Demystifying Einvoicing in India via IRP - Regulations, Status, and Updates

| Country | India |

| Status - B2G | Mandatory |

| Status - B2B | Mandatory for taxpayers with aggregate turnover >Rs.5Cr |

| Status - B2C | Mandatory for taxpayers with aggregate turnover >Rs.500Cr |

| Formats | QR on Invoice, PDF |

| Authority | GST Council |

| Network name | Invoice Registration Portal (IRP) |

| Legislation | Rule 48(4) of CGST Rules 2017 |

Overview

India follows clearance model for einvoicing. The invoices generated by the supplier needs to be registered with the Invoice Registration Portal (IRP). On successful registration IRP returns an Invoice Reference number (IRN) and a QR code in the response. This QR code and the IRN number needs to be printed on the invoice before sending it to the buyers. India has adopted a standard framework called the Goods and Services Tax (GST) e-invoicing system for nationwide einvoicing under the GST regime.

What is GST EInvoicing?

GST einvoicing is a system introduced by the Indian Government for reporting business-to-business (B2B) invoices and certain other specified documents to the GST System and obtaining a unique Invoice Reference Number (IRN) that makes the invoice legally valid.

Under the GST law, notified businesses have to generate an IRN for every B2B invoice by electronically uploading specified invoice details to the Invoice Registration Portal (IRP). The IRP verifies the data and returns a signed e-invoice with a QR code containing the IRN. This IRN then has to be mentioned on the invoices shared with buyers.

The GST einvoicing system has been developed by the GST Network (GSTN), the organization responsible for providing IT infrastructure and services for GST implementation in India.

The GST einvoicing system is also referred to as the IRN or e-invoice/IRN system. It is applicable only for business-to-business (B2B) invoices and specified documents issued by notified businesses. Any invoice issued without an IRN is considered invalid under GST.

Objectives of GST Einvoicing

Some of the major objectives behind introduction of GST einvoicing in India are:

- Improve tax compliance by reducing fake invoicing and other tax frauds

- Create a single source of truth for reporting of B2B invoices

- Reduce transcription errors and improve data quality

- Automate reconciliation between input tax credit and output tax liability

- Enable seamless sharing of invoice data across the GST System, reducing reporting in multiple forms

- Eliminate manual data entry errors by buyers through system level exchange of e-invoice data

- Create analytics around B2B transactions for policy and business intelligence

- Support invoice-based financing for MSME sector

Applicability of GST Einvoicing

Einvoicing is applicable to registered businesses whose aggregate annual turnover exceeds the prescribed threshold limit set by Government of India. This turnover limit has been gradually reduced over time to onboard more businesses.

The current applicability threshold is ₹20 crores annual aggregate turnover. Further, einvoicing applies for B2B taxable supplies only. Export invoices also have to be e-invoiced, whereas invoices to end consumers or unregistered businesses are excluded.

Some categories exempted from e-invoicing mandate are:

- Special Economic Zone units

- Insurers, banks and financial institutions

- Goods transport agencies

- Suppliers of passenger transportation service

- Cinema hall ticket issuers

How GST EInvoicing Works

The key steps involved in the GST einvoicing process are:

- The seller/supplier's billing or accounting software generates the invoice as per usual business process.

- The JSON file of the invoice data is programmatically extracted from the accounting software and reported online to the IRP via APIs.

- The IRP validates the JSON data against the specified schema, generates the IRN hash and digitally signs the invoice data.

- The IRP returns the signed JSON back to the supplier containing the IRN and QR code.

- The supplier's system prints the invoice with IRN QR code or shares it electronically with the buyer.

- The signed JSON is also shared by the IRP with the GST and e-way bill systems for further processing.

The exchange between supplier's software, IRP and GST system is completely automated with no manual intervention. The invoice only becomes a legally valid GST document after IRN generation by the IRP.

