Isle of Man TIN number guide

Tax Reference Number (TRN)

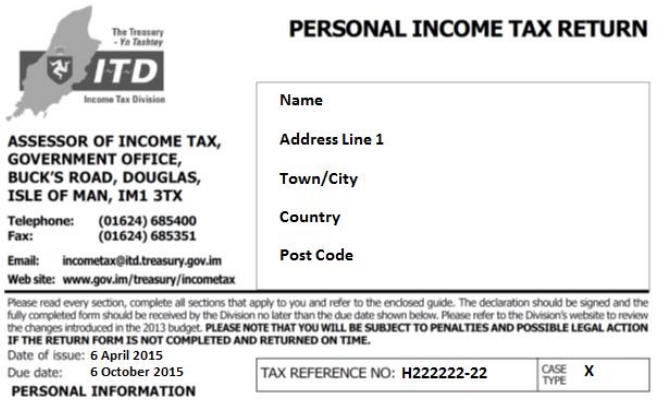

The Isle of Man issues Tax Reference Numbers (TRN) to individuals, partnerships, and entities (including companies, trusts, and foundations) obligated to file an Isle of Man tax return. This unique identifier, the Tax Reference Number, is assigned during the registration process with the Income Tax Division.

Format

All Tax Reference Numbers follow a consistent format, comprising one letter and six numbers, succeeded by a hyphen and a two-digit suffix. The prefixes for different entities are as follows: 'H' for Individual Tax Reference Numbers, 'C' for Companies (including Limited Liability Companies – LLCs), and 'X' for Trusts, Foundations, and Partnerships (including Limited Liability Partnerships - LLPs).

While the use of a two-digit suffix is optional, a Tax Reference Number without the suffix, such as C222222, is considered acceptable. Here are some examples:

- Individual: H111111-11

- Company: C333333-33

- Trust: X555555-55

|

| TRN on Income Tax Return |

National Insurance Number (NINO)

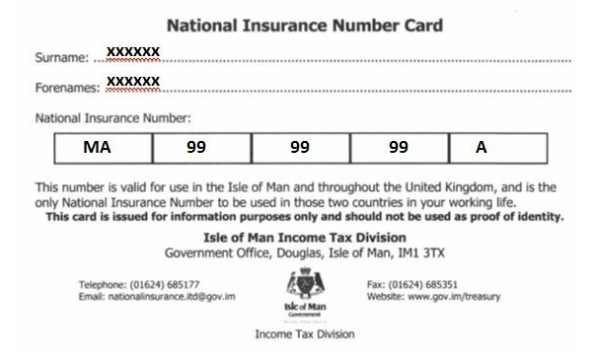

Every employed individual within the working age range (16-65) is mandated to possess a National Insurance Number (NINO). The issuance of NINO is facilitated either by the Isle of Man Income Tax Division or Her Majesty’s Revenue & Customs (HMRC) in cases where the individual has previously lived and worked in the UK before relocating to the Isle of Man.

Format

National Insurance Numbers (NINOs) are structured with two letters, followed by six numbers, and capped off with a suffix letter - A, B, C, or D. An illustrative example of this format is MA999999A.

|

| National Insurance Card |

How Lookuptax can help you in VAT validation?

Lookuptax VAT validation revolutionizes VAT number validation with its robust platform, empowering businesses to seamlessly verify VAT numbers across over 100 countries. Our cutting-edge technology ensures accurate and efficient validation, reducing errors and enhancing compliance.