Canada GST number guide

Business Number (BN)

For businesses, the tax identification is a distinctive nine-digit Business Number (BN) provided by the Canada Revenue Agency. Canadian-resident corporations hold income tax reporting responsibilities, necessitating the possession of a BN. Ensure compliance with your BN for seamless income tax reporting in Canada. Business Number is also issued to partnerships in canada.

Format

A BN is a unique nine-digit number issued to identify businesses and partnerships.

|  |

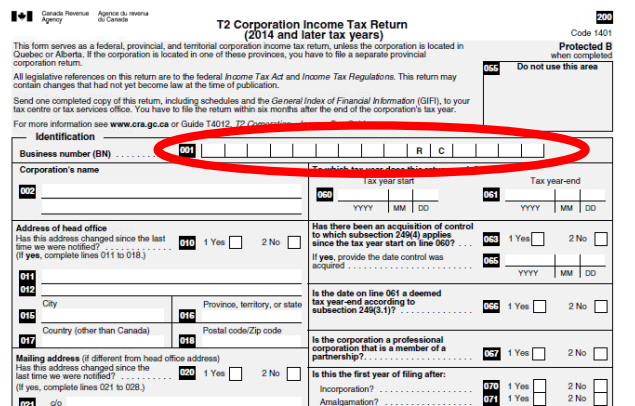

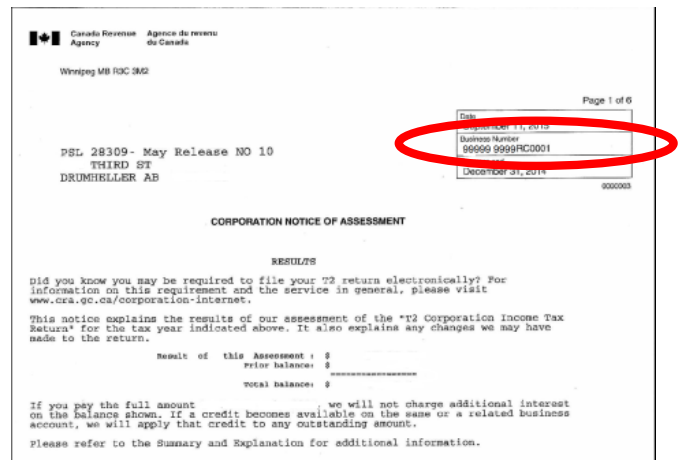

| BN on income tax return | BN on notices of tax assessment |

Foreigners

Non-Residents can also obtain a business number in Canada. The registration process is completely online. You can learn about it here Find out if you need to register for GST here

Read more about Business number here

Social Insurance Number (SIN)

Every Canadian resident with income tax filing responsibilities (or for whom an information return is necessary) must possess (or acquire) a Social Insurance Number (SIN). SINs, vital for tax reporting, remain confidential but must be provided to financial institutions upon request. Ensure compliance with tax regulations by having your SIN for seamless financial transactions and reporting.

Format

A Social Insurance Number (SIN) is a distinct nine-digit identifier .

