United Kingdom VAT number guide

VAT Number

In the UK, the tax identification number is referred to as the VAT number. It typically consists of either 9 or 12 numbers, occasionally preceded by 'GB,' such as 123456789 or GB123456789. Validating a UK VAT number can be done through the official HMRC site website or a VAT validation service provider like Lookuptax.

Unique Taxpayer Reference (UTR)

"UTR" stands for Unique Taxpayer Reference. The UTR is a 10-digit code that is unique to each taxpayer or entity registered with His Majesty's Revenue and Customs (HMRC). It is used to identify individuals, partnerships, and companies for tax purposes. The UTR is an essential component when communicating with HMRC, filing tax returns, and managing various tax-related matters. It's important to keep the UTR secure and readily accessible, especially when engaging in activities that involve taxation in the UK

Where to find UTR ?

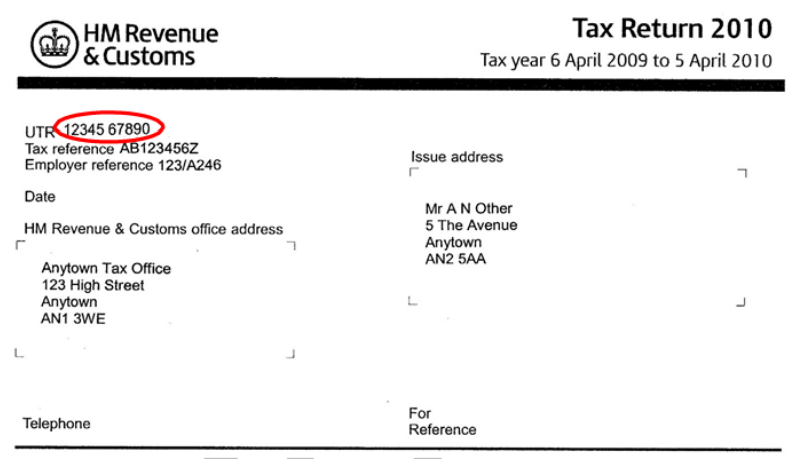

The UTR may be found on the front page of the tax return (form SA100 or CT600) as shown in the example below. The UTR may also be found on a “Notice to complete Tax Return” (form SA316 or CT603) or a Statement of Account. Depending on the type of document issued the reference may be printed next to the headings “Tax Reference”, “UTR” or “Official Use”.

|

| UTR on tax return form |

National Insurance Number (NINO)

A National Insurance Number (NINO) is composed of two letters, six numbers, and a suffix letter (such as A, B, C, or D, for instance, DQ123456C). All individuals residing regularly in the United Kingdom are either assigned or can receive a NINO. Young people living in the UK are automatically granted a NINO as they approach the age of 16. This identifier appears on various official documents, and individuals are informed of their NINO through an official letter from the Department for Work and Pensions or HM Revenue and Customs.

It's important to note that this letter explicitly states, "This is not proof of identity," and therefore cannot be utilized for identity verification. While the NINO can be cited as the tax reference number on certain official documents from HM Revenue and Customs, it does not serve as proof of identity.

Where to find NINO ?

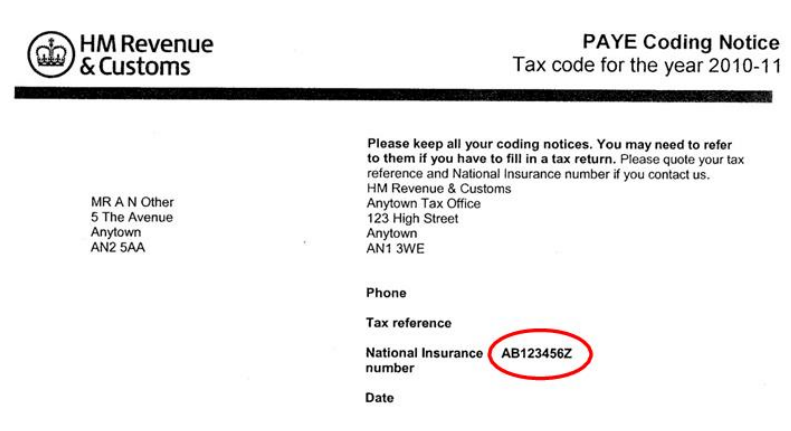

HMRC issues coding notices to taxpayers. The heading of the notice contains the National Insurance Number as indicated in the example below.The National Insurance Number may also be shown on a National Insurance card and on letters issued by the Department for Work and Pensions (DWP). The number also appears on an employee's pay slip and on a Statement of Account issued by HMRC.

|

| NINO on coding notice |

How Lookuptax can help you ?

Lookuptax VAT validation revolutionizes VAT number validation with its robust platform, empowering businesses to seamlessly verify VAT numbers across over 100 countries. Our cutting-edge technology ensures accurate and efficient validation, reducing errors and enhancing compliance