E-invoicing in Portugal -eSPap

| Country | Portugal |

| Status - B2G | Mandatory |

| Status - B2B | Voluntary |

| Status - B2C | NA |

| Formats | UBL 2.1 CIUS-PT or CEFACT CIUS-PT |

| Authority | Entidade de Serviços Partilhados da Administração Pública |

| Network name | eSPap |

| Legislation | DECREE LAW No. 123/2018 |

Portugal is embarking on an ambitious initiative to modernize and digitize invoicing processes, both in public administration and in business transactions. This major transformation aims to increase efficiency, improve control, and enhance integration with national accounting systems.

The government has mandated e-invoicing for all suppliers to public entities starting November 2020 based on contract thresholds. There are also plans to eventually require e-invoicing for business-to-business (B2B) and business-to-consumer (B2C) transactions. This article examines how e-invoicing is being implemented in Portugal and key considerations for suppliers, service providers, and taxpayers.

Public Sector E-Invoicing Mandate

Portugal’s mandate for e-invoicing in public procurement comes from Directive 2014/55/EU on electronic invoicing in public contracts. Domestic legislation was enacted in 2017 to make e-invoicing mandatory for suppliers to government bodies under certain contract values.

The National Public Procurement Portal (Portal Nacional de Compras Públicas) run by the Central Purchasing Body (Entidade de Serviços Partilhados da Administração Pública or ESPAP) serves as the central platform and single entry point for intake, processing, and management of all e-invoices issued to public entities.

Suppliers must issue structured e-invoices in XML format aligned with the European standard (EN 16931) and submit them via the portal. Public contractors above specified annual thresholds are required to join the portal to receive e-invoices starting November 2020. Remaining public entities must onboard by end of 2022.

The aim is to automate and streamline the entire invoice-to-pay process for public procurement. Electronic invoices registered on the portal will interface seamlessly with the government’s financial management systems. This is expected to reduce processing costs, improve transparency, and speed up payment cycles.

Private Sector E-Invoicing

For transactions between private companies (B2B) and from businesses to consumers (B2C), e-invoicing in Portugal is still voluntary. The government has signaled intent to eventually mandate e-invoicing across the economy using a phased approach, but no definite timeline has been set yet.

The adoption of e-invoicing for private transactions so far has been driven by large companies implementing it independently to achieve efficiencies and lower costs. Most smaller businesses continue using paper invoices or PDF invoices sent by email.

Portugal is closely monitoring the experience of nearby countries like Spain and Italy which have embarked on mandated B2B e-invoicing to inform their own timeline. The rollout is expected to focus first on large taxpayers and then gradually extend to medium and small-sized enterprises.

E-Invoicing Formats and Platforms

For public procurement, e-invoices must be submitted to the National Public Procurement Portal in the XML format defined by the European standard EN 16931. The portal offers several options for suppliers to generate and transmit compliant invoices including:

- Procure-to-pay software integrated via the portal's API

- Free browser-based invoice creation tool

- Uploading XML files generated from other systems

- Third-party e-invoicing platforms connected to the portal

For private sector e-invoicing, any format like PDF can currently be used as long as the invoice data is transmitted electronically. The government has not yet designated any centralized platforms for transmission of structured e-invoices between companies. Adoption so far has utilized various private networks and service providers.

Issuing and Receiving E-Invoices

Suppliers issuing e-invoices to government entities must electronically sign and submit structured invoices in XML format to the National Public Procurement Portal. These undergo automatic validation checks on the format and issuer credentials before accepting.

The portal returns a unique registry number upon receipt that identifies the invoice in the national e-invoicing system. It then makes the e-invoice and issuance data available to the buying entity, automatically triggering the start of the payment process.

Suppliers can track status and retrieve both invoices and issuance receipts from the portal. Buyers can look up invoice details based on search parameters like supplier tax ID, invoice number, date, value etc.

For B2B and B2C invoices, issuers and receivers exchange invoices in formats and methods mutually agreed upon, such as EDI, email, web uploads etc. However, businesses are likely to transition to structured e-invoicing over time, especially if it gets mandated.

E-Invoice Processing and Integration

The National Public Procurement Portal automates much of the invoice receipt, registration and routing process for government entities. Invoice data can be fed into the entity’s financial system, avoiding manual re-entry.

However, proper integration still needs to be implemented by each public entity to update payables in accounting, post against appropriate cost centers, reconcile invoices and perform three-way matching with purchase orders.

