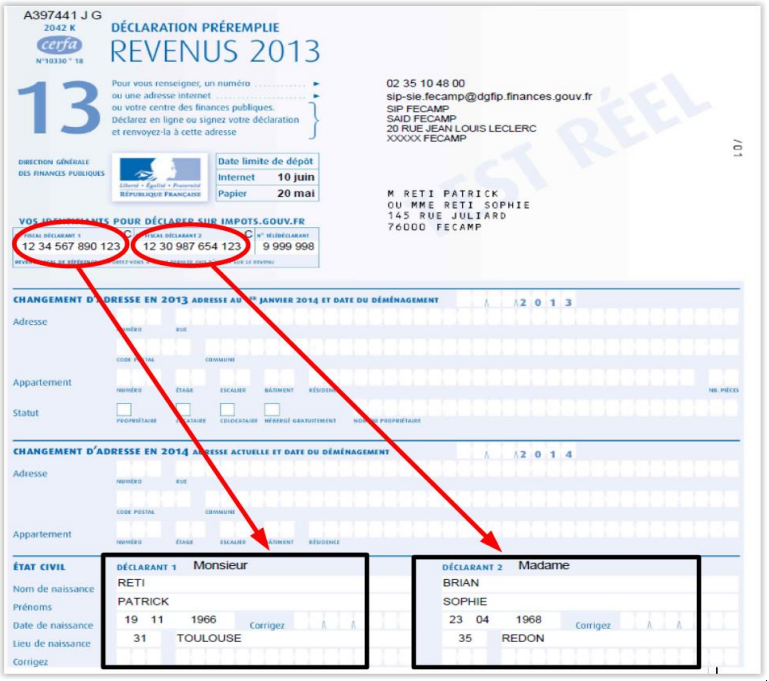

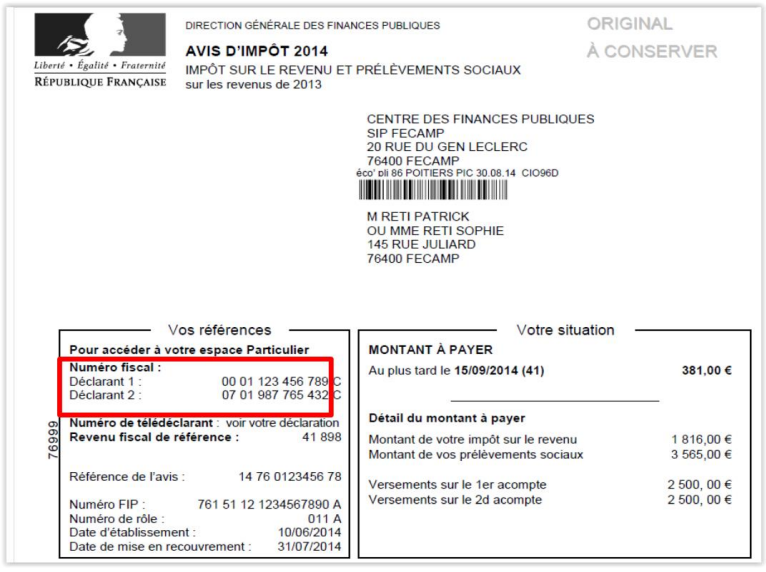

The NIF comprises of 13 numerals in the format 99 99 999 999 999. The initial digit of the TIN is consistently 0, 1, 2, or 3.

|

| Numéro fiscal on tax return |

|

| Numéro fiscal on Notice of assessment |

SIREN

Upon establishment, French entities and individuals engaging in business activities are assigned an identification number by a governmental authority. This numéro SIREN serves various purposes, notably for taxation. Financial institutions like Fonds communs de placement (FCP) and Sociétés d’investissement à capital variable (SICAV) fall into this category. Unlike FCP, SICAV does not possess a tax identification number. Notably, the collection of tax identification numbers is not mandatory for entities classified as financial institutions (FIs)

Format

The SIREN number comprises 9 numerals in the format 999 999 999.

Official database - SIREN Search

Taxe sur la Valeur Ajoutee (TVA)

Format - FR (country code) + 2 digits + SIREN

Country code + 11 characters. May include alphabetical characters (any except O or I) as first or second or first and second characters.

Example - 12345678901, X1234567890, 1X123456789, XX123456789

SIRET

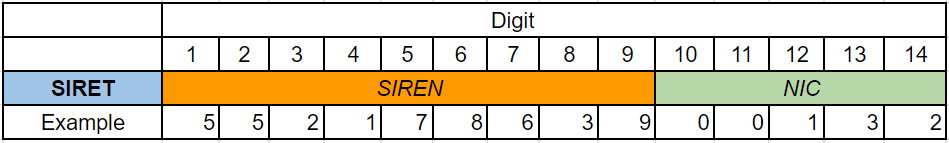

The SIRET (Système d'Identification du Répertoire des Entreprises et de leurs Établissements) is a unique identification number assigned to businesses in France. It consists of 14 digits and serves to identify specific establishments of a business. The SIRET number is crucial for business registration, tracking, and compliance purposes. It is part of the broader French business registration system, including the SIREN (Système d'Identification du Répertoire des Entreprises).

The SIRET number, a 14-digit identifier, comprises the SIREN number along with an extra five-digit component representing the specific location or establishment of the business. Consequently, the SIRET number offers more granular details about the physical location of the business within France.

|

| SIRET |

How Lookuptax can help you ?

Lookuptax VAT validation revolutionizes VAT number validation with its robust platform, empowering businesses to seamlessly verify VAT numbers across over 100 countries. Our cutting-edge technology ensures accurate and efficient validation, reducing errors and enhancing compliance.