Qatar TIN number guide

Personal Identification Number (PIN)

Individuals in Qatar who do not engage in industrial, commercial, craft, or professional activities as defined by Article 1 of the Income Tax Law (ITL) are distinguished by their Personal Identification Number (PIN) for Qatari nationals and their residence permit number for foreign residents in Qatar.

Residence Permit Number

Assigned to foriegn residents in Qatar.

Taxpayer Identification Number (TIN)

Any taxpayer engaging in an activity or earning taxable income must undergo registration with the GTA (General Tax Authority) and file an application for a Tax Identification Number (TIN) with the GTA. This TIN does not expire and remains valid for as long as the firm is licensed and continues to conduct their licensed activities. At present, the QFC only has corporate income tax, thus, the TIN is only for corporate tax purposes. There are no individual QFC taxpayers. Consequently, the following individuals and entities are identified by their TINs:

- Natural persons involved in industrial, commercial, craft, or professional activities.

- Legal entities incorporated in or having their place of effective management in the State of Qatar.

- Entities established within the Free Zone of Qatar Science and Technology Park (QSTP).

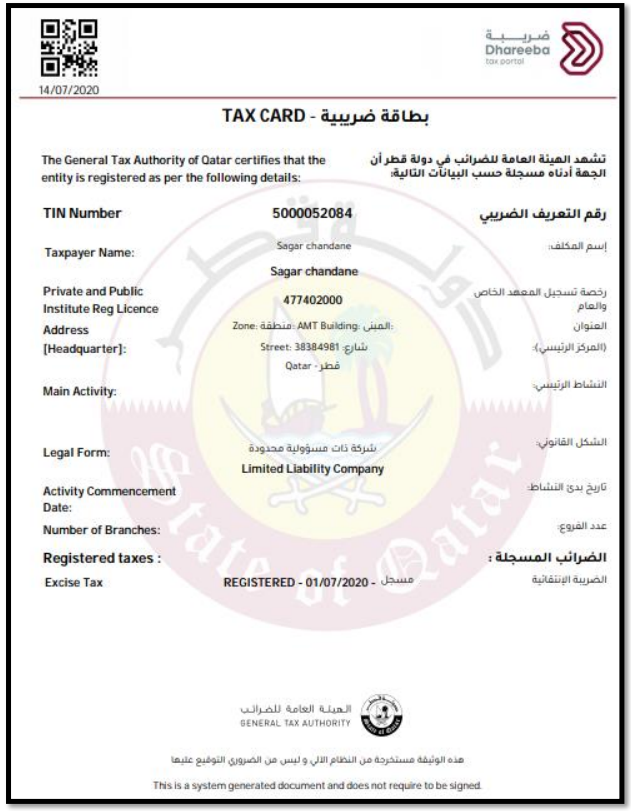

TIN Format For individuals and entities under the jurisdiction of the GTA, the Tax Identification Number (TIN) is comprised of 10 digits, commencing with the digit 5, denoting Qatar's affiliation with the Gulf Cooperation Council (GCC). The subsequent 9 digits are algorithmically generated and include a check digit.

For entities under the jurisdiction of QFCA, the TIN structure follows the format T00000, with the zeroes representing the QFC License Number assigned to firms. Therefore, a QFC firm with License Number 00001 would have T00001 as its TIN.

|

| TIN on Qatar Tax Card |

|

| Registration Certificate |

Special Registration Number

For the purpose of fulfilling withholding tax (WHT) obligations, specific individuals and entities are distinguished by a unique registration number:

- Ministries.

- Governmental bodies.

- Public authorities and institutions.

- Tax-exempt associations, professional associations, and private foundations registered with the Ministry of Administrative Development, Labor and Social Affairs (ADLSA).

- Tax-exempt private institutions of public benefit registered with the Ministry of Justice (MOJ).

- Tax-exempt charitable associations and charitable private foundations registered with the Regulatory Authority for Charitable Activities (RACA).

How Lookuptax can help you in VAT validation?

Lookuptax VAT validation revolutionizes VAT number validation with its robust platform, empowering businesses to seamlessly verify VAT numbers across over 100 countries. Our cutting-edge technology ensures accurate and efficient validation, reducing errors and enhancing compliance.