Norway TIN number guide

National Identity Number (NIN)

In Norway, every resident is allocated a distinct national identity number. This encompasses individuals born in Norway, those residing in the country for a minimum of 6 months, or Norwegian citizens born or living abroad requiring a national identity number for obtaining a Norwegian passport or ID-card. The national identity number comprises 11 digits, with the initial six representing the individual's date of birth. Eligible individuals receive their Norwegian national number through an official letter from the Tax Office. It is also known as "Fødselsnummer" in Norwegian

NIN Format

The national identity number is an 11-digit code, with the initial six digits indicating the date of birth in the format day, month, year. Following this, the subsequent three digits make up the individual number, with the third digit denoting gender – even for women and odd for men. The final two digits serve as control digits.

Allocation of the individual number's three digits follows a sequential order within the specific date of birth. The breakdown is as follows:

a) For those born between 1854-1899, digits are allocated from series 749-500. b) For individuals born between 1900-1999, digits are allocated from series 499-000. c) For those born between 1940-1999, digits are also allocated from series 999-900. d) Individuals born between 2000-2039 have digits allocated from series 999-500.

In summary, the national identity number structure includes date of birth, gender indication, and control digits, with specific digit allocation criteria based on the birth year range.

Example :01 12 99 551 31

|  |

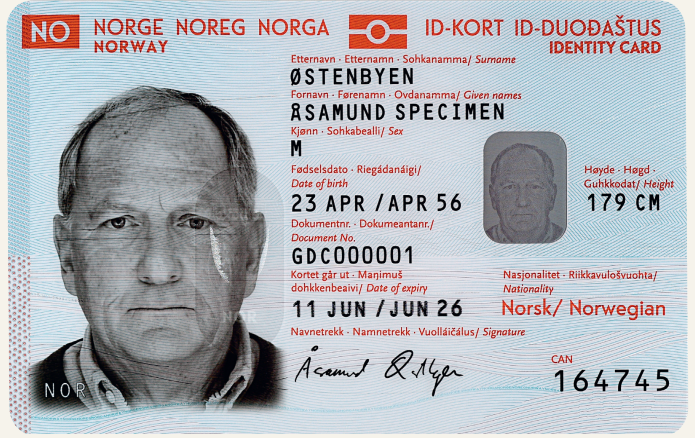

| ID card - Front | ID card - Back |

|  |

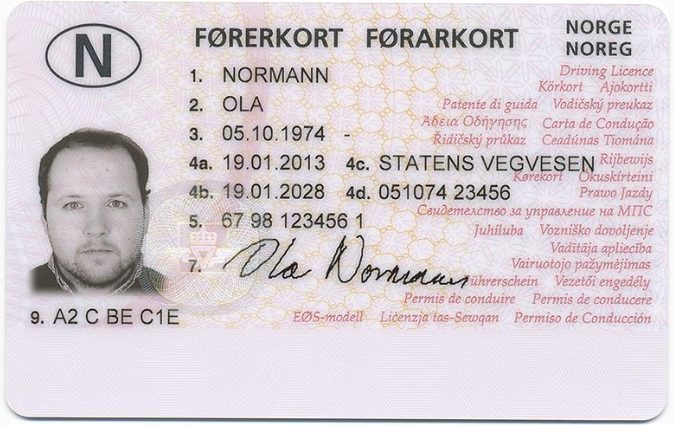

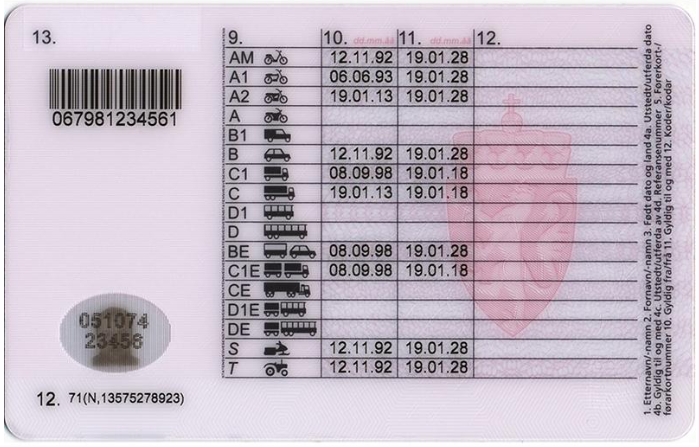

| Driving License - Front | Driving License - Back |

D-number

Foreign nationals coming to Norway for short-term work or having a temporary connection to the country receive a unique identity number known as a D-number. Structurally similar to national identity numbers, D-numbers have the first digit increased by four.

These numbers are assigned when individuals require and qualify for a D-number but do not meet the criteria for a national identity number. D-numbers are often assigned in relation to requests for tax deduction cards or upon request from various authorities for different purposes.

If individuals, initially assigned a D-number, later register as residents of Norway, they can only utilize their new national identity number thereafter.

D Number Format

- The D number is composed of 11 digits.

- The first 6 digits represent the date of birth, with the first digit increased by 4. For instance, if born on 1 January 1985, the initial digits in the D number would be 410185.

- The next three digits signify individual numbers, where the third digit denotes gender – even for women and odd for men.

- The final two digits serve as a verification mechanism.

- In instances where a D number is not available for your birth date, the registration date is utilized. For example, if you applied for your D number on 15 January 2020, the initial digits in your D number would be 550185.

- Your accurate date of birth continues to be recorded in the National Population Register under the date of birth field.

Example : 410185 123 45

Organisation Number

In Norway, the Central Coordinating Register for Legal Entities is the go-to platform for registering fundamental information about legal entities. Incorporation of any legal entity mandates registration, resulting in the issuance of an organization number. This unique organization number not only serves as the identifier for the legal entity but also functions as the Tax Identification Number (TIN) for legal entities in Norway. It is known as "Organisasjonsnummer" in norwegian.

Organisation number Format The Tax Identification Number (TIN) or organization number is a crucial nine-digit identifier. Its technical structure mandates that the first digit must be either 8 or 9, and it incorporates a modulus 11 check digit at the end. As per the Central Coordination Register's guidelines, the weighting factors are calculated from the first digit and include values such as 3, 2, 7, 6, 5, 4, 3, and 2. The digits undergo multiplication with these factors, and the product sum is divided by 11. The remainder, subtracted by 11, becomes the check digit.

For legal entities registered in the Value Added Tax Register, an additional requirement is to append the letters MVA as a suffix to the organization number.

Examples - Legal entity: 999999999, VAT registered legal entity : 999999999LLL

Official Database - Search Organisation number

DUF number

A DUF number serves as a registration identifier within the UDI's application system. Individuals applying for residence or protection are assigned a unique DUF number during the application process.

MVA-nummer

mva-nummer is the VAT number in Norway. MVA stand for Merverdiavgift. VAT number is the same as your organization number. When you have become VAT registered, your VAT number is the organization number followed by the letters MVA. Example: 999999999MVA

How Lookuptax can help you in VAT validation?

Lookuptax VAT validation revolutionizes VAT number validation with its robust platform, empowering businesses to seamlessly verify VAT numbers across over 100 countries. Our cutting-edge technology ensures accurate and efficient validation, reducing errors and enhancing compliance.