Germany TIN number guide

Steuerliche Identifikationsnummer (IdNr)

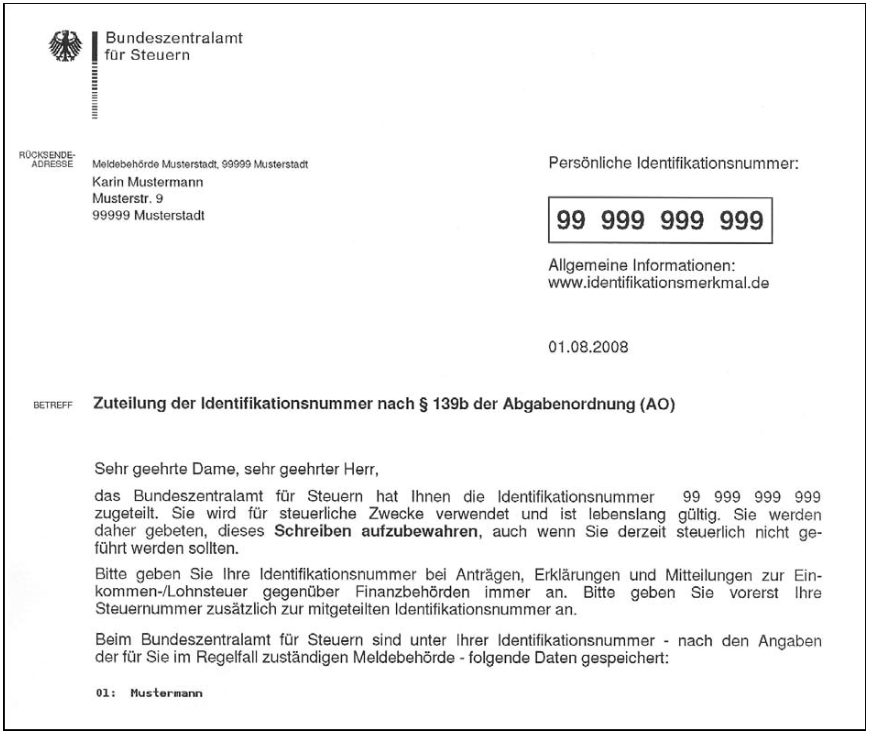

The Federal Central Tax Office (Bundeszentralamt für Steuern - BZSt) allocates a personal identification number to every registered individual in Germany. This distinct identifier consists of 11 digits and is not generated from personal data (Legal basis: § 139b Abgabenordnung -AO-). It consists of 10 digits plus one check digit.

|

| Steuerliche Identifikationsnummer |

|

| Steuerliche Identifikationsnummer |

Steuernummer

The tax number, known as "Steuernummer," is a unique identifier crucial for businesses and freelancers in Germany. With a format like "12/345/67890" or "3012034567890," it spans 10 or 11 digits, including the Bundesland code. Acquiring this number involves submitting the "Fragebogen zur steuerlichen Erfassung" to the tax office (Finanzamt). It differs from the tax ID (Steueridentifikationsnummer) or VAT number (Umsatzsteuernummer). Your Steuernummer, not private, must be visible on invoices and in your Impressum. It changes if you relocate to a different area, highlighting its dynamic nature in the business landscape. Stay informed for seamless compliance.

A natural question usually arises on Why do we have both a tax number and a tax identification number? The initial query naturally revolves around the existence of these two distinct numbers, and unfortunately, they are not interchangeable.

Introduced in 2008 for the purpose of modernizing the taxation process, the Steuer-Identifikationsnummer (also known as "Steuer-ID") specifically caters to income tax. It serves as a lifelong companion for each taxpayer, persisting even 20 years after their demise. Unlike the previous tax number, the Tax Identification Number remains constant, even after relocating to a new address.

Over time, the Tax Identification Number is anticipated to supersede the "old" tax number (Steuernummer) in the realm of income tax. The exact validity period of the "old" tax number remains undetermined. However, its obsolescence will become apparent on tax forms when no longer needed. During a transitional phase, it's advisable to furnish both the tax number and the Tax Identification Number in communications with the tax office, streamlining their processes. Stay informed for seamless navigation of tax-related matters.

Umsatzsteuer Identifikationsnummer (USt-ID)

Businesses engaging in transactions within the European Union's internal market must have a Value Added Tax Identification Number (Umsatzsteuer-Identifikationsnummer or USt-IdNr) for seamless processing.

A valid USt-IdNr is essential for ensuring that these transactions qualify for value-added tax exemption, especially when the counterpart company in another EU member state also holds a valid USt-IdNr.The VAT ID number, is an independent number that is issued to companies by the BZSt in addition to their company's tax number.

Format - 11 digits Eg:DE123456789

Official Database - USt-ID Search

How Lookuptax can help you ?

Lookuptax VAT validation revolutionizes VAT number validation with its robust platform, empowering businesses to seamlessly verify VAT numbers across over 100 countries. Our cutting-edge technology ensures accurate and efficient validation, reducing errors and enhancing compliance.