Glossary

VAT Registration thresholds

VAT registration threshold is the minimum amount of annual turnover a business needs to reach before it must register for VAT. The threshold varies by country and failure to register can result in penalties.

Intrastat

Intrastat is a system used in the European Union to collect data on the movement of goods between EU member states. Businesses exceeding the Intrastat threshold must provide monthly reports detailing their intra-EU trade. It helps the EU to monitor trade flows and inform policy decisions.

Distance selling

Distance selling refers to selling goods or services to customers in another country without physically being present there. It typically involves online sales, and businesses may have to register for VAT in the destination country and comply with local regulations. Distance selling thresholds vary by country.

GST

GST (Goods and Services Tax) is a value-added tax on the consumption of goods and services. It is levied by many countries worldwide, including India, Canada, and Australia. It simplifies the taxation system and is applied at each stage of the supply chain, with businesses able to claim back any GST they have paid on inputs.

VAT

VAT (Value Added Tax) is a tax on the value added to goods and services at each stage of production and distribution. It is a consumption tax applied in many countries worldwide, including the EU and UK. Businesses collect VAT on sales and can reclaim VAT paid on purchases.

Sales tax

Sales tax is a tax on retail sales of goods and services. It is typically applied at the point of sale, and the rate can vary by state, county, or city. In the United States, sales tax is imposed by individual states and is not federally mandated. Businesses collect sales tax from customers and remit it to the state or local government.

Reverse Charge

Reverse charge is a tax system where the responsibility for reporting and paying VAT or sales tax shifts from the supplier to the customer. It applies to certain transactions, such as purchases from foreign suppliers or certain types of goods and services. The customer reports and pays the tax instead of the supplier. This system is designed to simplify tax reporting and prevent tax fraud.

Electronic invoice

An electronic invoice, also known as e-invoice, is a digital version of a traditional paper invoice. It is generated, transmitted, received, and processed electronically, using computer systems and electronic communication methods such as email, EDI, or XML. E-invoicing offers several advantages over traditional paper invoicing, including faster processing, lower costs, and reduced errors. E-invoicing is becoming increasingly popular around the world, and some countries have even made it mandatory for businesses to use e-invoicing for certain transactions.

SAFT

SAFT stands for Standard Audit File for Tax, which is a standardized format for the electronic exchange of accounting and tax data between businesses and tax authorities. It was developed to simplify tax reporting and auditing, and it typically includes information on invoices, payments, and other financial transactions. SAFT is used in several countries around the world, including Portugal, Poland, and Norway.

Chorus Pro

Chorus Pro is an electronic invoicing and payment platform developed by the French government. It allows businesses to create and send invoices electronically and enables customers to pay them securely online. Chorus Pro is mandatory for businesses working with French public authorities.

Peppol

Peppol (Pan-European Public Procurement Online) is a standardized e-invoicing network that enables businesses to exchange electronic invoices with their customers and suppliers across Europe. It simplifies the invoicing process, reduces costs, and improves efficiency by using a common standard for the exchange of electronic documents. Peppol is used in several countries around the world, including Europe, Singapore, and Australia.

OpenPEPPOL

OpenPEPPOL is an international non-profit association that develops and maintains the Peppol e-invoicing network. It aims to promote the adoption of e-invoicing and other electronic business documents across Europe and beyond, and to facilitate interoperability between different e-invoicing systems. OpenPEPPOL provides a range of services, including the development of technical specifications, the certification of service providers, and the management of the Peppol network infrastructure.

Peppol BIS v3

Peppol BIS v3 (Business Interoperability Specification version 3) is the latest version of the Peppol e-invoicing standard. It is a standardized format for the exchange of electronic documents, such as invoices, between businesses across Europe and beyond. Peppol BIS v3 includes several improvements over previous versions, including better support for international trade, enhanced security features, and improved data quality. Peppol BIS v3 is widely used in the public and private sectors across Europe, and its adoption is growing globally.

UBL

UBL (Universal Business Language) is a standardized XML-based format for the exchange of electronic business documents, such as invoices, purchase orders, and shipping notices. It was developed to simplify and streamline business-to-business transactions by providing a common language for the exchange of data. UBL is used in several countries around the world and is supported by many software vendors and service providers.

