Malaysia TIN number guide

Nombor Pengenalan Cukai

In Malaysia, individuals and entities undergo registration with the Inland Revenue Board of Malaysia (IRBM) and are allocated a Tax Identification Number (TIN), referred to as "Nombor Pengenalan Cukai."

Format

For Individuals the TIN consists of 11 - 13 characters. Eg: IG115002000, IG4040080091, IG56003500070. Note that till Jan 2nd 2023, the TIN used to contain prefix SG/OG. The prefix SG/OG were converted to IG however the numeric characters remain unchanged

For non-individuals in Malaysia, various entities are assigned specific Tax Identification Numbers (TIN) based on their categories. The TIN consists of 11 - 12 characters. Eg: C20880050010, D4800990020, E91005500060, F10234567090 From 2023, the number “0” has been added at the end of the existing TIN.

- Companies: TIN Code - C

- Cooperative Societies: TIN Code - CS

- Partnerships: TIN Code - D

- Employers: TIN Code - E

- Associations: TIN Code - F

- Non-Resident Public Entertainers: TIN Code - FA

- Limited Liability Partnerships: TIN Code - PT

- Trust Bodies: TIN Code - TA

- Unit Trusts/Property Trusts: TIN Code - TC

- Business Trusts: TIN Code - TN

- Real Estate Investment Trusts/Property Trust Funds: TIN Code - TR

- Deceased Person’s Estate: TIN Code - TP

- Hindu Joint Families: TIN Code - J

- Labuan Entities: TIN Code - LE

Nombor Pengenalan Cukai search is availanble for free at https://mytax.hasil.gov.my under “e-Daftar” menu.

National Registration Identity Card Number (NRIC Number)

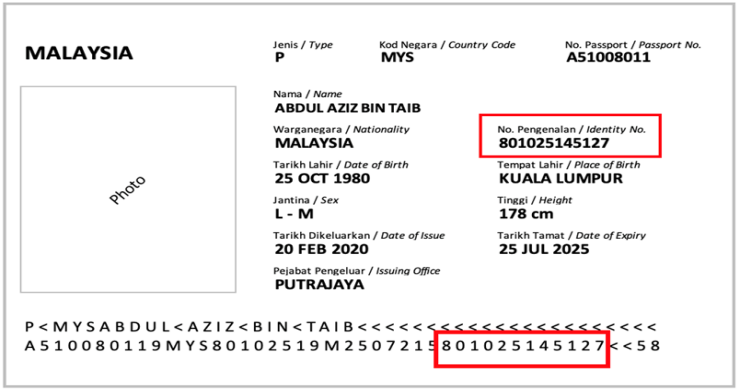

The NRIC Number is a unique 12-digit number issued to Malaysian citizens and permanent residents and is used by the Inland Revenue Board of Malaysia (IRBM) to identify its taxpayers in the absence of Nombor Pengenalan Cukai. NRIC appears on Malaysian Passport.

|

| NRIC on Passport |

SST Registration Number

Sales and Service Tax Registration Number consists of 15 digits. Eg: W24-1808-32000049. The middle section is the year and month of registration

How Lookuptax can help you in VAT validation?

Lookuptax VAT validation revolutionizes VAT number validation with its robust platform, empowering businesses to seamlessly verify VAT numbers across over 100 countries. Our cutting-edge technology ensures accurate and efficient validation, reducing errors and enhancing compliance.