E-Invoice Schema

A key requirement for einvoicing is that the invoice data must be in a structured standard format so that it can be understood by machines and systems.

In India, the standard for e-invoice data is referred to as the GST e-invoice schema or GST INV-1 format. It uses JSON (JavaScript Object Notation) for representing the invoice data.

The schema specifies the mandatory fields that must be present in an invoice for IRN generation such as supplier and buyer GSTIN, invoice number, date, value, tax rates, HSN codes etc.

Software providers enable generation of invoices as per the schema requirement through suitable customization and integration with IRP. The schema ensures interoperability of e-invoice data across accounting systems.

Invoice Registration Portal

The Invoice Registration Portal (IRP) is the website provided by GSTN for suppliers to electronically upload their invoice data for IRN generation. It has been designed to process and return IRNs at high speed to support large volumes.

Key aspects of the IRP are:

- Provides APIs for system integration by suppliers to upload JSONs and receive IRN.

- Validates invoices against schema and checks for duplicity using the GST central registry of invoices.

- Generates the IRN hash and digitally signs the invoice data along with QR code.

- Shares signed invoices with supplier and also transfers them to the GST System.

- Allows bulk uploading of invoices through offline utilities provided by GSTN.

The IRP aims to serve as a pass-through portal and not store or archive invoice data for long periods. Currently, GSTN operates a single IRP but plans to implement multiple IRPs for redundancy in future.

Cancellation and Amendments

You can't delete or modify an IRN or invoice once it is generated. However, it can only be cancelled and you can report a new document a with new invoice number and generate a fresh IRN (ideally issue credit note and then generate a new invoice) If required, the supplier can cancel an issued invoice within 24 hours of generating the IRN, through a cancellation API provided on the IRP. However, cancellation is not permitted if the connected e-way bill is active or verified by tax officer during transit.

Amendments to the e-invoice data are not allowed on the IRP. Any changes have to be carried out only on the GST Portal while filing GSTR-1. The system will flag such amendments to tax officers for information. .

E-Way Bills

E-way bills are mandatory for transportation of goods worth over ₹50,000 in India. The e-invoice system is integrated with e-way bill system to enable seamless generation of e-way bills from e-invoice data.

If the supplier enters transporter and vehicle details during e-invoice generation, the e-way bill can be automatically created without re-entering information. The IRN also serves the e-way bill reference number for logistics tracking.

Impact on Businesses

Adoption of GST e-invoicing system necessitates certain changes by suppliers, buyers and intermediaries involved:

Suppliers have to:

- Modify or integrate accounting/billing systems to extract invoices as JSON data and integrate with IRP.

- Build validations, modifications to ensure e-invoices are schema compliant.

- Operationally adapt to IRN based invoicing and make necessary process changes.

- Train staff on e-invoicing procedures and manage transition.

Buyers have to:

- Update systems to be able to automatically consume and process IRN compliant e-invoices.

- Change processes around invoice verification, payments etc. to rely on IRN as unique identifier.

- Cooperate with suppliers during onboarding to provide necessary identification details.

Intermediaries like GSPs, ASPs and tax consultants assist businesses in the e-invoicing lifecycle, from solution selection, development to compliance.

Phased Rollout

The Indian Government has progressively reduced the applicability threshold over different phases to onboard all sizable businesses onto e-invoicing:

- Phase 1: ₹500 crores+ turnover from Oct 2020

- Phase 2: ₹100 crores+ turnover from Jan 2021

- Phase 3: ₹50 crores+ turnover from April 2021

- Phase 4: ₹20 crores+ turnover from April 2022

This phased approach has aimed to stabilize the system and address initial challenges before expanding to smaller businesses. The coverage is expected to reach over 80% of GST registered businesses eventually.

Relationship with GST Returns

A key benefit of e-invoicing is auto-population of invoice information into GST returns of suppliers and buyers.

