India GSTIN number guide

Goods and Services Tax Identification Number (GSTIN)

GSTIN stands for Goods and Services Tax Identification Number. It is a unique alphanumeric identifier assigned to businesses registered under the Goods and Services Tax (GST) regime in India. The GSTIN is crucial for businesses to engage in GST-related transactions and compliance.

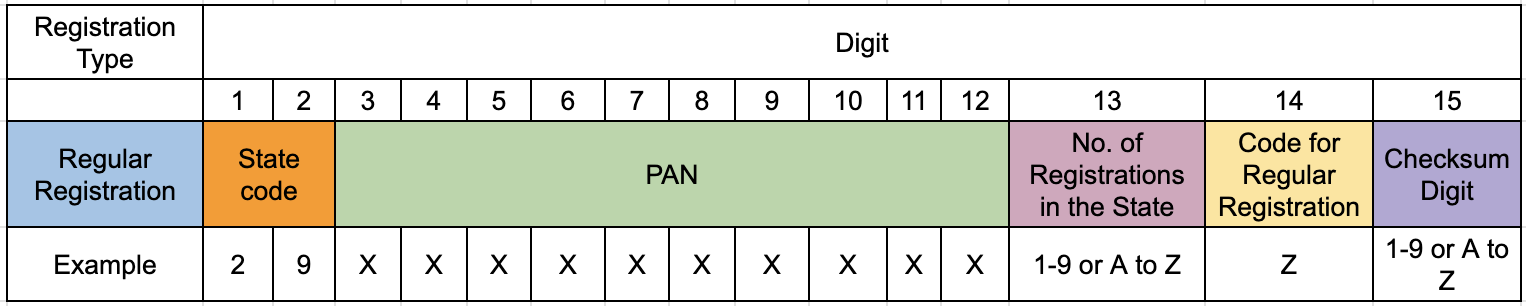

Following are the details of the GSTIN format

- 1st 2 digits: This is the state code as per the Indian Census 2011

- Next 10 digits:This is the PAN of the business entity.

- 13th digit: This denotes the serial number of registrations the business entity has for business verticals in the state, under the same PAN. It can range from 1-9 for businesses with up to 9 business vertical registrations in the state and for more than 9 registrations, from A-Z.

- 14th digit:This will be ‘Z’ by default.

- 15th digit: This digit denotes a ‘checksum’. It may be an alphabet or a number.

- Special Code 99 for 'Other Country'

- Special Code 97 for 'Other Terrritory'

Permanent Account Number (PAN)

In India, the official term for TIN is Permanent Account Number (PAN). The legal authority governing the allocation and utilization of PAN is outlined in Section 139A of the Income-tax Act, 1961, with detailed regulations specified in Rule 114 of the Income Tax Rules, 1961. PAN is a ten-digit alphanumeric identifier, presented as a laminated card, issued by the Income Tax Department to any "person" upon application or as allocated by the department without one. It is not obligatory for all residents or nationals but is mandatory for individuals or entities with taxable income. Once assigned, PAN remains unchanged indefinitely.

To obtain PAN, individuals or entities apply to either UTI or NSDL, who process the applications on behalf of the Income Tax Department. PAN serves the sole purpose of facilitating Income Tax-related matters.

A typical PAN is AFZPK7190K.

- First three characters i.e. "AFZ" in the above PAN are alphabetic series running from AAA to ZZZ.

- Fourth character of PAN represents the status of PAN holder i.e. "P" in the above PAN represents the status of the PAN holder.

- "P" stands for Individual,

- "F" stands for Firm,

- "C" stands for Company,

- "H" stands for HUF,

- "A" stands for AOP,

- "T" stands for TRUST

- “B” stands for Body of Individuals

- “L” stands for Local Authority

- “J” stands for Artificial Juridical Person

- “G” stands for Government

- Fifth character i.e. "K" in the above PAN represents first character of the PAN holder's last name/surname.

- Next four characters i.e. "7190" in the above PAN are sequential number running from 0001 to 9999. Last character i.e. "K" in the above PAN is an alphabetic check digit.

Example : AACCG0527D

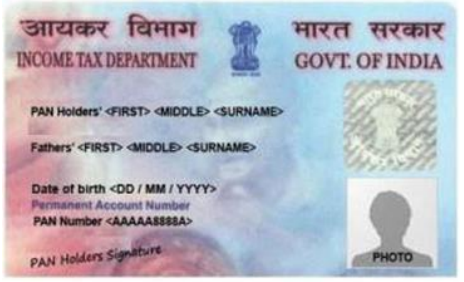

Where to find PAN ? PAN can be found on PAN card or PAN allotment letter

|

| PAN card |

How Lookuptax can help you ?

Lookuptax VAT validation revolutionizes VAT number validation with its robust platform, empowering businesses to seamlessly verify VAT numbers across over 100 countries. Our cutting-edge technology ensures accurate and efficient validation, reducing errors and enhancing compliance.