GSTN

GSTN (Goods and Services Tax Network) is a non-profit, private limited company that provides IT infrastructure and services to support the implementation of the Goods and Services Tax (GST) in India. GSTN maintains a central database of registered taxpayers, processes tax returns and payments, and provides a range of online services to taxpayers and tax authorities. It aims to simplify tax compliance, reduce the burden of paperwork, and increase transparency and accountability in the tax system.

KoSIT

KoSIT (Coordination Office for IT Standards) is a German organization responsible for coordinating and promoting the development and adoption of IT standards in the public sector. It provides guidance, support, and resources to public authorities and IT vendors to ensure interoperability and compliance with legal and technical requirements. KoSIT is also involved in the development of national and international standards, and it promotes the use of open standards and open source software in public IT systems.

Sistema di Interscambio (SdI)

Sistema di Interscambio (SdI) is the Italian government's electronic invoicing system. It provides a standardized platform for the exchange of electronic invoices between businesses and the public administration.

Spanish Tax Identification Number (NIF)

The Tax Identification Number (NIF) is the numerical ID needed by a natural person (individual) or a legal person in order to do any procedures that may have any relevance for the Spanish Tax Agency. The Spanish Tax Identification Number (NIF) is necessary for dealing with the Tax Agency when the interested party does not have a Spanish National ID (DNI) or Foreigner Identification Number (NIE).

The following are entitled to obtain a NIF through the Consular Office:

- Spanish citizens residing abroad who do not have a DNI and are registered in the Consular Registration Registry (NIF-L)

- Foreigners residing in the Consular area who do not have a NIE (NIF-M)

- Legal persons whose registered office is within the Consular area (NIF-N)

Finvoice

Finvoice is a Finnish e-invoicing standard for electronic invoicing, developed by Finnish banks and software vendors.Finvoice is based on the international standard UBL (Universal Business Language) and allows for the electronic transmission of invoices and related documents between businesses and public authorities in Finland.

KID number

KID number (Kundeidentifikasjon) is a Norwegian payment identification number used for the processing of electronic payments. It is a unique number assigned to each payment transaction to identify the payer and facilitate the processing of payments between banks. The KID number contains information such as the invoice or reference number, the amount to be paid, and other details required for the transaction. The KID number helps to ensure accuracy and reliability in the payment process, and it is widely used in Norway for electronic banking and invoicing.

IRN number

IRN (Invoice Reference Number) is a unique identification number assigned to every e-invoice generated under the Indian government's GST (Goods and Services Tax) system. The IRN number is generated by the GST Network and serves as a unique identifier for each invoice, helping to prevent fraud and duplication. It also helps to streamline the invoicing process, improve compliance, and reduce errors and disputes between taxpayers and the government. The IRN number must be included on all e-invoices generated under the GST system and is mandatory for compliance with GST regulations in India.

QR Codes on invoice

QR codes on invoices are machine-readable codes that contain key invoice data such as payment amount, invoice number, and payment instructions. These codes usually allow customers to scan and pay invoices using their mobile devices or banking apps, eliminating the need for manual entry and reducing the risk of errors. QR codes also help to simplify the invoice validation process, reduce processing time, and improve payment accuracy and security. Many countries have adopted QR code requirements for invoices, including China, India, and Italy, and they are becoming increasingly popular as a payment option around the world.

Input Tax Credit (ITC)

Input Tax Credit (ITC) is a mechanism for reducing the tax liability of a business under a Value Added Tax (VAT) or Goods and Services Tax (GST) system. It allows a business to claim a credit for the tax paid on purchases or expenses related to their business activities, which can then be used to offset their tax liability on sales or output. This helps to avoid double taxation and promotes efficiency in the tax system. To claim ITC, the business must maintain proper records and documentation to support their claim, and the purchases or expenses must be used for business purposes and be eligible for credit under the relevant tax laws.

Tax obligation monitoring

Tax obligation monitoring is the process of regularly tracking and reviewing a business's tax obligations to ensure compliance with relevant tax laws and regulations. This includes monitoring tax filing and payment deadlines, identifying changes in tax laws or regulations that may affect the business, and assessing the business's overall tax compliance posture. Effective tax obligation monitoring can help businesses avoid penalties and interest charges for non-compliance, as well as ensure that they are taking advantage of all available tax benefits and incentives. This process can be conducted internally or outsourced to a tax professional or third-party service provider.

