Albania TIN number guide

Tax Identification Number (TIN) (NUIS)

The Tax Identification Number (TIN) for businesses is granted by the National Business Center (NBC), an Albanian government entity. Every business operating within the Republic of Albania must obtain the Number of Identification as a Taxable Person. The initial registration and any subsequent updates to the registration are processed through applications submitted to the National Business Center (NBC). Initial registration for non-profit organizations, tax representatives, and farmers is conducted at the Regional Tax Directorate of the relevant district.

Format

The Tax Identification Number (TIN) assigned to taxpayers, including legal entities and individuals engaged in economic activities, follows the format J12345678N. The first character is a capital letter denoting the decade of TIN issuance (e.g., "J" for 1990-1999, "K" for 2000-2009). The second character indicates the year within the specified decade (e.g., 1 for 2011, 2 for 2012).

The third and fourth characters signify the converted month of TIN issuance, depending on the district where the business was originally established. For example, January in Tirana is represented by 13, February in Tirana by 14, January in another district by 25, February in that district by 26, and so on.

The fifth and sixth characters represent the day of the month on which the TIN was issued (e.g., 01, 02, 03, etc.). Characters 7 to 9 indicate the sequential order of TIN issuance on the specified day within a specific district (e.g., 009 is the 9th TIN issued in Tirana district, 108 is the 8th TIN issued in another district).

The tenth character is a check digit, a capital letter calculated based on a formula dependent on the first nine characters.

|

| NUIS(TIN) |

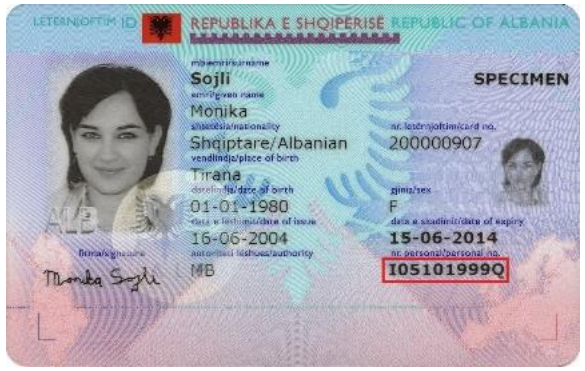

National ID number (NID)

The Tax Identification Number (TIN) for individuals, known as the National ID (NID), is issued to both Albanian citizens and foreign citizens with permanent residence in the Republic of Albania. It serves various purposes:

- Inclusion in the National Registry of Civil Status.

- As the identification number on the national identity document.

- As a social security number for identification, registration, and claiming benefits from social security, health insurance, and other social protection programs.

- Entry in the National Register of Elections.

- As a Tax Identification Number.

- For the issuance of a driving license.

- To meet the requirements of other state institutions, including those related to justice, order, prosecution, education, and the Property Registration Office.

The individual Tax Identification Number (TIN), also known as the National ID number (NID), is a distinctive ten-character code (e.g., I05101999Q) containing encoded information, structured as follows:

- Characters 1 and 2: Year of birth

- Characters 3 and 4: Month of birth and gender

- Characters 5 and 6: Day of birth

- Characters 7 to 9: Issuing order number on the same date

- Character 10: Check digit.

|

| NID |

Frequently Asked Questions

What is the difference between NIPT and NUIS?

In Albania, NIPT (Numri i Identifikimit për Personin e Tatueshëm) and NUIS (Numri Unik i Identifikimit të Subjektit) refer to the same 10-character unique identification number. NUIS is the modern term used by the National Business Center (QKB) for business transparency, while NIPT is the traditional term used by the General Directorate of Taxes (DPT). They are used interchangeably on invoices and tax returns.

Do I need a NIPT if I’m a remote worker or digital nomad in Albania?

Yes. If you stay in Albania for more than 183 days or become a tax resident, you are legally required to register as a "Person Fizik" (Sole Proprietor) to issue invoices compliant with Albanian law. This grants you a NIPT, which allows you to pay mandatory social and health insurance contributions, even if your clients are abroad.