For suppliers issuing e-invoices, the details get auto-populated into their GSTR-1 sales return. The updated return can also be viewed by their buyers in GSTR-2A.

E-invoicing is expected to increase accuracy of returns, reduce discrepancies and compliance burden for businesses. Returns having e-invoice linked data will see lower incidence of tax authority scrutiny.

Future Developments

The e-invoicing system aims to bring additional functionalities over time:

- Enabling exchange of returns and e-invoice information on a real-time basis between businesses.

- Permission for specified amendments to invoices on the IRP itself through supplier login, avoiding changes only via returns.

- Introduction of digital signature based authentication option on IRN to enhance security.

- Support for e-invoicing in special economic zones, exports and other areas currently exempted.

- Launch of new IRPs to distribute load for enhanced availability and redundancy.

- Providing mobile app and web-based modes to generate e-invoices, in addition to system integration.

As GST e-invoicing stabilizes over time, it is also expected to pave the way for India to move towards a more interoperable Peppol-based e-invoicing framework. This will enable seamless exchange of e-invoices across borders.

Authentication of GST E-Invoices

The digitally signed IRN and QR code returned by the IRP allow various parties to authenticate and validate a GST e-invoice.

Buyers can verify that the invoice has indeed been reported to the IRP by:

- Scanning the QR code on the invoice using the mobile app provided by GSTN

- Uploading the JSON or QR code into the IRP portal to independently verify authenticity

- Checking for IRN on the GST Portal while reconciling with input tax credits

- Parsing the signed JSON to ensure it is digitally signed by IRP's private key

Tax officials can also scan the QR code on an invoice during movement of goods or at any point to check its genuineness via the central registry of IRNs maintained by the GST System.

The IRN linking, IRN authentication and structured e-invoice data make it very difficult to fake or manipulate invoice information. This improves transparency and compliance.

Comparison with Other E-Invoicing Frameworks

While GST e-invoicing in India serves the primary purpose of reporting of B2B invoices for tax compliance and fraud prevention, other global e-invoicing frameworks focus more on enabling automation and interoperability across diverse platforms andCompanies like Peppol, CEF, GS1 are leading some of these initiatives which allow seamless exchange of invoices between systems across the supply chain.

Some key differences between GST e-invoicing and frameworks like Peppol are:

- GST e-invoicing is centralized and regulated by government agency GSTN whereas frameworks like Peppol are decentralized allowing participants to join freely.

- The GST e-invoice schema is very India specific including GSTINs and HSN codes whereas Peppol uses international standards like XML, UBL.

- The GST e-invoicing workflow focuses on IRN generation for regulatory compliance. Peppol focuses more on automating the full procure-to-pay cycle and integrating with steps like payments, logistics etc.

- GST e-invoicing currently does not directly facilitate B2B exchange of invoice data between buyer and supplier systems. Peppol enables system level transmission of invoice data between businesses.

- GST e-invoicing applies only to B2B invoices for domestic transactions. Peppol operates cross-border and also covers business-to-government and business-to-consumer domains.

However, GST e-invoicing can over time evolve to support machine-readability, automation and interoperability aspect through the common GSTIN identifier and integration with GST System and India Stack components. This will reduce the gaps considerably.

EInvoicing for Small Businesses

There are a few options available for small businesses to generate GST e-invoices:

- Using their existing accounting software: Many software providers like Tally, Marg, Busy etc. have enabled e-invoicing in their base packages. Users have to simply check if the add-on is available and activate e-invoicing if required by providing IRP credentials.

- Using GST Suvidha Provider (GSP) portal solutions: GSPs provide web-based or on-premise apps to create e-invoices by data entry and generate IRN without an accounting software.

- Using GSTN Offline Utility: The Excel based offline tool allows creation and bulk generation of JSONs for reporting to IRP.

- Using e-invoicing enabled billing/invoicing software: Many startups provide e-invoicing focused apps and billing software for SMEs at low cost.

