Lithuania TIN number guide

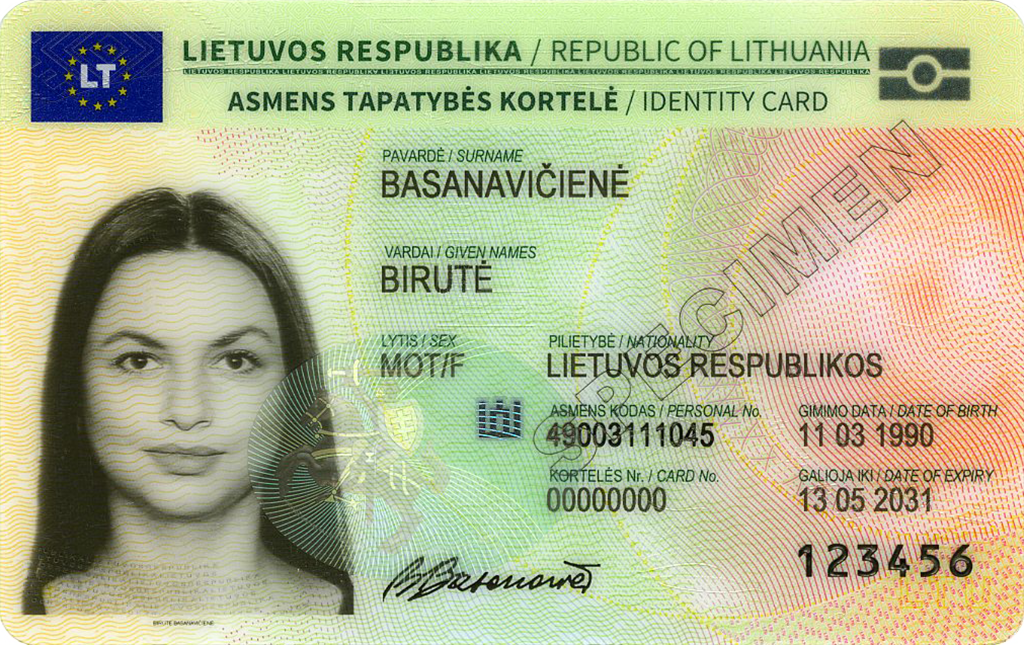

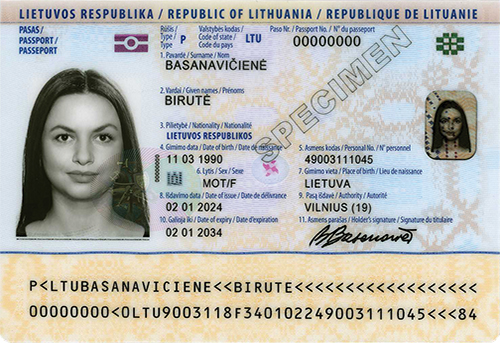

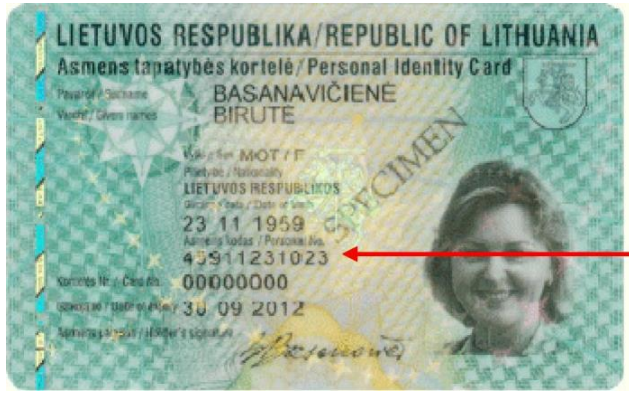

Asmens Kodas

Asmens Kodas is also known as personal code.

Format: 11 digits without spaces and delimiters

Pattern: 11 digits without spaces and delimiters, following this structure:

- One digit (1-6) representing the person's gender and century of birth.

- Six digits representing the birth date in the format YYMMDD.

- Three digits representing the serial number of the date of birth.

- One check digit for validation.

|

| Asmens Kodas |

TIN

TIN Structure: The Taxpayer Identification Number (TIN) follows the format TIN = F || SEQ || K, where:

- "F" is a fixed number, either 6 or 9.

- "SEQ" represents 8 digits generated from a sequence of natural numbers (e.g., 00000001, 00000002).

- "K" is a control number calculated using the algorithm described below.

The TIN is composed of a ten-digit number N9N8N7N6N5N4N3N2N1K, where the tenth digit (K) serves as the control number.

To validate the correctness of the taxpayer's identification number, follow the algorithm outlined in steps 2-8:

- Extract digits N9 to N1 from the TIN.

- Multiply each digit by the corresponding number in the sequence 9, 8, 7, 6, 5, 4, 3, 2, 1, and sum the results: A = Σ(Ni * i), where i = 1,…,9.

- Divide the sum (A) by the two-digit number formed by the first two digits of the TIN (N9N8): B = A mod N9N8.

- If B < 10, set K = B. If B >= 10, add the individual digits of B: Z = Σ(Sm), where m is the position of the digit.

- If Z < 10, set K = Z. If Z >= 10, repeat the process of adding digits until Z < 10, and the final Z becomes the control number K of the TIN.

|

| Passport |

|

| Drivers license |

|

| ID card |

PVM mokėtojo kodas

PVM stands for Pridėtinės vertės mokestis. PVM mokėtojo kodas is the VAT number in Luthuvania

Format PVM mokėtojo kodas consi9 or 12 digits. eg: LT999999999 or LT999999999999

How Lookuptax can help you in VAT validation?

Lookuptax VAT validation revolutionizes VAT number validation with its robust platform, empowering businesses to seamlessly verify VAT numbers across over 100 countries. Our cutting-edge technology ensures accurate and efficient validation, reducing errors and enhancing compliance.