Andorra NRT number guide

Número d’Identificació Administrativa (NRT)

The Tax Administration allocates a distinctive number to both legal entities and those without legal personality, irrespective of their residency status in the Principality of Andorra. This assigned number remains constant unless there is a modification in legal structure or nationality, as outlined in Article 16 of the Regulations.

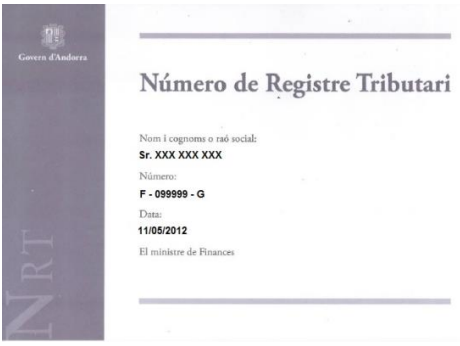

For individuals residing in Andorra, the NRT (Tax Identification Number) is referred to as the Número d’Identificació Administrativa (Administrative Identification Number, NIA), prefixed with the letter “F” according to Article 14 of the Regulations. The NIA is governed by Law 8/2007, dated 17 May, which outlines the regulation of the Administrative Identification Number.

Foreigners

For individuals not residing in Andorra, the NRT is the Número d’Identificació Administrativa (Administrative Identification Number, NIA), assigned to them and preceded by the letter “E” as per Article 15 of the Regulations.

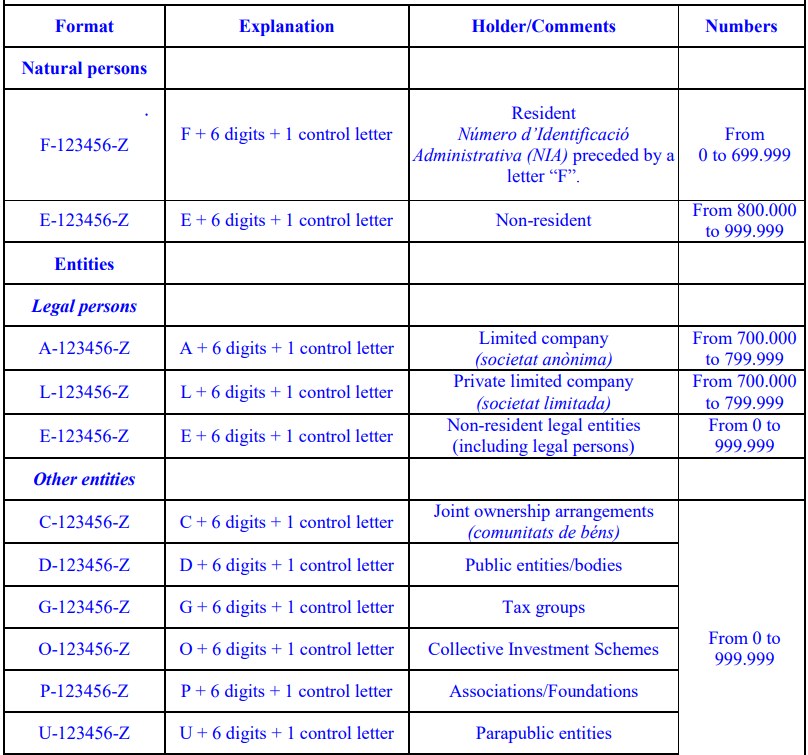

Format

|

| NRT Format |

|

| NRT |

Frequently Asked Questions

What is the difference between NRT and NIA in Andorra?

The NRT (Número de Registre Tributari) is your primary Tax ID, used for all fiscal activities, invoicing, and tax filings. The NIA (Número d'Identificació Administrativa) is an administrative number assigned to residents for general identification (ID cards). While residents have both (and they share the same number sequence), only the NRT is used for commercial and tax-specific transactions.

How can I verify an Andorran NRT number online?

Andorra does not have a public real-time verification tool like the EU's VIES system. To verify a business's tax status, you must typically search the official Registre de Societats via the Govern d'Andorra portal or request a Certificat de Residència Fiscal directly from the counterparty. [1]

Is an NRT required for selling digital services to Andorra?

Yes, for B2C sales. Foreign companies selling digital or electronic services to individuals in Andorra must register for an NRT and collect IGI (Impost General Indirecte)—the Andorran equivalent of VAT—if their annual turnover from Andorran customers exceeds €40,000. For B2B sales, the "reverse charge" mechanism usually applies, placing the tax liability on the Andorran business customer. [2]

What are the standard formats for Andorran Tax IDs?

NRT numbers consist of a leading character, 6 digits, and a control letter (e.g., L-123456-A). The prefix indicates the entity type:

- F: Individual Residents

- E: Non-resident Individuals

- L: Limited Liability Companies (S.L.)

- A: Joint-stock Corporations (S.A.)

Why do I need 'Comuns' registration in addition to a Tax ID?

The Comuns are Andorra's local parish governments. Even with a national NRT, you cannot legally operate a physical business without a commerce license (Llicència de Comerç) from the specific Comú where your office is located. This local registration is often a mandatory prerequisite for activating commercial bank accounts. [3]

Can I use my NRT for banking immediately after registration?

While you receive an NRT quickly upon business incorporation, local Andorran banks have extremely strict KYC/AML protocols. It often takes 2 to 6 months to fully open and "activate" a commercial bank account for a new NRT entity, which is a common hurdle for foreign investors.

How Lookuptax can help you ?

Lookuptax VAT validation revolutionizes VAT number validation with its robust platform, empowering businesses to seamlessly verify VAT numbers across over 100 countries. Our cutting-edge technology ensures accurate and efficient validation, reducing errors and enhancing compliance.