Tax Registration

Tax registration is the process of obtaining a tax identification number (TIN) or other registration number from the relevant tax authority to enable a business or individual to fulfill their tax obligations. This includes filing tax returns, paying taxes, and receiving tax benefits or incentives. The registration process may vary depending on the type of tax and jurisdiction, but generally involves providing information about the business or individual and their activities to the tax authority.

Nexus Status

In the context of US sales tax, nexus refers to the level of business activity that triggers a sales tax collection obligation in a particular state. If a business has nexus in a state, it is required to collect and remit sales tax on taxable transactions that occur in that state. The factors that determine whether a business has established nexus for sales tax purposes vary by state and may include physical presence, economic activity, sales volume, and other factors. It is important for businesses to understand their nexus obligations in each state in which they conduct business to avoid penalties for non-compliance.

Tax Returns

Tax returns are forms that individuals, businesses, and other entities must file with tax authorities to report their income, deductions, and tax liability. The information reported on a tax return is used to calculate the amount of tax owed or refund due for the relevant tax period. Tax returns may be filed annually, quarterly, or on another schedule, depending on the tax authority and the type of tax involved. It is important for taxpayers to accurately and timely file their tax returns to avoid penalties and interest charges for non-compliance.

Tax filing

Tax filing refers to the process of submitting tax returns and related forms to tax authorities to report income, deductions, and other relevant information for the purpose of calculating tax liability or refund amounts. Tax filing may be required on an annual, quarterly, or other basis, depending on the applicable tax laws and regulations. Taxpayers may be required to file tax returns for various types of taxes, such as income tax, sales tax, or value-added tax (VAT)

Autofiling

Autofiling is a system that uses automation and artificial intelligence (AI) to help businesses and individuals prepare and file their tax returns. This technology can streamline the tax filing process by automatically populating tax forms with data from other sources, such as bank accounts and accounting software. Autofiling can reduce the risk of errors and improve the accuracy and completeness of tax filings. In addition, it can save time and effort for taxpayers and tax professionals by automating routine tasks and minimizing the need for manual data entry.

Transitional rates

Transitional rates are temporary tax rates or thresholds introduced during a tax reform or transition period to mitigate the impact of the changes on taxpayers. These rates are often lower than the regular tax rates and are intended to provide a gradual adjustment to the new tax system. Transitional rates may be based on the taxpayer's prior tax liability or other factors that are relevant to the specific tax reform. The duration of transitional rates may vary depending on the scope and complexity of the tax reform and the applicable legal framework.

Trade Tariffs

Tariffs are taxes imposed by a government on imported or exported goods. Tariffs can be specific (based on the quantity of the goods) or ad valorem (based on the value of the goods) and are typically designed to protect domestic industries, generate revenue for the government, or regulate international trade. Tariffs can have significant impacts on the prices of goods and services, as well as on the competitiveness of businesses and the overall economy. Tariffs can also be used as a tool in trade negotiations and disputes between countries.

Customs duty

Customs duty is a tax levied by a government on goods that are imported or exported across its borders. The purpose of customs duty is to regulate and control international trade, protect domestic industries, generate revenue for the government, and enforce trade agreements and policies. Customs duty rates can vary based on the type of goods, their origin and destination, and other factors, and can be a significant cost for businesses engaged in international trade. Customs duties are usually collected by customs authorities at ports of entry or exit.

Excise duty

Excise duty is a type of tax imposed by a government on certain types of goods that are produced within the country. These goods include tobacco, alcohol, petroleum products, and other items that are considered harmful or luxury items. The purpose of excise duty is to discourage the consumption of such goods and to generate revenue for the government. Excise duty rates can vary based on factors such as the type of goods, their production and distribution, and any trade agreements or policies in place. Excise duty is usually collected by the government or its authorized agencies at the time of production or sale of the goods.

Cess

Cess is a type of tax levied by the government of India on specific goods or services. It is imposed over and above the existing taxes and is collected to fund specific government initiatives or schemes. Cesses are usually temporary taxes, and their proceeds are earmarked for a particular purpose. Some examples of cesses in India include the Swachh Bharat cess, Krishi Kalyan cess, and Education cess. The rate of cess varies depending on the type of goods or services, and the revenue generated from cess goes directly to the designated fund or scheme.

