Malta TIN number guide

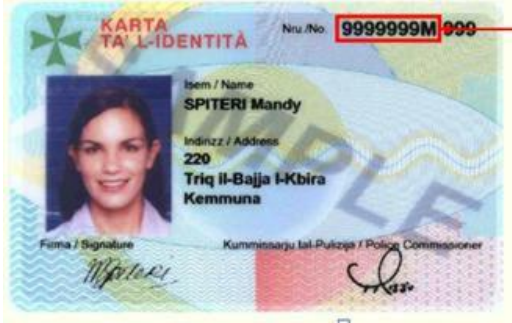

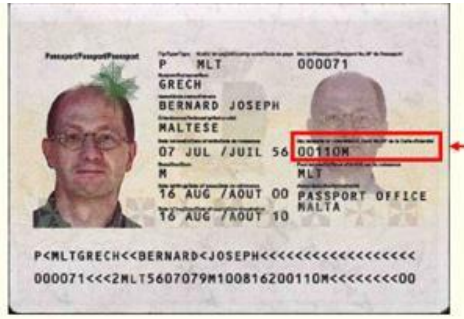

Identity Card Number

In Malta, Maltese nationals use their Identity Card Number as the Tax Identification Number (TIN), structured as (0000)999L, with a range from 9999999L. This TIN format comprises 8 characters, featuring:

- 7 digits

- 1 letter (M, G, A, P, L, H, B, Z)

For Maltese nationals, it's important to note that the first 4 digits can be omitted if they are 0 (zero). Additionally, in IT processing, the TIN must always be 8 characters long, ensuring that the first 0 (zero) is consistently recorded. This systematic approach guarantees accurate and standardized Tax Identification Numbers for individuals in Malta.

|

| ID card |

|

| Passport |

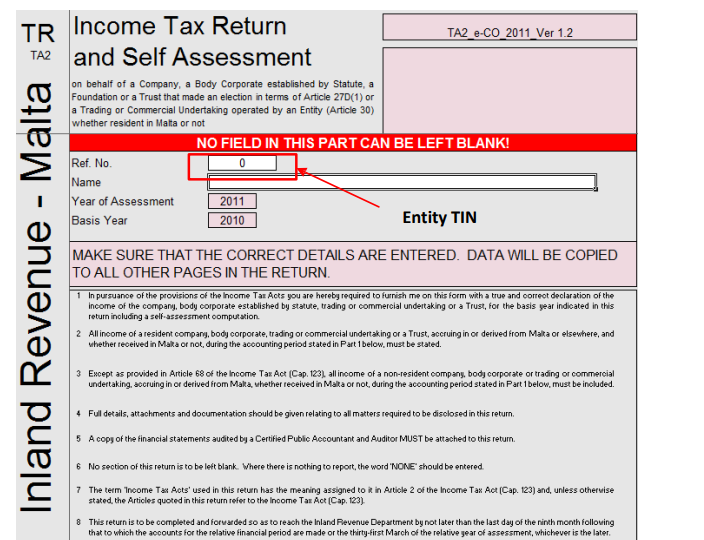

Taxpayer Reference Number

Non-Maltese nationals and entities residing in Malta for tax purposes receive a distinctive 9-digit taxpayer reference number, automatically generated by the IRD. The TIN for non-Maltese nationals is created upon submitting a completed registration form, while newly established entities registering with the Maltese Registry of Companies are automatically enrolled with the IRD.

TRN Format

The Taxpayer Reference Number consits of 9 digits Eg: 999999999

|

| Entity TIN |

VAT number

VAT number in Malta consists of 8 digits eg: MT99999999

How Lookuptax can help you in VAT validation?

Lookuptax VAT validation revolutionizes VAT number validation with its robust platform, empowering businesses to seamlessly verify VAT numbers across over 100 countries. Our cutting-edge technology ensures accurate and efficient validation, reducing errors and enhancing compliance.