Private companies face similar integration challenges to incorporate inbound e-invoices into their financial systems and ERPs seamlessly. Adoption of automated workflows for handling and approval of e-invoices can significantly optimize the order-to-pay cycle.

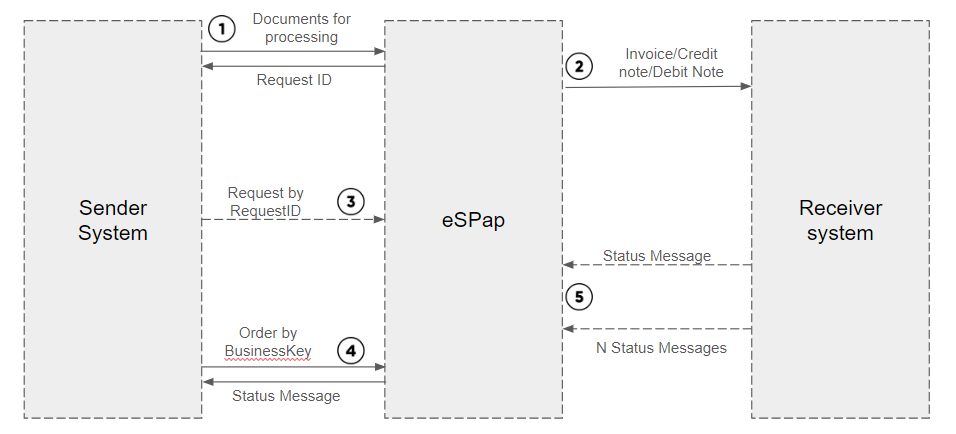

Asynchronous document exchange flow

|

| Asynchronous document exchange flow |

- Emitter system (ERP) sends a legal document (invoice, credit note, or debit note) and immediately receives (synchronously) a RequestId.

- If the document is processed successfully (quality control with no reported errors),eSPap sends the document to the receiving system through the established communication channel.

- At any time, the emitter system can inquire with eSPap systems using the RequestId, sent in the document submission response (1), to obtain the result of the document processing.

- As soon as the emitter system obtains the processing result, it can inquire about the document's status at any time, using either the RequestId or the Business Key.

- The receiving system sends N status messages according to the processing and validation of the document in its systems.

Benefits and Challenges of E-Invoicing

The transition to e-invoicing brings significant benefits but also some change management challenges:

Key Benefits:

- Cost reduction from eliminating paper and manual processing

- Faster settlement of invoices and improved cash flow

- Increased accuracy of data for accounting and tax reporting

- Enhanced visibility into invoice processing status

- Better archival and analytics on invoice data

- Seamless integration with national reporting systems

Key Challenges:

- Change management and user training on new processes

- Upgrading existing finance systems and integration work needed

- Dependency on reliability of central e-invoicing platform

- Adapting workflows to handle exceptions like rejections

- Getting buy-in and transitioning suppliers currently issuing paper invoices

- Cybersecurity risks from increasing digital attack surfaces

Overall, the gains for government, private entities, and the national economy from transitioning to automated e-invoicing at scale justify the temporary disruptions and costs involved.

Recommendations for Smooth Transition

Both private and public sector organizations in Portugal should take the following steps for a successful transition to e-invoicing:

- Do a comprehensive review of existing invoice workflows and data needs – identify changes required to extract and provide all information required for structured e-invoicing.

- Assess software systems and determine upgrades, integrations, and new solutions needed – including accounting software, ERPs, procurement systems, etc.

- Consult with major existing suppliers and key customers on their e-invoicing readiness and capabilities.

- Provide technical specifications and testing facilities early on to involve suppliers in the transition.

- Validate that all electronic invoice formats and transmission methods comply with legal requirements.

- Train accounts payable and procurement teams on new e-invoicing procedures and exception management.

- Implement robust cybersecurity controls to prevent unauthorized access to invoice data during transmission or storage.

- Start transition by onboarding larger suppliers first followed by smaller suppliers – conduct pilot tests before full-scale rollout.

- Plan for contingencies and business continuity procedures in case of disruptions to availability of e-invoicing platforms.

Portugal’s e-invoicing mandate for the public sector aims to increase efficiency, improve financial controls, close revenue gaps, and integrate with national reporting systems. The cost savings for government alone are estimated at €195 million annually. The digital invoicing transformation will deliver significant productivity gains and economic benefits nationally in the long term.

Frequently Asked Questions

Here are answers to some common questions about e-invoicing in Portugal: