Panama TIN number guide

Registro Único de Contribuyente (RUC)

The Single Taxpayer Registry (Registro Único de Contribuyente, RUC) functions as the unique Tax Identification Number for both Panamanian individuals and legal entities. This individualized RUC serves to identify and differentiate natural or legal persons specifically for tax purposes. The absence of this identification number restricts stakeholders from engaging in any commercial transactions within Panama. It's crucial to emphasize that, although conducting economic activities in Panama requires a RUC, every registered Legal Person, regardless of operational status in the Republic of Panama, must possess a RUC.

For natural persons, the RUC is comprised of their personal identity card number, along with a check digit (dígito verificador, DV) assigned by the General Directorate of Revenue (Dirección General de Ingresos, DGI). Conversely, for legal persons, the RUC corresponds to their designated registration number at the Public Registry (Registro Público). This is followed by a combination of other registry numbers provided by the Public Registry Office, such as microjacket, roll, or image, or alternatively, by the year of incorporation, also accompanied by a DV.

In Panama, the Tax Identification Number, known as RUC (Registro Único de Contribuyentes), is allocated upon request from the General Directorate of Revenue under the Ministry of Economy and Finance. Individuals residing in Panama have the option to request either an RUC or NT (Número Tributario).

The assigned RUC is exclusive and cannot be transferred, providing a unique identifier for each taxpayer. Any modifications to the RUC data must be promptly communicated to the DGI (Dirección General de Ingresos). The RUC remains valid as long as the taxpayer is active and requires notification to the DGI in the event of dissolution, elimination, death, or any other relevant circumstances.

RUC Format

Individuals are identified as Natural Persons through their personal identity card number, which includes an assigned DV (Verification Digit). For instance, 8-100-678 with DV: 90. The initial number designates the province or region (1-13) of the taxpayer's birth.

The length of a Natural Person's RUC (Registro Único de Contribuyentes) can vary, and future structures may include 6, 7, 8, or more characters. Examples of RUC structures for natural persons may follow formats such as:

- X-XX-XXX DV

- X-XXX-XXX DV

- X-XXX-XXXX DV

- For Panamanian citizens by birth, the key number of the applicant's province of birth is used, followed by the volume and entry in which it appears registered in the Civil Registry. For example: 8-926-1601

- Panamanians born abroad will bear the letters (PE), followed by the volume and entry in which it appears registered in the Civil Registry. For example: PE-5-687.

- Naturalized Panamanians will bear the letter (N), followed by the volume and entry in which the definitive letter of nature is registered in the Civil Registry. For example: N-19-473

