Ecuador TIN number guide

This post is also available in: Español

Registro Unico de Contribuyentes (RUC)

The Tax Identification Number in Ecuador is referred to as the Taxpayer's Unique Registry (RUC), crucial for registering and identifying taxpayers for tax-related purposes, providing essential information to the Internal Revenue Service of Ecuador.

In various situations, obtaining a Tax Identification Number (RUC) is necessary, including:

-

Individuals, Legal Entities, and Entities Without Juridical Personality:

- Nationals or foreigners engaging in economic activities in Ecuador, whether permanent or occasional.

- Holders of goods or rights generating profits, benefits, fees, and other income subject to taxation in Ecuador.

-

Public Sector Entities and Similar Organizations:

- This includes the Armed Forces, National Police, entities, foundations, cooperatives, corporations, or any similar entity, regardless of profit-seeking intentions.

-

Foreign Companies with Immovable Property in Ecuador:

- Applies to companies residing in tax havens or any jurisdiction owning property in Ecuador, even if the property doesn't generate income subject to taxation. Compliance with this requirement is necessary for notaries and property registrars.

Additionally, specific exemptions apply:

- International Organizations, Embassies, Consulates, and Commercial Offices:

- These entities, related to countries with diplomatic, consular, or commercial ties to Ecuador, are not mandated to obtain an RUC. However, they have the option to do so at their discretion.

Format

- Individuals

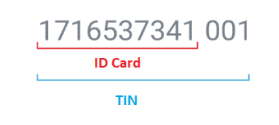

- 13 Digits. First Ten digits of the identity or citizenship card and the last three digits are always 001.

- Private companies

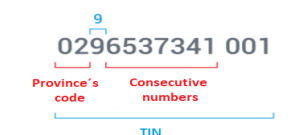

- 13 Digits. The initial two digits represent the province code of RUC issuance. The third digit is consistently 9. The fourth to ninth digits are sequential numbers, and the tenth digit serves as the check digit. The final three digits always remain 001.

- Public companies

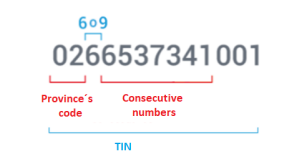

- 13 Digits. The initial two digits denote the province code where the RUC was issued. The third digit is invariably 6. From the fourth to the eighth digit, consecutive numbers are assigned. The ninth digit functions as the check digit, and the tenth digit is always 0. The final three digits consistently remain 001.

|  |  |

| Individuals | Private Companies | Public Companies |

ID card

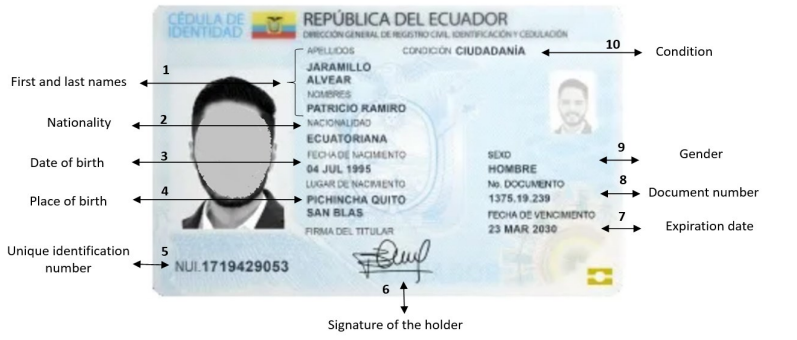

The Organic Law for Identity and Civil Data Management outlines that the identity card serves as the primary public document designed for identifying both Ecuadorian and foreign individuals within Ecuador. The unique identification card number, exclusively assigned, holds legal validity for all public and private matters, as granted by the General Directorate of Civil Registry, Identification, and Identification Cards.

Obtaining an identity card is obligatory for Ecuadorians from the age of 18 and for foreign citizens residing in Ecuador. This legal requirement underscores the importance of proper identification in various contexts, emphasizing its significance in both public and private spheres.

Format

10 Digits

|

| ID card Front side |

|

| ID card back side |

How Lookuptax can help you ?

Lookuptax VAT validation revolutionizes VAT number validation with its robust platform, empowering businesses to seamlessly verify VAT numbers across over 100 countries. Our cutting-edge technology ensures accurate and efficient validation, reducing errors and enhancing compliance.