- Outsourced generation: Accounting firms also offer e-invoicing services by generating IRN compliant invoices on behalf of their SME clients.

E-invoicing Readiness

When considering adoption of GST e-invoicing, businesses should assess their current invoicing process and systems. Some key aspects include:

- Evaluating the accounting/billing software capabilities w.r.t e-invoicing integration.

- Estimating changes needed to ensure compliance with e-invoice schema fields.

- Modifications required to print IRN QR code on invoices.

- Assessing impact on reporting of export invoices, credits/debit notes etc.

- Interaction with customers/buyers to provide required information prior to rollout.

- Availability of high speed internet connectivity.

- Training requirements for staff handling invoicing on new e-invoicing protocols.

- Legal requirements regarding digitally signed invoices for statutory purposes.

By considering these changes and challenges in advance, businesses can plan the transition smoothly when mandated or if voluntarily adopting GST e-invoicing.

E-Invoice Adoption Challenges

The rollout of GST e-invoicing on such a large scale has also posed certain challenges which have been progressively addressed:

- Many businesses initially struggled with integration of accounting software and IRP due to lack of technical capability, time or cost constraints. This was gradually resolved by improvements in API, offline tool availability and GSP offerings.

- For some, the JSON format meant overhauling systems designed for PDF/print invoicing leading to technology change hurdles.

- Frequent changes in IRP like new releases, downtimes etc. meant suppliers faced uncertainties and disruptions during transition phase.

- Buyers faced challenges in modifying ERP and systems quickly to align with mandated e-invoicing timelines affecting interoperability.

- Absence of a certification program for software led to taxpayers being unsure of compliance with latest requirements.

- Constraints faced by suppliers in modifying systems led to delays and non-compliance penalties affecting their businesses during initial phases.

- Lack of IRN amendment facility on IRP leading to hardship for genuine mistakes requiring corrections only through returns.

- Limitations in handling special scenarios like printing IRN over signature, sub-contractor invoicing, accounting software GAPs etc. needing clarifications.

The Government has addressed many of the initial challenges through continued education of ecosystem participants and progressive system enhancements. The onboarding pains have smoothened considerably with adoption at scale.

Who need to generate einvoices ?

Einvoicing is mandatory for all b2b merchants registered for GST with annual turnover of more than 5cr in any financial year from 2017-18 with effect from 1st August 2023. The current limit is 10 cr.

Entities/Persons exempted

The following list of entities are exempted from issuing einvoices in India

- SEZ Units

- Insurance

- Banking (including NBFCs)

- Goods Transport Agency (transporting goods by road in goods carriage)

- Passenger Transport Services

- Multiplex Cinema Admissions

Difference Between B2B and B2C eivoices

- B2B einvoices - These einvoices are generated by submitting the invoice to the IRP portal. The einvoices should cointain an IRN (Invoice Reference Number) and a QR code issued by the IRP.

- B2C einvoices - These einvoices are not registered with the IRP portal. It contains a QR code generated by the merchants themselves. The QR code is supposed to enable digital payments. Hence it should ideally be a UPI static/dynamic QR code. This case be generated by any of the digital payment providers.

B2C einvoices

B2C einvoices in India are nothing by invoices with a dynamic QR code.

Type of transactions on which Dynamic QR code needs to be displayed

Dynamic QR code needs to be captured in all the B2C (business to consumers) invoices. In simple words, on all the supplies made by a registered business to unregistered persons, a dynamic QR code needs to be captured.

Type of businesses who need to display dynamic QR code for B2C invoices

All the businesses whose annual turnover exceed 500 crores in any preceding financial year (starting from 2017-18) are mandated to display QR code on their B2C invoices from 1st December 2020.

