Singapore TIN number guide

UEN - Business (ROB)

UEN - Business (ROB) refers to the Unique Entity Number issued to business entities registered in Singapore.

UEN is used to uniquely identify registered businesses operating in Singapore It is issued by government agencies like Accounting and Corporate Regulatory Authority (ACRA), Inland Revenue Authority of Singapore (IRAS) and others. All companies, businesses, partnerships, societies etc are required to register for a UEN.

Format

UEN – Business (ROB): NNNNNNNNC - 9 characters

Official Database - UEN search

|

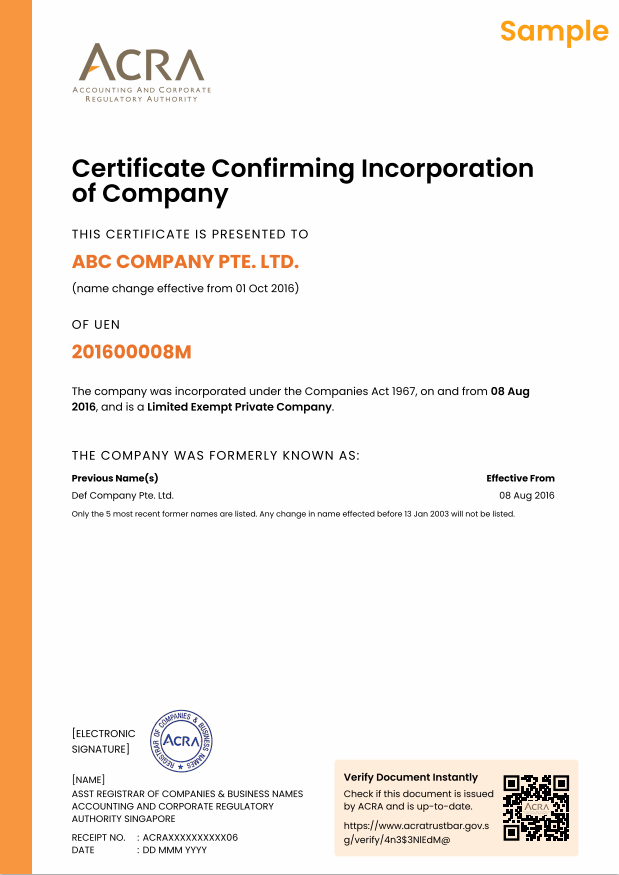

| Singapore Incorporation certificate |

UEN – Local Company (ROC)

UEN - Local Company (ROC) refers to the Unique Entity Number issued to locally registered companies in Singapore. ROC stands for "Registered Of Company" It is issued by the Accounting and Corporate Regulatory Authority (ACRA) in Singapore. All companies incorporated in Singapore are required to register for a UEN-Local Company

Format

For Local Companies - YYYYNNNNNC - 10 characters For Foreign Companies - F000NNNNNC or FDDDNNNNNC

UEN – Others

This is the standard identification number assigned to entities that are not classified as businesses or local companies.

Format

SYYPQNNNNC or TYYPQNNNNC - 10 characters

In the above formats

- D is a space

- C is a check alphabet

- N is numeric

- YYYY is a year

- TYY and SYY are the year of issuance, where T represents ‘20’ and S represent ‘19’ PQ is the entity type, e.g. ‘LL’ represents ‘Limited Liability Partnership’

NRIC number

The National Registration Identity Card (NRIC) number is a unique identification number issued to Singaporean citizens and permanent residents. It serves as a vital document for identification purposes in various transactions and interactions with government agencies and private entities. The NRIC number contains personal information such as the individual's birth date, gender, and a checksum digit for validation. It is crucial for accessing government services, opening bank accounts, applying for jobs, and other official matters.

Format : #0000000@

First letter #

The letter assigned to individuals can vary based on their status:

- For Singapore citizens and permanent residents born before 2000, the letter "S" is assigned.

- Singapore citizens and permanent residents born in or after 2000 are designated the letter "T."

- Foreigners with employment or student passes issued before 2000 are allocated the letter "F."

- Those with employment or student passes issued in or after 2000 are assigned the letter "G."

- Foreigners with employment or student passes issued in or after 2022 are given the letter "M."

Digits 2-8

This 7-digit sequence is specifically designated to the individual documented:

- For Singapore citizens and permanent residents born in 1968 and later, their NRIC number commences with their birth year, such as 71xxxxx#. Conversely, for those born in 1967 or earlier, the NRIC number isn't linked to their birth year and usually starts with 0 or 1.

- Non-native Singaporeans born before 1967 receive leading digits 2 or 3 upon gaining permanent residency or citizenship, randomly assigned based on the issuance sequence.

- Subsequent digits are solely for individuals obtaining permanent residency or citizenship after 2008, indicated by "4" or "5."

@ - The last digit is a checksum

|

| NRIC Card |

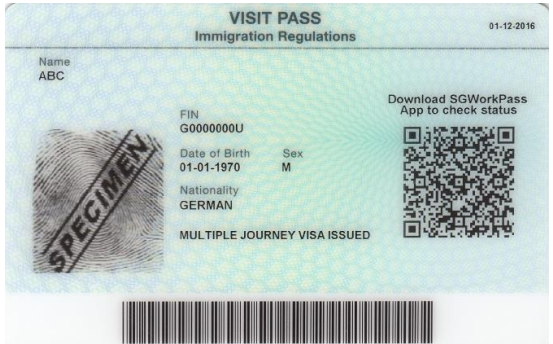

FIN number

The Foreign Identification Number (FIN) is assigned to foreign individuals residing or working in Singapore who hold a Work Pass Card, such as an Employment Pass or an Immigration Pass issued by the Ministry of Manpower (MOM). It serves as a unique identifier for foreign nationals and is essential for various administrative and legal purposes within Singapore. The FIN facilitates access to government services, employment, banking, and other essential activities requiring identification. It ensures smooth transactions and compliance with immigration and labor regulations for foreign individuals contributing to Singapore's workforce and economy.

