New Zealand TIN number guide

IRD Number

The IRD number in New Zealand is a unique identifier issued by Inland Revenue to individuals and non-individual entities like Companies, Partnerships, Trusts, and Charities. Typically utilized throughout a customer's lifetime, except in cases of bankruptcy, this number is crucial for both residents and non-residents engaging with New Zealand's tax system. It serves as a necessity for various taxes, encompassing Income Tax, Goods and Services Tax, as well as Employer taxes like Pay as You Earn and Fringe Benefit Tax. Additionally, the IRD number is essential for social policy entitlements managed by Inland Revenue, covering areas such as Working for Families Tax Credits, Child Support, Student Loans, Paid Parental Leave, and KiwiSaver.

IRD Number Format

The format of the IRD number in New Zealand varies based on its age, appearing as either an eight or nine-digit number, structured as 99-999-999 or 999-999-999. This identifier comprises a base number of seven or eight digits, accompanied by a trailing check digit. An emerging trend involves appending a 0 to eight-digit numbers to extend their length to nine digits, exemplified as 099-999-999.

|

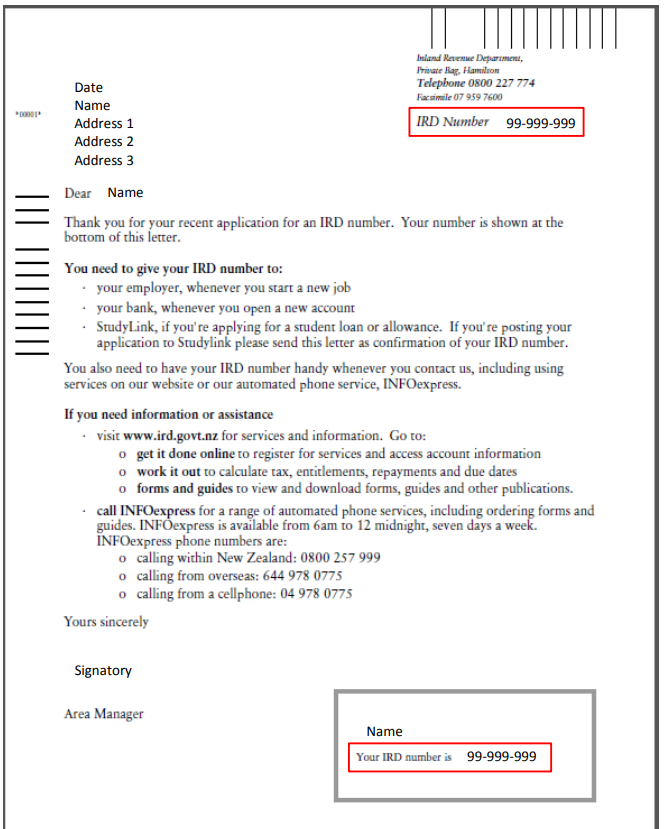

| IRD number on initial notification |

|

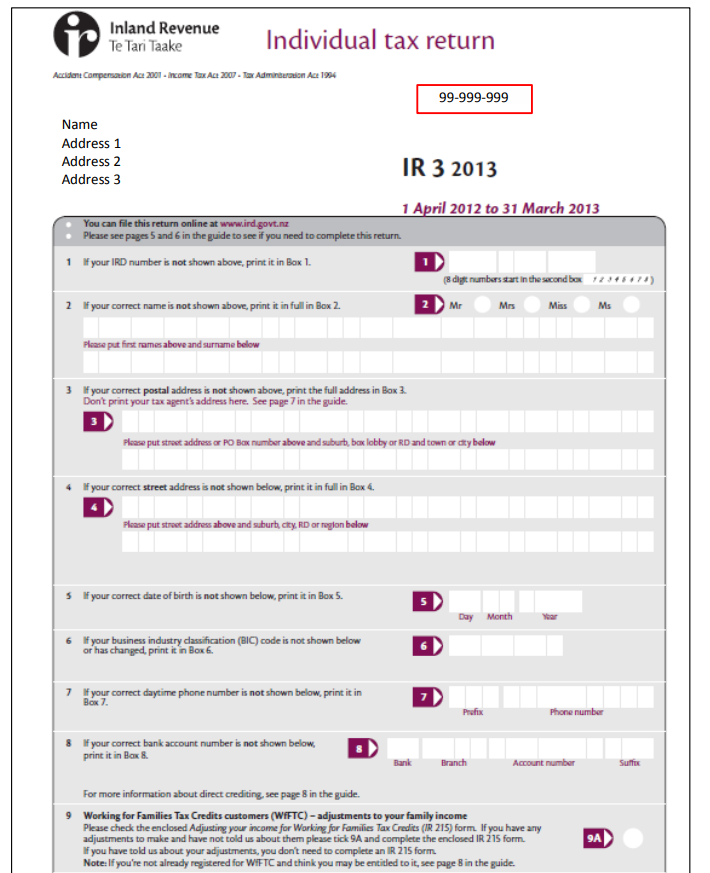

| IRD number on Tax return |

How Lookuptax can help you in VAT validation?

Lookuptax VAT validation revolutionizes VAT number validation with its robust platform, empowering businesses to seamlessly verify VAT numbers across over 100 countries. Our cutting-edge technology ensures accurate and efficient validation, reducing errors and enhancing compliance.