Free Trade Zones

Free trade zones, also known as foreign trade zones or free zones, are designated areas within a country where imported goods can be stored, processed, or assembled without being subjected to customs duties or other taxes. The aim of free trade zones is to promote international trade by providing a secure and cost-effective environment for businesses to operate. Free trade zones can offer various benefits, such as exemption from import/export duties, relaxed regulations, and simplified customs procedures. They can be found in different countries and are often located near ports, airports, or other transportation hubs.

Subsidy

A subsidy is a financial assistance provided by the government to individuals, businesses, or organizations to encourage or protect certain industries, create jobs, or promote specific economic activities. It is usually in the form of direct payments or tax incentives to offset costs or reduce prices, aimed at achieving social, economic, or political objectives. However, subsidies can also have negative effects on competition, market distortions, and fiscal burdens, and must be carefully balanced and monitored.

Zero-rated products

Zero-rated products refer to goods or services that are taxable, but the rate of tax applicable to them is zero. This means that while the transaction is recorded for tax purposes, no tax is payable on the sale of these goods or services. Examples include basic food items, essential medicines, and exports.

Tax exemption

Sales tax exemption refers to the legal exclusion of certain goods or services from sales tax collection and payment obligations. This exemption may apply to specific items, individuals or organizations based on various factors like their intended use, location, or tax laws of the governing jurisdiction.

Exemption certificate

An exemption certificate is a document that exempts a business or individual from paying sales tax on certain purchases. It's issued by a government agency or authorized body, and it specifies the items or transactions that are exempted from sales tax. Businesses or individuals must provide the exemption certificate to the seller to claim the exemption.

Sanctions

Sanctions are measures taken by governments or international organizations to restrict or prohibit trade or other economic activity with a particular country or entity in order to achieve foreign policy objectives. Sanctions may include trade embargoes, asset freezes, travel bans, and other restrictions designed to limit economic or political engagement with the targeted country or entity. Sales to sanctioned regions are usually prohibited and can result in legal and financial consequences. Companies that violate sanctions may face penalties, fines, legal action, and reputational damage. It is important for businesses to ensure that their sales practices comply with all relevant laws and regulations to avoid such risks.

Invoice

An invoice is a commercial document that itemizes a transaction between a buyer and seller, typically including the quantity, description, and price of goods or services sold, as well as any applicable taxes, discounts, and payment terms. It serves as a formal request for payment and evidence of the transaction.

Credit note

A credit note is a document that records a reduction in the amount due from a buyer to a seller. It is issued by the seller to correct a previous invoice, typically to account for returns, allowances, or discounts. The credit note shows the original invoice details, the amount being credited, and the reason for the credit. A credit note is a document issued by a seller to a buyer that reduces the amount owed by the buyer for a previous sale, while a debit note is a document issued by a seller to a buyer that increases the amount owed by the buyer due to an adjustment in the initial transaction. In other words, a credit note is issued to reduce a debt, while a debit note is issued to increase a debt.

Purchase order

A Purchase Order (PO) is a commercial document that a buyer sends to a seller, requesting goods or services. It includes details such as the item description, quantity, price, delivery date, and payment terms. The seller creates an invoice based on the PO, and the buyer uses it to track and verify the order.

Quote

A quote is a formal document provided by a seller to a potential buyer that outlines the details of goods or services being offered, including the price, quantity, and delivery terms. It serves as a preliminary agreement between the two parties and can be used as a basis for negotiating the terms of a sale.

A PO is a legal document that a buyer sends to a seller to order goods or services, while a quote is a non-binding document that a seller provides to a buyer detailing the cost of goods or services. A PO is a commitment to purchase, while a quote is only an offer to sell.

Contract

In the context of sales, a contract is a legally binding agreement between two or more parties that outlines the terms and conditions of a sale. It establishes the rights and obligations of each party involved, including the product or service being sold, the price, payment terms, delivery details, and any warranties or guarantees.

A purchase order (PO) is a document issued by the buyer to the supplier, indicating the details of goods or services required. A contract, on the other hand, is a legal agreement between the buyer and the seller that outlines the terms and conditions of the sale, including payment terms, delivery schedules, warranties, and other important details. A PO is often used as part of the contracting process, but it is not the same as a contract. The contract is a broader agreement that governs the entire relationship between the buyer and the seller, while a PO is a specific document that outlines the details of a particular transaction.

Receivables

Receivables refer to the money owed to a business by its customers for the goods or services provided on credit. It is recorded as an asset on the balance sheet until payment is received, and can be managed using accounts receivable management techniques to ensure timely payment and minimize bad debt.

Revenue recognition

Revenue recognition is the process of accounting for the revenue earned by a company. It determines the timing and amount of revenue that can be recognized in a financial statement. Generally, revenue is recognized when a product or service is delivered, and the customer is invoiced for it. However, there are different rules and methods for revenue recognition depending on the industry and nature of the business. Accurate revenue recognition is crucial for a company's financial reporting, as it affects profitability, cash flow, and key performance metrics.

Accural accounting

Accrual accounting is an accounting method where revenue and expenses are recognized when they are earned and incurred, respectively, regardless of when the payment is received or made. This provides a more accurate picture of a company's financial position and performance by matching revenue with expenses incurred to generate that revenue.

Cash Accounting

Cash accounting is a method of accounting where transactions are recognized when cash is received or paid. It is a simple and straightforward method that does not take into account when the transaction actually occurred, but instead records it based on when the cash was exchanged. It is commonly used by small businesses and is useful for managing cash flow.

The choice between cash and accrual accounting methods depends on the specific needs of a business. Generally, accrual accounting is better for larger businesses with complex financial transactions, while cash accounting is simpler and more appropriate for smaller businesses with straightforward transactions. It's best to consult with a professional accountant to determine which method is best for your business.

GDPR

The General Data Protection Regulation (GDPR) is a regulation by the European Union (EU) that governs the processing and protection of personal data of individuals within the EU. It applies to all organizations, including those outside the EU, that process the personal data of EU individuals. The regulation aims to provide greater transparency, control, and security to individuals over their personal data.

PII

PII (Personally Identifiable Information) regulations are laws that govern the collection, use, storage, and sharing of sensitive personal information. These regulations protect an individual's privacy and typically require organizations to obtain explicit consent, implement adequate security measures, and provide notification in the event of a data breach. Examples of PII include names, addresses, social security numbers, and financial information.

PII (Personally Identifiable Information) and GDPR (General Data Protection Regulation) are similar in that they both deal with protecting personal data, but GDPR is a comprehensive regulation that applies to all EU member states, while PII regulations are specific to certain countries or industries. PII regulations typically define the types of data that are considered personally identifiable and outline guidelines for how that data can be collected, used, and protected.

SOC

SOC stands for System and Organization Controls. It is a set of auditing standards and procedures that measures how well a service organization controls its information, data, and systems. There are three types of SOC reports, which are SOC 1, SOC 2, and SOC 3, each addressing different areas of concern.

PCI compliance

PCI compliance refers to the adherence of Payment Card Industry Data Security Standards by organizations that handle credit card information. The standards ensure that sensitive cardholder data is securely stored, processed, and transmitted to prevent fraud and data breaches. Organizations must regularly undergo audits and implement necessary security measures to maintain PCI compliance.

Annual Aggregated Turnover (AATO)

Annual Aggregated Turnover (AATO) is the total value of sales made by a business in a financial year. In some countries, AATO is used to determine whether a business needs to register for VAT/GST and comply with its related regulations. It includes the value of taxable and non-taxable supplies, exports, and inter-state supplies.

Input VAT

Input VAT, also known as input tax, is the tax paid by a business on purchases of goods and services used for business purposes. It can be deducted from the output VAT, or sales tax, owed to the government. The difference between the input VAT and output VAT is either paid to the government or refunded to the business.

Output VAT

Output VAT is the value-added tax collected on sales made by a business, which is charged to the buyer and must be remitted to the tax authorities. It is calculated as the difference between the VAT charged on sales and the VAT paid on purchases, and is payable to the tax authorities on a periodic basis.

Remote services

Remote services refer to services that are provided to a client by a service provider located in a different geographic location, typically through electronic means such as the internet or telecommunication networks. These services can include a range of activities such as consulting, software development, and customer support.