Can I verify an Albanian VAT number on the EU VIES system?

No. Because Albania is not a member of the European Union, its tax identification numbers are not available on the VIES portal. To verify an Albanian VAT number, you must use the official Albanian General Directorate of Taxes (DPT) portal or the National Business Center (QKB) search tool. [1]

What is the format of an Albanian NIPT/Tax ID?

The Albanian NIPT follows a 10-character alphanumeric structure: L00000000L (One Letter + 8 Digits + One Letter).

- First Letter: Indicates the entity type or registration era (e.g., 'J' for legal entities, 'K'/'L'/'M' for specific decades, 'I' for individuals).

- Middle 8 Digits: A unique sequential sequence.

- Last Letter: A check character (control digit) used to validate the number algorithmically.

Can I open a business bank account in Albania without a NIPT?

Generally, no. Most Albanian banks require a NIPT certificate (issued by the QKB) to open a business bank account. However, you can typically open a personal resident account with just your passport and residence permit. The "chicken and egg" problem often arises because you need a local bank account (or proof of capital) to register certain types of companies (like LLCs/SHPK), though Sole Proprietors ("Person Fizik") often have simpler requirements.

How do I check if an Albanian company is currently "Active"?

You can check a company’s status by searching their NIPT on the National Business Center (QKB) website. The registry will show statuses such as "Aktiv" (Active), "Pasiv" (suspended/no current activity), or "Çregjistruar" (Deregistered). Always ensure a business is "Aktiv" before entering into a commercial agreement. [2]

Is the NIPT number the same as the VAT number in Albania?

Yes. For businesses registered for VAT, their NIPT serves as their VAT ID. While the internal 10-character code is used for domestic filing, the prefix "AL" is often added (e.g., ALJ12345678K) for international transactions and intra-state communication, even though Albania is outside the EU VAT area.

Is a physical office required for a NIPT, or can I use my home address?

You must have a registered "Business Address" to get a NIPT. For digital nomads and freelancers, using a residential rental address is common, but it requires a notarized rental contract that explicitly permits business activity (or at least doesn't forbid it) and property ownership proof from the landlord. Some use service providers (accountants/lawyers) who offer "virtual office" registration services to bypass this hurdle.

Do I need an Albanian NIPT to sell software or SaaS to private customers in Albania?

Yes. Non-resident companies providing digital services (e.g., streaming, SaaS, e-learning) to individuals (B2C) in Albania are generally required to register for VAT and obtain a NIPT from their first sale. There is no minimum threshold for non-resident digital service providers. You must traditionally appoint a local tax representative to handle this registration. [3]

Is an EORI number required for exporting goods to Albania, or should I use a NIPT?

While EORI numbers are standard for EU trade, Albania (a non-EU country) uses the NIPT (NUIS) as the primary identifier for its customs system (Asycuda World). Foreign exporters should ensure their commercial invoices and customs declarations correctly cite the Albanian importer's NIPT to avoid delays at the border. [4]

What is "Fiskalizimi" and does it apply to foreign companies?

Fiskalizimi is Albania's real-time electronic invoicing and fiscalization system. If a foreign company is registered for VAT in Albania (e.g., for digital services or local projects), it must comply with Fiskalizimi rules. This implies that invoices issued to Albanian entities or consumers must be reported in real-time to the tax administration, often requiring specific software or a certified local representative to generate the correct "Fiscal Code" on the invoice. [5]

Can a non-resident company register for an Albanian VAT NIPT without a local office?

Yes, a physical local office is not required for the NIPT itself, but appointing a fiscal representative (tax representative) who is a resident in Albania is currently a mandatory requirement for non-resident companies to register for VAT and manage their local tax obligations.

How Lookuptax can help you ?

Lookuptax VAT validation revolutionizes VAT number validation with its robust platform, empowering businesses to seamlessly verify VAT numbers across over 100 countries. Our cutting-edge technology ensures accurate and efficient validation, reducing errors and enhancing compliance.