Read more about Social Insurance Number here

|  |

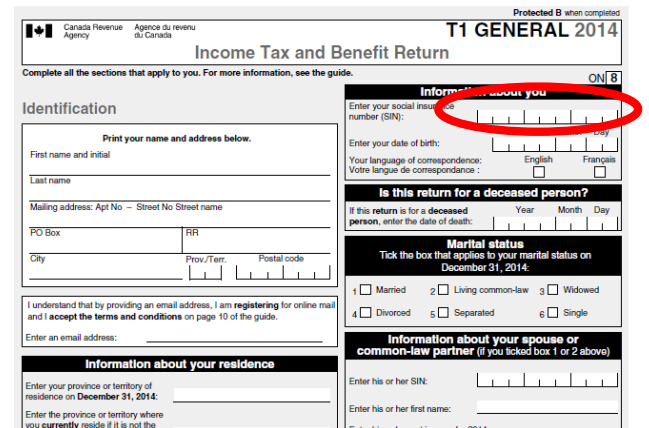

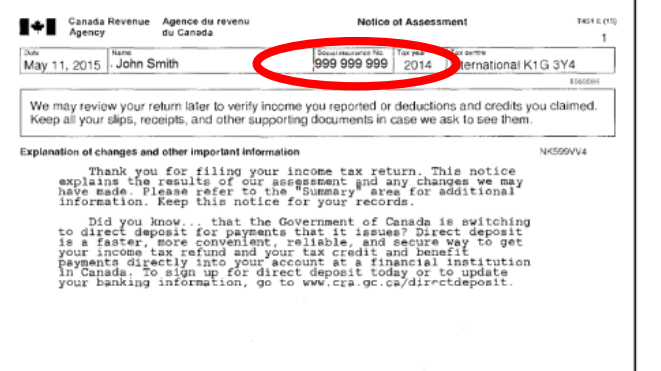

| SIN on income tax return | SIN on notices of tax assessment |

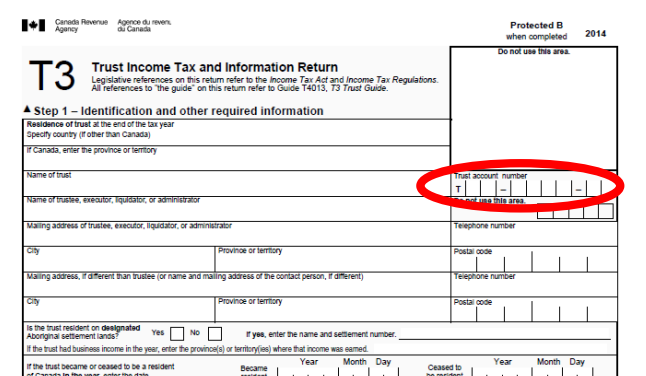

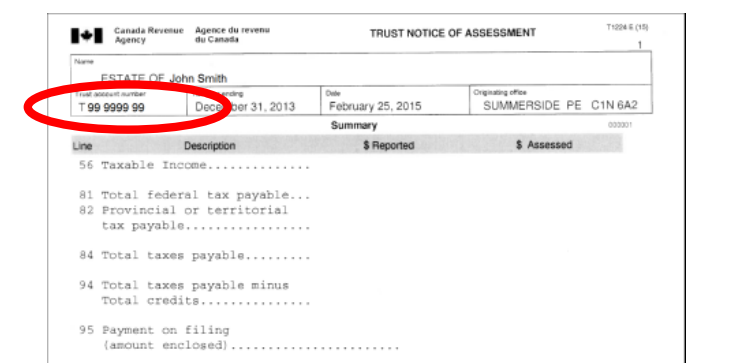

Trust Account Number

For trusts, the tax identification involves an eight-digit trust account number prefixed by the letter "T," issued by the Canada Revenue Agency. Canadian-resident trusts, with income tax reporting responsibilities, are mandated to possess a trust account number. Ensure compliance with your trust account number for seamless income tax reporting in Canada.

|  |

| Trust Account Number on income tax return | Trust Account Number on notices of tax assessment |

Goods and Services Tax (GST)

The Goods and Services Tax (GST) number in Canada is a unique identifier assigned by the Canada Revenue Agency (CRA) to businesses engaged in taxable transactions. This registration is essential for businesses meeting certain revenue thresholds, allowing them to collect and remit GST. Obtaining a GST number is crucial for compliance with Canadian tax regulations, enabling businesses to navigate the complexities of the GST system and fulfill their tax obligations. GST number is a unique 9 digit number.

Official Database - GST search

Harmonized Sales Tax (HST)

The Harmonized Sales Tax (HST) number in Canada is a distinctive identifier assigned by the Canada Revenue Agency (CRA) to businesses involved in taxable transactions in provinces that have adopted the HST system. Obtaining an HST number is essential for businesses meeting specific revenue thresholds, enabling them to collect and remit HST. This registration ensures compliance with Canadian tax regulations, facilitating seamless navigation of the HST system and fulfillment of tax obligations. Stay informed about HST updates by checking official CRA documentation for the latest details.

Quebec Sales Tax (QST) registration number

The Quebec Sales Tax (QST) registration number is a unique identifier issued by Revenu Québec for businesses operating in Quebec. This registration is necessary for businesses engaging in taxable transactions, ensuring compliance with QST regulations. Obtaining a QST registration number is vital for businesses conducting sales in Quebec, facilitating proper tax collection and reporting.

Format

A QST account number is a unique 10-digit number issued by Revenue Quebec.

Official Database - QST search

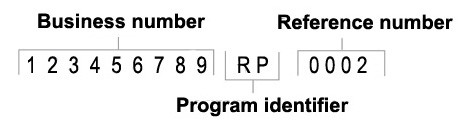

Canada Revenue Agency (CRA) program accounts

Two letters and four digits attached to a BN and used for specific business activities that must be reported to the CRA

Format

|

| CRA program account number |

A CRA program account number has three parts:

- the nine-digit BN to identify the business

- a two-letter program identifier code to identify the program account

- a four-digit reference number to identify an individual program account (since businesses can have more than one of the same kind)

Frequently Asked Questions

Do I need a Business Number (BN) if I am a freelancer?

Not necessarily. As a sole proprietor (freelancer), you only need a Business Number if your total taxable revenues (before expenses) exceed $30,000 in a single calendar quarter or over four consecutive calendar quarters. At that point, you must register for a GST/HST account, which generates a BN.[1] However, you can choose to register voluntarily before hitting this threshold to claim Input Tax Credits (refunds on GST/HST you pay for business expenses).

What is the difference between a SIN, BN, and GST number?

- Social Insurance Number (SIN): A 9-digit personal identifier for working and filing personal income tax in Canada. You use this if you are a sole proprietor without a BN.

- Business Number (BN): A 9-digit number assigned to a business legal entity (corporation, partnership, or sole proprietorship) to identify it to the government.

- GST/HST Number: This is your BN plus a program identifier. It is 15 characters long: the 9-digit BN +

RT(for GST/HST) +0001(reference number).[2]

How can I verify if a GST/HST number is valid?

You can verify if a supplier's GST/HST number is valid using the official GST/HST Registry provided by the Canada Revenue Agency. You must enter both the GST/HST number and the supplier's name to confirm they match. This protects you from claiming ITCs on invalid invoices.[3]

How do I find my Business Number if I lost it?

You can find your BN on your:

- Income tax return or Notice of Assessment.

- Incorporation documents.

- By searching for your business name on Canada's Business Registries.[4]

What formats are used for Canadian Tax IDs?

- Business Number (BN): 9 digits (e.g.,

123456789). - GST/HST Program Account: 15 characters (e.g.,

123456789 RT 0001). - SIN: 9 digits (e.g.,

123 456 789).

How Lookuptax can help you ?

Lookuptax VAT validation revolutionizes VAT number validation with its robust platform, empowering businesses to seamlessly verify VAT numbers across over 100 countries. Our cutting-edge technology ensures accurate and efficient validation, reducing errors and enhancing compliance.