Portugal TIN number guide

This post is also available in: Português

NIF (Número de Identificação Fiscal)

The Tax and Customs Authority holds the authority to issue a tax identification number (TIN) for individuals. This TIN is unique and carries legal significance for various purposes. It is imperative to possess an allocated TIN before commencing any activity, as it serves as a prerequisite for registering the start of operations.

Legal entities obtain their identification numbers through the Registo Nacional de Pessoas Coletivas (RNPC), which is a service under the Instituto dos Regist.

NIF Format The numbering system structure comprises 9 consecutive digits along with a control digit. The format of fiscal numbers varies based on the taxpayer's type:

-

Individuals:

- 1xx xxx xxx

- 2xx xxx xxx

- 3xx xxx xxx (not yet allocated)

-

Non-resident individuals (subject to final withholding at source):

- 45x xxx xxx

-

Corporations and Public entities:

- 5xx xxx xxx

-

State entities:

- 6xx xxx xxx

-

Inheritances, Non-resident Corporations (subject to final withholding at source), and Investment Funds:

- 70x xxx xxx

- 71x xxx xxx

- 72x xxx xxx

-

Irregular Companies and other entities:

- 90x xxx xxx

- 91x xxx xxx

-

Non-resident Corporations (with or without permanent establishment):

- 98x xxx xxx

-

Civil Partnerships:

- 99x xxx xxx

Citizen card Portugal NIF on citizen card

|

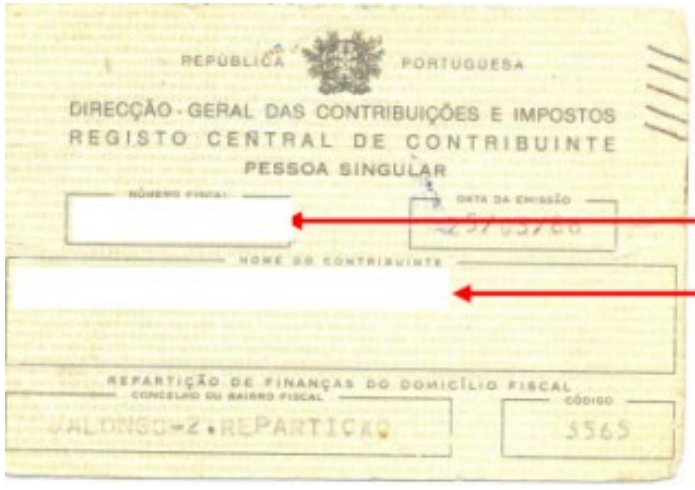

| Taxpayer Card |

|  |

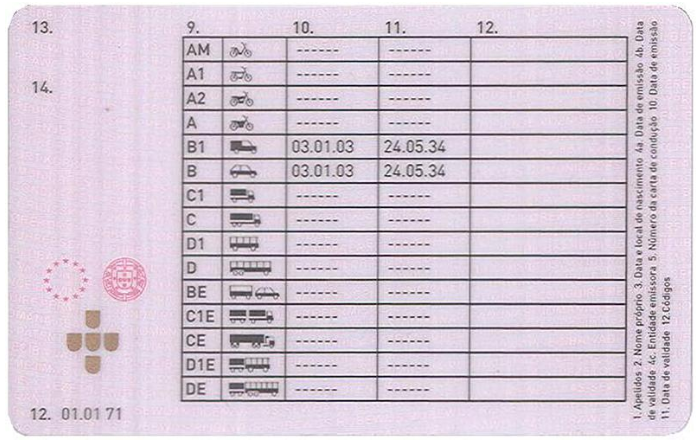

| Driving License | |

How Lookuptax can help you in VAT validation?

Lookuptax VAT validation revolutionizes VAT number validation with its robust platform, empowering businesses to seamlessly verify VAT numbers across over 100 countries. Our cutting-edge technology ensures accurate and efficient validation, reducing errors and enhancing compliance.