Australia ABN number guide

Australian Business Number(ABN)

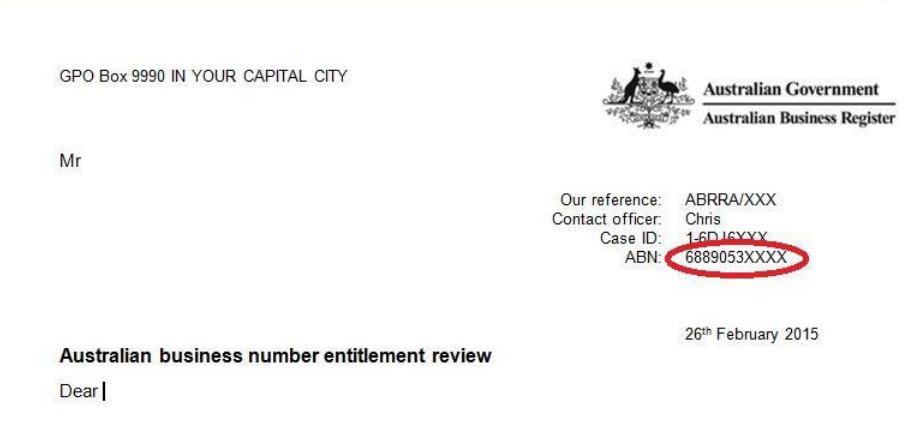

Australian enterprises utilize the Australian Business Number (ABN) as a unified identifier for all interactions with the Australian Taxation Office (ATO) and for engagements with other governmental departments and agencies. The ABN is also a key component for tax identification purposes. To enroll for the goods and services tax and other facets of The New Tax System (Goods and Services Tax) Act 1999, businesses are required to obtain an ABN. Much like the Tax File Number (TFN), the application process for an ABN can be carried out online or through traditional paper channels. Furthermore, the registration for the goods and services tax can be concurrently completed with the ABN application. The introduction of the ABN by the Australian Government was in response to the recommendations of the Small Business Deregulation Task Force Report, aiming to provide a singular identifier to streamline business interactions with the Australian Government.A client’s ABN is available to State, Territory and local government regulatory bodies to streamline registration requirements.

Format

The ABN is a unique 11 digit number formed from a nine digit unique identifier and two prefix check digits. The two leading digits (the check digits) will be derived from the subsequent nine digits using a modulus 89 check digit calculation. The check digits will be included to identify common data entry errors such as digit transposition. The ABN will be structured as XX XXX XXX XXX.

For bodies registered under Corporations Law, their ABN will be formed by prefixing two digits to their Australian Company Number or Australian Registered Business Number issued by the Australian Securities and Investment Commission (ASIC). These companies must have their identity established and first register with ASIC prior to the normal registration process for an ABN. The ABN will eventually replace the ACN and the ARBN

ABN search is freely available for public us on ABN lookup tool

|

| Australian Business Number |

Australian Tax File Number (TFN)

In Australia, the Tax File Number (TFN) serves as the Tax Identification Number. It is utilized by both individuals and entities involved in interactions with the Australian Taxation Office (ATO). These interactions encompass reporting information to the ATO, filing income tax returns, and engaging in the superannuation (retirement income) system. A TFN can be allocated to individuals as well as non-individual entities such as companies, trusts, partnerships, and superannuation funds.

The issuance of a TFN is governed by the Income Tax Assessment Act 1936 (ITAA 1936) and occurs upon application by the client or as deemed necessary by the ATO for internal purposes. The application process for a TFN is flexible, allowing applicants to apply online or through traditional paper channels. The TFN is issued upon satisfactory submission of proof of identity, which, for individuals, includes one primary document (birth certificate, passport, citizenship certificate) and up to two secondary documents (driver's license, Medicare card, bank statement, firearms license, student card, proof of age card, student examination certificate). Proof of identity requirements for partnerships, companies, and trusts involve establishing the identity of the partners, director(s), public officer, and trustee, respectively.

Format

The TFN is an eight or nine digit number compiled using a check digit algorithm to allow accurate data capture of the TFN in ATO systems. Generally the TFN is displayed on correspondence as three sets of three numbers (for example XXX XXX XXX) but is stored as an eight or nine number string on internal systems.

Frequently Asked Questions

Why was my ABN application rejected?

The most common reason for rejection is failing the "Entitlement" test. The ATO is strict about preventing employees from posing as contractors. If you cannot prove you are "carrying on an enterprise" (e.g., own your equipment, can delegate work, bear financial risk), the tool may classify you as a hobbyist or employee, making you ineligible for an ABN. [1]

Do foreign directors need a Director ID?

Yes. It is now a mandatory requirement for all directors of Australian companies (including foreign companies registered with ASIC) to verify their identity and obtain a Director ID. Foreign directors cannot use the myGovID app and must typically apply via a paper form with certified identity documents. [2]

What if a supplier refuses to provide an ABN?

If a supplier does not provide an ABN and the transaction is for business purposes, you are legally required to withhold 47% (the top tax rate) from the payment and send it to the ATO. However, the supplier can avoid this by providing a "Statement by a supplier" form if specific exceptions apply (e.g., it is a hobby or private sale). [3]

What is "Sham Contracting"?

"Sham contracting" occurs when an employer forces an employee to get an ABN and invoice them as a contractor to avoid paying entitlements like superannuation and leave. This is illegal. The ATO looks beyond the contract to the reality of the relationship (control, delegation, risk) to determine the true status. [4]

How Lookuptax can help you ? Lookuptax VAT validation revolutionizes VAT number validation with its robust platform, empowering businesses to seamlessly verify VAT numbers across over 100 countries. Our cutting-edge technology ensures accurate and efficient validation, reducing errors and enhancing compliance.