Austria TIN number guide

Firmenbuchnummer

In Austria, "Firmenbuchnummer" refers to the Commercial Register Number. The Commercial Register (Firmenbuch) is a public register maintained by the Austrian courts, and it contains important information about companies and legal entities

Format

For head offices up to 7 characters: up to 6 digits + last character is a letter (not case sensitive); In case of registered branches: Up to 10 characters: up to 6 digits + 1 letter (not case sensitive) + up to 3 digits

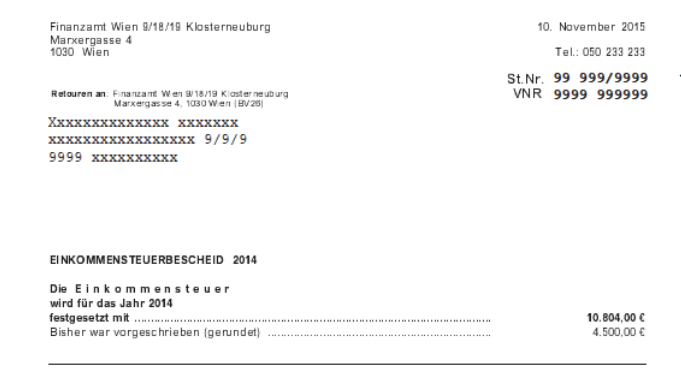

Abgabenkontonummer

The Abgabenkontonummer is a unique identification number assigned to individuals and entities for tax-related purposes. This number is used to track and manage tax payments, returns, and other financial transactions with tax authorities

Format

Abgabenkontonummer(The Austrian tax identification number) consists of 2 digits for the issuing tax office (Finanzamtsnummer) and 7 digits for the subject and a check digit (Steuernummer).

|

Umsatzsteuer-Identifikationsnummer(UID)

The Umsatzsteuer-Identifikationsnummer (UID) in Austria is the Value Added Tax Identification Number (VAT ID) assigned to businesses for transactions involving the exchange of goods and services within the European Union (EU)

Format

9 characters. The first character is always ‘U’

Gemeindenummer

In Austria, "Gemeindenummer" translates to "municipality number" in English. The Gemeindenummer is a unique identification number assigned to each municipality (Gemeinde) in Austria. These numbers are used for administrative and statistical purposes and help identify and differentiate between various municipalities across the country.

How Lookuptax can help you ?

Lookuptax VAT validation revolutionizes VAT number validation with its robust platform, empowering businesses to seamlessly verify VAT numbers across over 100 countries. Our cutting-edge technology ensures accurate and efficient validation, reducing errors and enhancing compliance.