Denmark TIN number guide

Central Person Registration Number (CPR Number)

In the Danish Central Person Registration System (CPR), every individual is enrolled if they meet the following criteria:

- Born or migrated to Denmark and are registered in the country.

- Covered under ATP, a specific work-related pension scheme.

- Mandated by tax authorities to obtain a CPR number for tax-related procedures in Denmark.

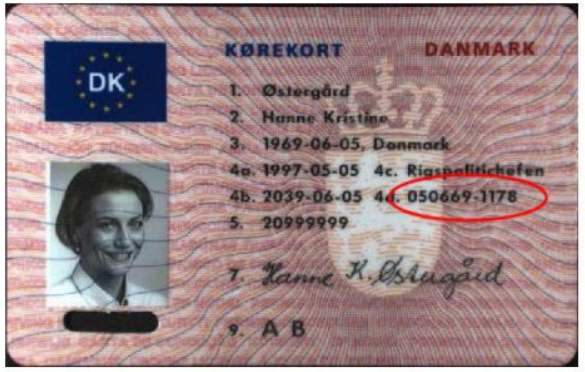

The Danish CPR number plays a crucial role in virtually all interactions with public authorities, including tax affairs. It is prominently featured on official identification documents such as passports, driver's licenses, health security cards, etc. It is also known as "personnummer" in Danish.

Format

A 10-digit number with a hyphen positioned between the 6th and 7th digits. The final digit serves as a check digit and also signifies the individual's gender. Specifically, an even number designates a female, while an odd number indicates a male. eg: 999999-9999

Foreigners

In scenarios where an individual is not a resident in Denmark but is deemed taxable to the country by the Danish Tax Agency, such as in the case of employment, the Danish Custom and Tax Administration have the authority to provide a CPR number. The structure and format of this number mirror those issued by local municipalities.

|

| CPR on Driver's licence |

CVR number or SE number

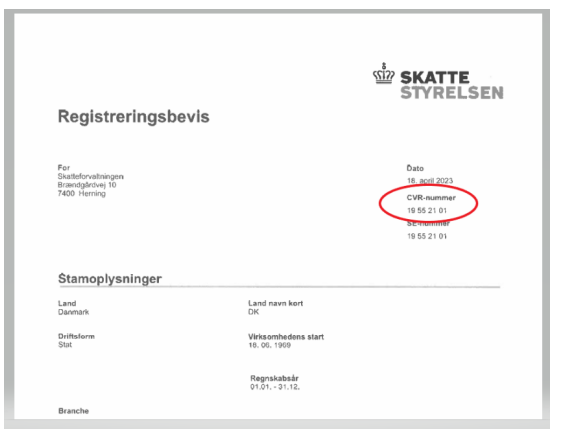

Also known as "Momsregistreringsnummer" in Denmark, the Tax Identification Number (TIN) for non-natural persons or legal entities corresponds to the Danish CVR number. The issuance of the CVR number follows the guidelines of the CVR law and is overseen by the Danish Business Authority, a division of the Ministry of Industry, Business, and Financial Affairs.

Corporations are required to apply for the CVR number during their establishment process. Non-natural persons and entities not classified as corporations have the option to delay CVR number application until they are obligated to register for VAT, excise duties, withheld tax on salaries, and similar obligations.

Format

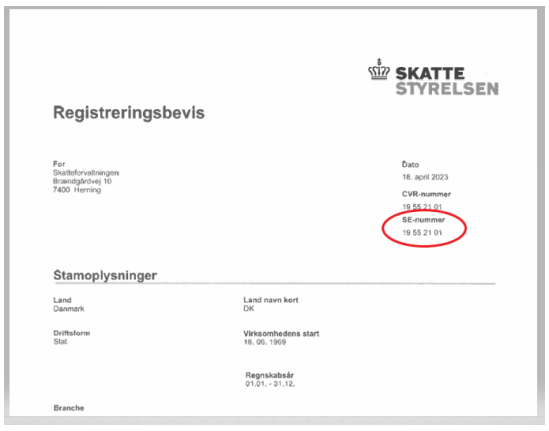

CVR consits of 8 digits. Eg:99999999. "CVR" or "SE" is frequently prefixed to the number, for instance, as CVR 99999999 or SE 99999999. In certain scenarios, a company may possess both a CVR number and a SE number.

Foreigners

For foreign companies without a permanent establishment in Denmark registering for VAT, their TIN is represented by the Danish SE number. The SE number is issued in accordance with various tax, VAT, and excise laws and is managed by The Danish Tax Agency, which operates under the Ministry of Taxation.

|  |

| CVR number on Registration certificate | SE number on Registration certificate |

How Lookuptax can help you ?

Lookuptax VAT validation revolutionizes VAT number validation with its robust platform, empowering businesses to seamlessly verify VAT numbers across over 100 countries. Our cutting-edge technology ensures accurate and efficient validation, reducing errors and enhancing compliance.