Azerbaijan TIN number guide

Tax Identification Number (TIN)

As stipulated in Article 13.2.4 of the Tax Code of the Republic of Azerbaijan, a taxpayer is defined as any individual who is obliged to pay taxes on the taxable entities specified in accordance with the Tax Code.

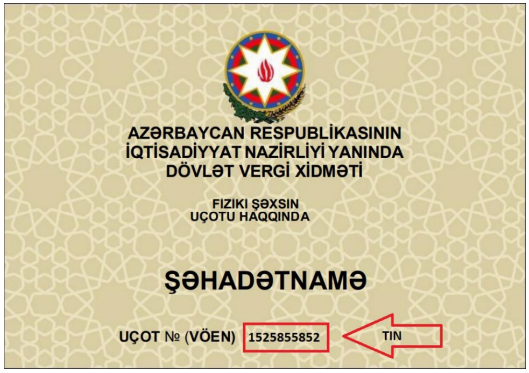

In line with Article 34.6 of the Tax Code of the Republic of Azerbaijan, the State Tax Service under the Ministry of Economy of the Republic of Azerbaijan is responsible for issuing the Tax Identification Number (TIN). The TIN serves as a unique identifier within the territory of the Republic of Azerbaijan for all taxpayers, encompassing all taxes and payments associated with the transfer of goods across the customs border of the Republic of Azerbaijan. TINs are allocated to both entities and natural persons involved in entrepreneurial activities, as well as individuals required to be registered as taxpayers according to the prevailing legislation.

Format

The Tax Identification Number (TIN) is a ten-digit code, where the initial two digits represent the code for the territorial administrative unit, and the subsequent six digits denote a serial number. The software calculates the ninth digit through a specific algorithm, while the tenth digit designates the legal status of the taxpayer, with number 1 assigned to legal persons and number 2 to natural persons.

The Personal Identification Number (PIN) is a unique code comprising a combination of letters and digits, totaling seven symbols, which remains constant. It consists of the following 7 digits and letters:

For old passports and National IDs, the first digit of the national identity card or the last 7 digits and letters of the passport are placed on the right lower corner before the < symbol.

For new passports and National IDs, it is indicated as “Personal No.”

Example for individuals: TIN: 1 5 2 5 8 5 5 8 5 2 PIN: 5VBK5VR (Note: The PIN does not contain the letter "O," only the digit "0" (zero))

Example for legal persons: TIN: 1 3 2 5 6 7 8 8 5 1

|  |

| New National ID | TIN Individuals |

|

| TIN for Entities |

Official database - TIN search

How Lookuptax can help you in VAT validation?

Lookuptax VAT validation revolutionizes VAT number validation with its robust platform, empowering businesses to seamlessly verify VAT numbers across over 100 countries. Our cutting-edge technology ensures accurate and efficient validation, reducing errors and enhancing compliance.