Format : The format of FIN number is same as that of NRIC mentioned above

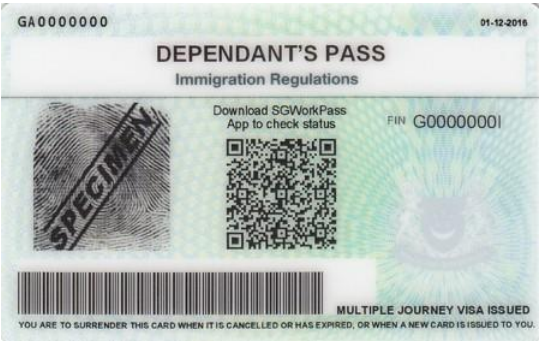

FIN number can be found on different passes such as Employment Pass, Overseas Networks and Expertise Pass, EntrePass, Training Employment Pass, Personalised Employment Pass, Work Holiday Pass, Dependant’s Pass and Long Term Visit Pass

|  |

| FIN on Employment Pass - Front | FIN on Employment Pass - Back |

|  |

| FIN on Dependant Pass - Front | FIN on Dependant Pass - Back |

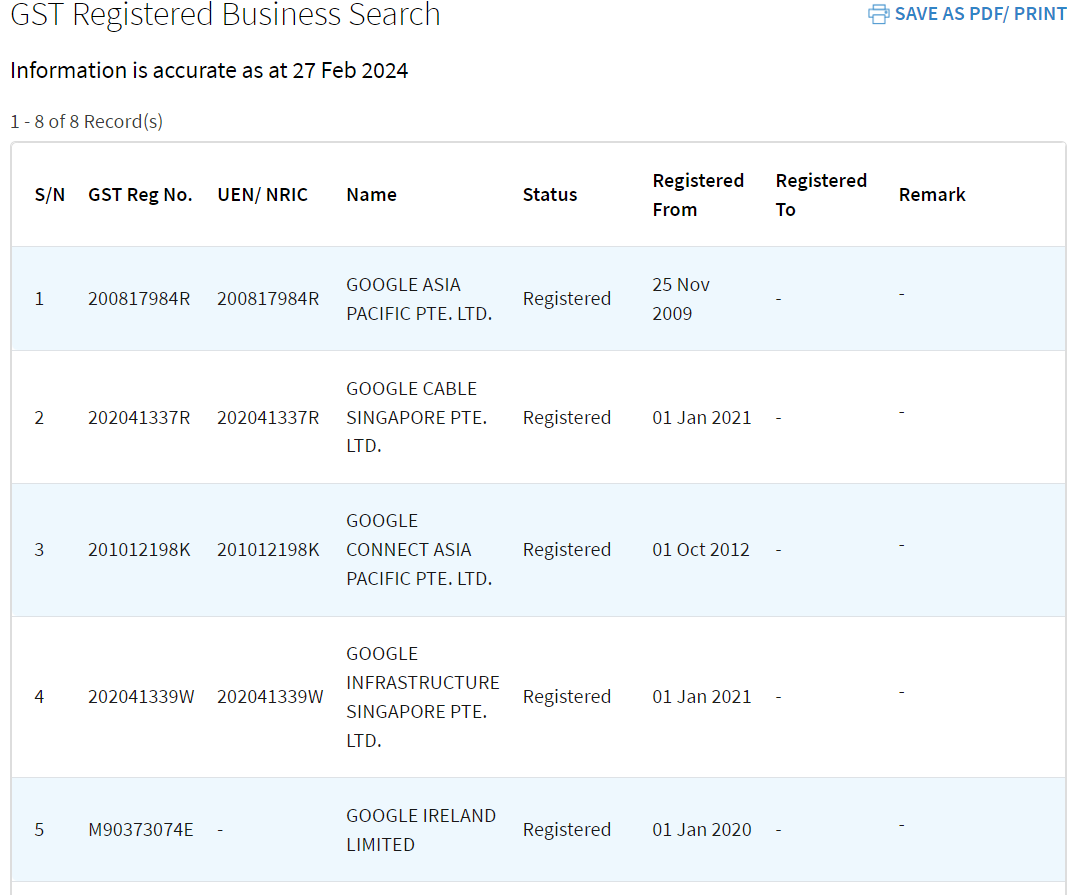

GST Reg Number

The Goods and Services Tax (GST) Registration Number in Singapore consists of 10 characters. The initial two characters can be either letters or numbers, followed by seven numeric characters, and ending with a checksum character. Issued by the Inland Revenue Authority of Singapore (IRAS), this number is assigned to entities registered for GST. Sometimes GST number will be same as the UEN number

|

| GST Reg Number |

How Lookuptax can help you in VAT validation?

Lookuptax VAT validation revolutionizes VAT number validation with its robust platform, empowering businesses to seamlessly verify VAT numbers across over 100 countries. Our cutting-edge technology ensures accurate and efficient validation, reducing errors and enhancing compliance.