Parameters/ details to be captured in the Quick Response (QR) Code

Dynamic QR Code should be such that it can be scanned to make a digital payment. The following are the details that need to be captured in dynamic QR code -

- Supplier GSTIN number

- Supplier UPI ID

- Payee’s Bank A/C number and IFSC

- Invoice number & invoice date,

- Total Invoice Value

- GST amount along with breakup i.e. CGST, SGST, IGST, CESS, etc.

Generating dynamic QR code B2C invoices

Businesses should generate dynamic QR code for B2C invoices using their own QR code generating machines and algorithms. Here, IRN generation is not required and you need not upload B2C invoices to IRP. If uploaded, IRP will reject such invoices.

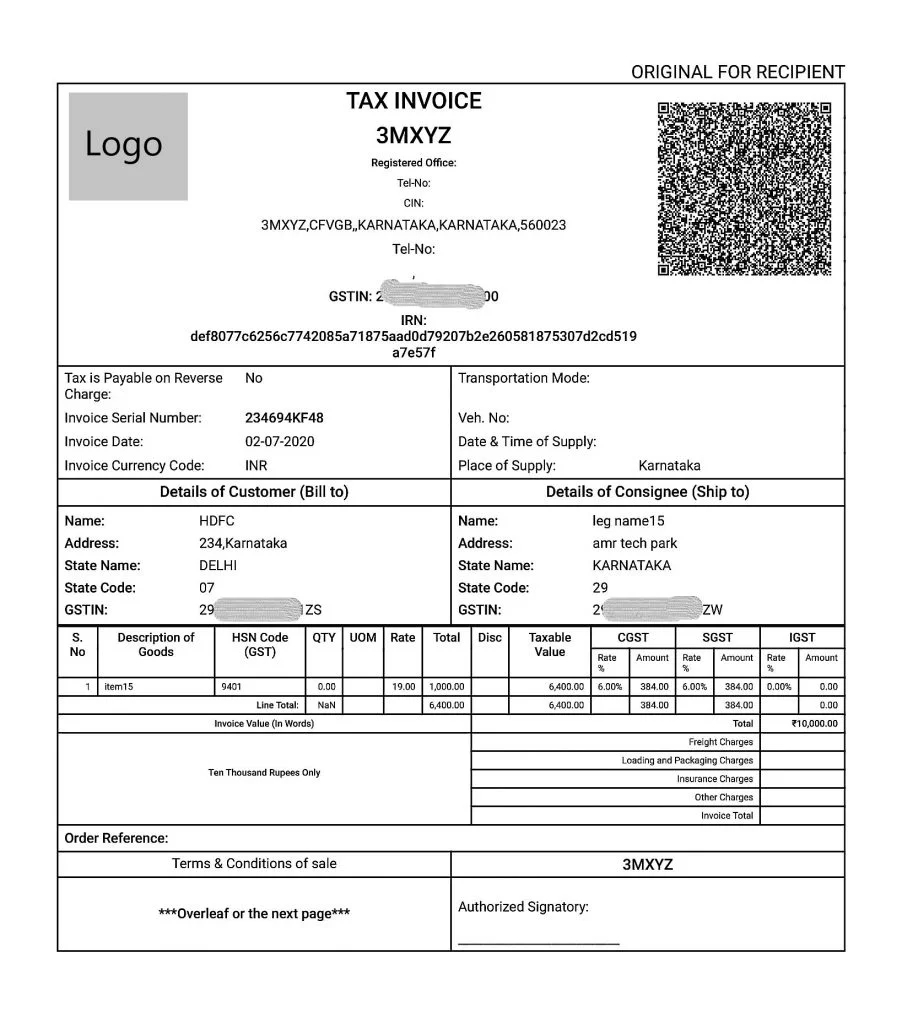

|

| Sample einvoice |

Latest updates

10-May-2023E-Invoicing threshhold limit reduced to Rs. 5 Crore from 01st August 2023- CBIC issued a notification mandating businesses with turnover of over 5 crore required to generate e-invoice from August 1. The current limit is 10cr. Learn More