VAT Listings - Key Takeaways from EU Member States' Experience

Value Added Tax (VAT) fraud costs EU governments billions of euros in lost revenue every year. A common type of fraud is missing trader intra-community (MTIC) fraud, where a business charges VAT on sales but disappears without remitting the VAT collected to tax authorities. To combat such fraud and increase compliance, several EU member states have implemented domestic VAT listings - requiring businesses to report detailed transaction data to tax authorities.

This blog article summarizes the key takeaways from a 2017 report by the EU's Fiscalis Project Group 74 on EU member states' experience with VAT listings. The report provides valuable insights for policymakers considering implementing similar transaction reporting requirements.

What are VAT Listings?

VAT listings require businesses registered for VAT to regularly submit detailed data to tax authorities on the VAT invoices they issue to customers and receive from suppliers. This supplements the standard VAT return, which only provides aggregated VAT amounts.

Specifically, VAT listings require identifying trading partners and providing invoice-level details including date, amount, VAT charged, etc. Tax authorities can use this transaction-level data to:

- Cross-check reports from buyers and sellers to catch inconsistencies that may indicate fraud.

- Analyze business networks and supply chains to identify high-risk traders and transactions.

- Improve risk analysis and targeting of audits compared to relying only on VAT return data.

- Provide feedback to support voluntary compliance.

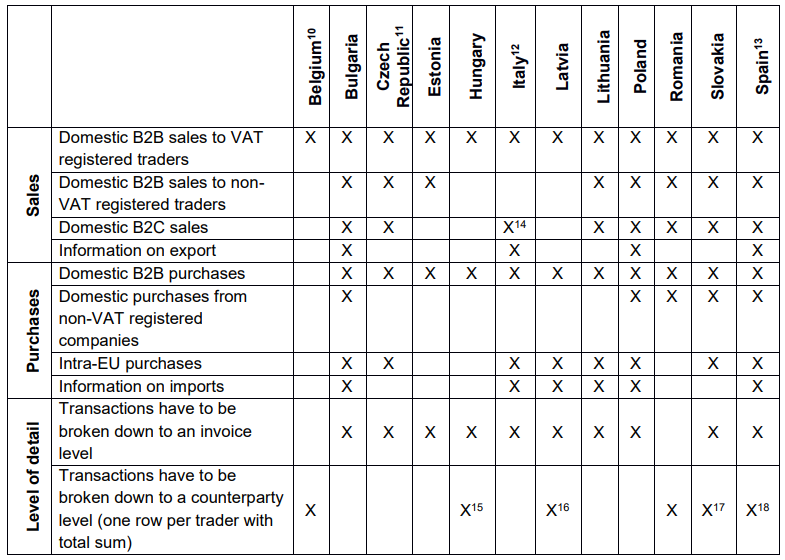

As of 2017, at least 12 EU member states have implemented some form of domestic VAT listings. The scope and reporting requirements vary but the purpose is similar - combating VAT fraud through increased transparency.

Key Benefits Reported by Member States

The 2017 EU report highlights several benefits realized by member states that have implemented VAT listings:

- Faster detection of fraudulent traders and networks - Previously, it could take tax auditors months to reconstruct supply chains. With transaction data, risk analysis can highlight suspicious traders in days.

- Improved VAT collection - Most states reported increased VAT revenue, especially from small businesses previously underreporting. Estonia reported a 10% increase in VAT collected the year after implementing listings.

- Better targeted audits - Detailed data allows tax authorities to pinpoint risky traders and transactions instead of auditing at random. The number of audits decreased in states like Hungary while audit yield increased.

- Faster VAT refunds - Data improved risk analysis of refund claims, enabling faster processing and reimbursement for compliant businesses. Estonia cut the processing time by nearly 80%.

- Increased compliance - VAT listings have a preventative effect as businesses know their data will be cross-checked. Estonia reported businesses suddenly started declaring higher sales and lower expenses.

- Administrative savings - Automated analysis of transaction data increased efficiency. Staff resources were redirected from manual data collection to higher value audit and enforcement activities.

Key Design Choices and Compliance Considerations

The EU report emphasizes VAT listings should leverage data businesses already collect for standard VAT reporting. This minimizes incremental compliance burdens. Other key design choices include:

- Invoice-level vs. aggregate reporting - Invoice-level reporting provides more details for cross-checks and supply chain analysis. But aggregated reporting reduces data volumes for tax authorities.

- Reporting frequency - Aligning with VAT return deadlines simplifies compliance. Shorter periods provide timelier data but increase reporting burdens.

- Thresholds - Setting reporting thresholds risks encouraging fraudsters to split transactions. Removing thresholds or setting aggregate partner-level thresholds helps avoid this.

- Electronic filing - Online filing enables real-time validation and data checks to improve quality. Member states utilize web forms, file uploads, API integrations.

- Feedback to taxpayers - Providing taxpayers access to data reported on them and notifications of discrepancies improves voluntary compliance.

To further reduce compliance costs, tax authorities should consult with business stakeholders and give adequate lead time when implementing listings. Offering free reporting software and extensive online guidance resources can also help ease the transition.

Reporting requirements for sellers

|

| Reporting requirements for sellers |

Improving Administrative Cooperation with VAT Listings

Domestically reported transaction data could also be utilized to strengthen administrative cooperation between EU member states in combating cross-border VAT fraud.

The Fiscalis report recommends exploring appropriate methods for member states to share data on intra-EU transactions declared in VAT listings. Access to partner country data would enable more robust verification of declared intra-EU supplies and acquisitions.

Analysis of full end-to-end supply chains for cross-border transactions could significantly enhance detection of MTIC fraud networks spanning multiple countries. While data sharing practices must incorporate appropriate taxpayer protections, better cooperative use of VAT listings data represents a promising avenue to bolster enforcement.

Key Takeaways and Recommendations

Based on the largely positive experiences reported by initial adopters, VAT listings appear to be an effective tool in the fight against VAT fraud that yields broader compliance dividends as well.

Member states considering similar transaction reporting requirements can benefit from the lessons learned to date:

- Seek high invoice-level detail but minimize incremental compliance burdens by leveraging existing accounting data.

- Remove reporting thresholds that enable fraud by concealing transaction parties or values.

- Emphasize electronic reporting and utilize real-time validation to improve data quality.

- Provide taxpayer feedback and notifications to drive voluntary self-correction of discrepancies.

- Share data and best practices with other tax authorities to combat cross-border fraud networks.

VAT listings have already demonstrated their value in boosting collections and enforcement for the initial group of adopting member states. As more countries implement transaction reporting frameworks, the positive effects are likely to compound across the EU. But realizing the full benefits demands a continued focus on minimizing compliance costs as well as enabling cooperative data usage. By learning from front-runners and iterating on VAT listings frameworks, the potential to modernize VAT administration and curb annual multibillion euro revenue losses can become a reality.