Digital Goods

Digital goods refer to any products or services that are delivered electronically over the internet or other digital networks, such as software, music, videos, e-books, and online courses. They do not have a physical form and can be easily replicated and distributed globally.

Place of Supply

The place of supply refers to the location where goods or services are deemed to be supplied. It determines the applicable tax rate, reporting requirements, and compliance rules. The place of supply is determined based on various factors such as the type of supply, the nature of the transaction, and the location of the supplier and the recipient.

Place of origin

Place of origin refers to the physical location where goods or products are produced, manufactured or assembled. It is an important concept in supply chain management, as it affects transportation costs, taxes, and other regulatory requirements. The place of origin is typically specified on the product label or in shipping documents.

Destination taxes

Destination taxes are taxes that are imposed on goods and services based on the location of the customer, rather than the location of the supplier. The taxes are usually imposed by the country or state where the customer is located and can include sales taxes, value-added taxes (VAT), and other similar taxes. The purpose of destination taxes is to ensure that the tax revenue from a transaction is collected by the jurisdiction where the customer is located.

Origin taxes

Origin taxes refer to taxes levied by the country of origin on goods and services exported to other countries. They are paid by the exporter, and the amount is calculated based on the value of the goods or services. Origin taxes can include customs duties, export taxes, and other taxes and fees imposed by the exporting country's government.

Both origin and destination taxes cannot be applied on the same transaction or invoice. Generally, only one type of tax, either origin or destination-based, is applied depending on the tax laws and regulations of the countries involved in the transaction. This is done to avoid double taxation and ensure that taxes are paid only once.

Double taxation

Double taxation refers to a situation where the same income or transaction is taxed twice by two different tax authorities, such as in the country where it was earned and in the country where it is received. This can result in an unfair tax burden on the taxpayer, reducing their income and discouraging cross-border trade and investment. To avoid double taxation, countries may enter into tax treaties or offer tax credits to taxpayers to offset the taxes paid in the other country.

GAAR

General Anti-Avoidance Rule (GAAR) is a tax law that allows tax authorities to invalidate tax arrangements that are contrary to the object and spirit of the tax laws, and entered into primarily to obtain a tax benefit. GAAR applies when the arrangements result in a reduction of tax liability or deferral of tax payment. This rule is applied in countries such as United States, Canada, Australia, and India.

Accounting books

Accounting books refer to the record-keeping documents used by businesses to track their financial transactions. They include journals, ledgers, financial statements, and other relevant documents used to record and report financial data. Proper accounting books are essential for accurate financial reporting and compliance with tax laws and regulations.

Audit trail

An audit trail is a record of events that provide documentary evidence of the sequence of activities that have affected a specific operation or procedure. It helps to verify the accuracy and completeness of the accounting records, and trace any discrepancies or errors in financial reporting. The audit trail typically includes information such as date, time, user identity, system status, and transaction details, and can be used to track changes made to financial data. An audit trail is needed to maintain the integrity of financial records and provide a clear and transparent record of all financial transactions. It helps to prevent fraud and errors, ensures compliance with regulatory requirements, and supports the accuracy of financial statements. Additionally, it helps auditors to review and verify the accuracy and completeness of financial records.

Financial year

A financial year is a 12-month period used for accounting and tax purposes. It may or may not coincide with the calendar year. The financial year is important for businesses and organizations to prepare financial statements, calculate taxes, and evaluate their financial performance over a specific period. In many countries, the financial year starts on January 1 and ends on December 31, while in others, it may start on a different date.

VAT VIES

VAT VIES stands for Value Added Tax (VAT) Information Exchange System. It's a system that enables EU member states to exchange VAT information on cross-border transactions. VIES helps businesses to confirm the validity of their customers' VAT registration numbers, and ensure that they charge the correct VAT rate on sales to customers in other EU countries. The system allows businesses to check the VAT numbers of their customers and suppliers in real-time, and ensures that VAT is accounted for correctly across borders.

HMRC

HMRC stands for Her Majesty's Revenue and Customs, which is the UK government department responsible for collecting taxes, enforcing customs and excise laws, and administering welfare programs. They also oversee compliance with tax and customs regulations and provide guidance to taxpayers and businesses.

DAC7

DAC7 is a directive proposed by the European Union that requires digital platforms to collect and report information on cross-border transactions made by their users to tax authorities. The directive aims to combat tax evasion and improve tax transparency in the digital economy.

Tax evasion

Tax evasion refers to the illegal practice of not reporting or underreporting income, or claiming false deductions or credits to avoid paying taxes. It is a criminal offense that can lead to penalties, fines, and imprisonment. Tax authorities use audits, investigations, and other measures to identify and prosecute individuals or businesses engaged in tax evasion.

Tax havens

Tax havens are countries or jurisdictions that offer favorable tax treatment to foreign individuals and companies. They often have low or zero tax rates, strict banking secrecy laws, and limited transparency. Tax havens are used by individuals and companies to minimize their tax liability and avoid disclosure of their financial affairs. However, their use has been criticized for facilitating tax evasion, money laundering, and other illicit activities. Many countries have taken steps to combat tax havens through international cooperation and regulatory measures.

FATCA

FATCA, or the Foreign Account Tax Compliance Act, is a U.S. federal law that requires foreign financial institutions to report information about their U.S. account holders to the Internal Revenue Service. This is aimed at preventing tax evasion by U.S. citizens and residents through offshore accounts. FATCA also requires U.S. taxpayers to report their foreign financial assets on their tax returns.

Common Reporting Standard (CRS)

The Common Reporting Standard (CRS) is a global standard for the automatic exchange of financial account information between tax authorities to combat tax evasion. Under CRS, financial institutions report account information of their foreign customers to the tax authorities in their country of residence, which is then shared with the tax authorities of the customer's country of residence. The aim of CRS is to provide tax authorities with a comprehensive view of the financial assets held by their taxpayers outside their home jurisdiction.

OECD

The Organisation for Economic Co-operation and Development (OECD) is an international organization of 38 member countries committed to promoting economic growth, prosperity, and sustainable development. It provides policy recommendations and research on a wide range of economic and social issues, including tax policy, international trade, and environmental policy. The OECD is a leading authority on international tax cooperation and has developed many global tax initiatives and guidelines, such as the Common Reporting Standard (CRS) and Base Erosion and Profit Shifting (BEPS).

Base Erosion

Base erosion refers to a tax planning strategy used by multinational companies to reduce their taxable income by shifting profits from high-tax countries to low-tax countries. This can be achieved through various means such as transfer pricing, treaty shopping, and use of tax havens. Base erosion can lead to a loss of tax revenue for high-tax countries and create an uneven playing field for domestic businesses. As a result, many countries have implemented measures to combat base erosion and profit shifting, such as the OECD's Base Erosion and Profit Shifting (BEPS) initiative.

TDS

TDS stands for Tax Deducted at Source, which is a tax collection mechanism used in India. It requires the payer to deduct a certain percentage of tax from the payment being made to the payee and remit it to the government on their behalf. TDS is applicable on various types of payments such as salaries, rent, professional fees, and interest payments. The recipient can claim credit for the TDS deducted while computing their total tax liability. TDS is aimed at ensuring regular and timely collection of tax, and to reduce the burden of tax collection on the government.TDS (Tax Deducted at Source) and withheld taxes refer to the same concept. TDS is commonly used in India, while withheld taxes is a more generic term. The key difference between the two terms is their usage and jurisdiction. TDS is a term used in the Indian Income Tax Act, whereas withheld taxes is a term used in other countries, including the United States.

Electronic Address Schemes (EAS)

Electronic Address Schemes (EAS) are systems used to identify and locate digital resources, such as websites, email addresses, and other online services. They typically consist of a hierarchical structure, with different levels of identifiers used to specify increasingly specific locations within the system. One example of an EAS is the Domain Name System (DNS), which uses domain names to identify websites and other resources on the internet. Another example is the Uniform Resource Locator (URL), which specifies the location of a resource on the web. EAS are essential for enabling users to access and share digital resources across the internet.

In the context of e-invoicing, Electronic Address Schemes (EAS) are used to identify the electronic addresses of businesses involved in the invoicing process. This allows for the secure and efficient exchange of electronic invoices between trading partners.

One example of an EAS used in e-invoicing is the Universal Business Language (UBL), which is a standardized format for electronic invoicing that includes an electronic address field. The electronic address field can be used to include information such as a PEPPOL ID or other electronic identification number, email address, or other identifying information that allows for the secure exchange of electronic invoices.

By using EAS in e-invoicing, businesses can automate their invoicing processes, reduce errors and delays associated with manual processing, and streamline their financial operations. EAS help to ensure the secure and efficient exchange of electronic invoices, while also facilitating compliance with regulatory requirements related to e-invoicing

Peppol ID

PEPPOL (Pan-European Public Procurement On-Line) ID is a unique identification number used in e-procurement processes to enable electronic document exchange between businesses and government entities across Europe. It is part of the PEPPOL network, which is a secure and standardized network used for the exchange of electronic documents such as invoices, purchase orders, and delivery notes. The PEPPOL ID is used to identify a participant in the network, and it consists of a country code, business registration number, and a unique identifier assigned by the PEPPOL Authority. This identification system simplifies cross-border procurement and helps to reduce administrative burdens, while ensuring the security and integrity of the exchange of electronic documents. The PEPPOL ID is a type of EAS used in e-procurement processes. Therefore, the PEPPOL ID is a specific example of how EAS can be utilized to facilitate electronic communication and document exchange between organizations.

CIUS

CIUS stands for "Core Invoice Usage Specification" and is a set of standardized rules and guidelines for the content and structure of electronic invoices. It was developed by the European Committee for Standardization (CEN) to ensure interoperability and compatibility of electronic invoices across different systems and countries.

CIUS defines a common set of data elements and attributes that must be included in an electronic invoice, such as the sender and recipient information, the invoice number and date, the goods or services provided, and the corresponding prices and taxes. It also provides guidelines for the formatting and transmission of electronic invoices

EN 16931

EN 16931 is the European standard on e-invoicing that was developed and published by the European Committee for Standardization (CEN), at the request of the European Commission. There are two main parts to the standard, a semantic data model and the two mandatory syntaxes that comply with the standard i.e. UBL and CII.

Nodo Smistamento Ordini

Nodo Smistamento Ordini(NSO) is a sytem used for the exchange of digital documents between the public bodies of the National Health Service and their supplier companies in Italy.

Digital sovereignty

A nation's control over its digital assets and data, vital for regulating information flows, securing infrastructure, and shaping policies in the digital age, especially relevant in taxation.

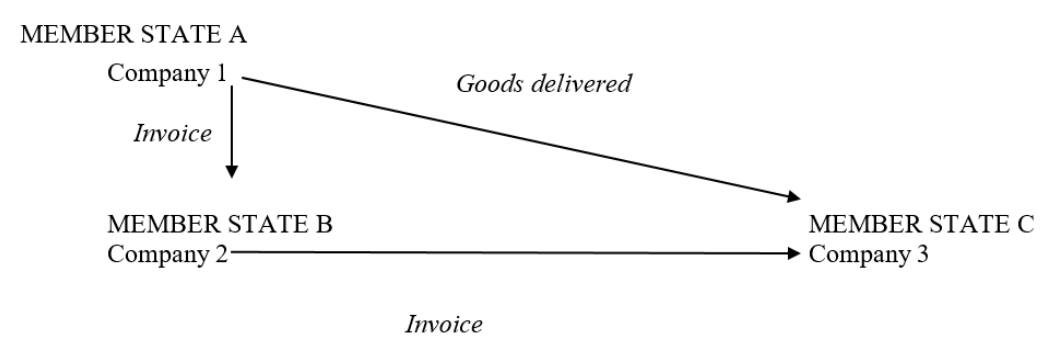

Triangulation

An example of triangulation would be where a trader established in Member State A sells goods to a trader established in Member State B who in turn sells the goods to a trader established in Member State C. However, the goods are sent direct from member State A to Member State C

|

| Triangulation |

Call-off stock

Call-off stock arrangements is a term used to describe a supply of goods which takes place in the following circumstances:

- Goods are transported from one Member State to another, but the ownership of the goods does not transfer until a later date after the arrival of the goods in the second Member State.

- At the time the goods are transported to the second Member State, the identity of the customer is known to the supplier.

- When the goods arrive in the second Member State, they are held in stock and are drawn down from stock by that customer, at his/ her own discretion at a later stage.