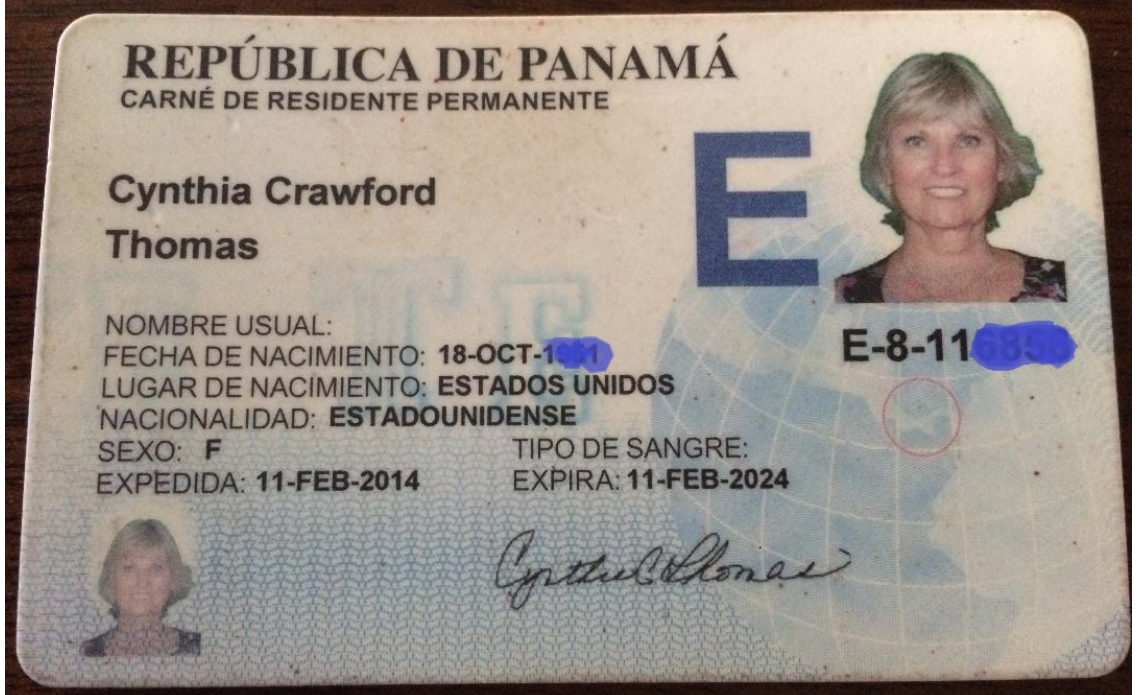

- For foreigners legally domiciled in the country, the letter (E) will be used, followed by the code number of the province where the application originated and finally the number of the application's entry order. For example: E-8-74258

|

| ID card |

• For Legal Persons, the identification is based on the registration number assigned by the Public Registry, accompanied by a designated DV (Verification Digit). In cases of companies registered before 1985, the entry may include numbers, periods, and/or other characters. An illustration is 4789-321-1515 with DV: 85.

The RUC's new structure, implemented in Q3 2014, follows Real Folio-2-YYYY or Real Folio-3-YYYY, determined by the type of company. Consecutive to the FOLIO, one series is for Commercial Companies (2), and another for Non-Commercial Companies (3), with YYYY representing the company's registration year.

The Real Folio-2-YYYY format applies to various company types, including Limited Liability, Anonymous Society, Limited Partnership by Shares, Simple Limited Partnership, Branches or Agencies of Foreign Companies, and Collective Societies. An example is 155986022-2-2019 with DV: 12.

On the other hand, the Real Folio-3-YYYY structure is designated for Private Interest Foundations, Non-profit Associations, and Civil Partnerships. For instance, 26631254-3-2020 with DV: 78.

The sequential Folio comprises 9 digits for commercial companies and 8 digits for non-commercial companies. It is consecutive, incremental, and expected to expand over time, offering a dynamic framework for efficient identification.

Official database - RUC Search

Número de identificación tributario (NIT)

In Panama, the Tax Identification Number (TIN), known as RUC (Registro Único de Contribuyentes), is of utmost significance. The Tax Identification Number (número de identificación tributario, NIT) serves as the access code for managing online procedures and services provided by the General Directorate of Revenue via its website. This unique key or password is personal, non-transferable, and recognized by the DGI for all electronic signature purposes. Safeguarding its privacy is the responsibility of the taxpayer. It's crucial to differentiate this private number, the NIT, from the RUC, often interchangeably referred to as the Tax Identification Number or TIN.

Número Tributario (NT)

For individuals with a migratory lifestyle unable to fulfill the registration criteria for a natural person's RUC, a Tax Number (Número Tributario, NT) becomes their essential identifier for tax-related matters. Foreign natural persons' RUC is distinguished by the prefix NT.

In situations involving Legal Persons lacking Legal Status due to birth under special laws, a Tax Number (NT) is allocated to identify the taxpayer and their responsibility before the Tax Administration. It's crucial to note that Tax Numbers (NT) should always be complemented with a DV for comprehensive identification.

NT Format

For foreigners residing in Panama, the RUC corresponds to the Tax Number, designated by the DGI and indicated with the letters NT. For instance: 3-NT-3-33 DV: 45. In every instance, the DV is a two-digit number.

For Estates (Fincas), before Executive Decree 847 of October 20, 2014, their RUC comprised the estate number and the location code. The first digit of the location code signifies the province of the property. For example: 000001-8001 (8 = Panama Province).

With the introduction of the Electronic Registry Enrolment System, new Estates originating from this system will be identified with a Real Electronic Folio Number, devoid of details like volume, document, roll, etc. The new Electronic Real Folios (FINCAS) resulting from segregations will consist of 8 digits.

How Lookuptax can help you in VAT validation?

Lookuptax VAT validation revolutionizes VAT number validation with its robust platform, empowering businesses to seamlessly verify VAT numbers across over 100 countries. Our cutting-edge technology ensures accurate and efficient validation, reducing errors and enhancing compliance.