Demystifying ViDA - A Deep Dive into the EU's Groundbreaking New VAT Rules

The European Union has unveiled a sweeping set of proposals to overhaul VAT rules called VAT in the Digital Age (ViDA). This ambitious initiative aims to modernize VAT reporting, promote convergence, and reduce costs for businesses.

Introducing VAT in the Digital Age (ViDA)

In December 2022, the European Commission released the long-awaited ViDA initiative outlining plans to bring VAT rules into the 21st century. ViDA contains proposed legislative changes to achieve five main goals:

- Improve reporting by unlocking the potential of digitalization

- Promote the interoperability of IT systems

- Create a level playing field for all business models

- Reduce fragmentation and costs

- Minimize the need for multi-country VAT registration

This reform package comes as VAT fraud contributes significantly to the €93 billion VAT gap across the EU. ViDA aims to modernize reporting to enhance tax authority visibility and compliance.

Three Pillars of the ViDA Proposals

ViDA contains proposals across three main pillars:

- New real-time reporting and e-invoicing requirements for business-to-business (B2B) transactions

- Updated VAT rules for platform sellers

- A single EU VAT registration system

In this article, we’ll focus specifically on the major changes proposed for real-time reporting and e-invoicing.

New Digital Reporting and E-Invoicing Rules

The centerpiece of ViDA is the plan to require real-time digital reporting of invoice data for intra-EU B2B transactions. This aims to help tax authorities spot potential missing trader fraud on cross-border trades.

Here are the key elements proposed:

- From 2028, businesses must issue structured e-invoices in a common EU standard format within 2 days of B2B cross-border transactions.

- Sellers and buyers will submit extract data sets to their tax authority within 2 days of invoice issuance or due date.

- Tax authorities will transmit the data to a central EU database.

- EU countries can mandate e-invoicing for domestic transactions but must use the same standard.

- Existing domestic e-invoicing regimes like Italy and Hungary must align with the EU system by 2028.

This near real-time data access will allow tax authorities to identify and address non-compliance much quicker.

|

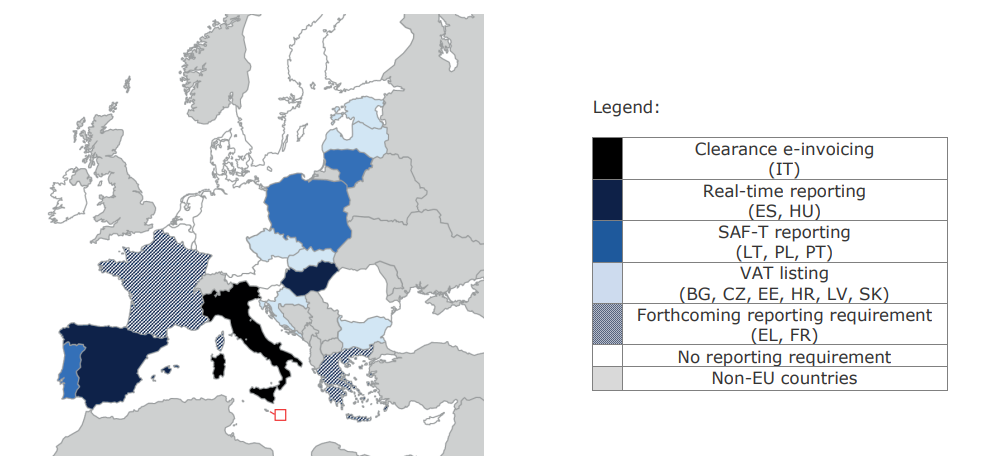

| Digital Reporting Requirements in the EU |

Who is Impacted by the New Rules?

The real-time reporting requirements apply for:

- All VAT registered businesses involved in intra-EU B2B transactions

- VAT registered customers acquiring goods cross-border

Domestic e-invoicing mandates are optional for EU members but will likely expand over time.

What Data Must Be Reported Digitally?

The extracted data to be reported digitally for intra-EU transactions includes:

- Seller and buyer VAT ID numbers

- Invoice date and number

- Product descriptions

- Quantity and price

- VAT amounts

- Payment account and terms

This data will be structured in a common XML schema and submitted via standardized channels determined by each country.

When Do the New Rules Take Effect?

EU countries must pass national laws to enable ViDA by end of 2022. The first reports on 2023 invoice data are due by January 31, 2024.

After that, ongoing reporting will happen on a quarterly basis within one month of each period closing. The information also gets exchanged between tax authorities within two months.

The mandatory intra-EU e-invoicing and real-time reporting kicks in from 2028 once the central systems are ready. EU members with existing e-invoicing rules (like Italy and Hungary) must align their systems by this deadline too.

How Should Businesses Prepare?

To get ready, businesses involved in intra-EU trade should:

- Evaluate if they are impacted based on the transactions carried out

- Identify the data that must be reported and map it to information collected

- Assess ERPs, accounting software, invoicing methods to determine changes needed

- Research when their country will mandate B2B e-invoicing and real-time reporting

- Analyze gaps to expected EU-wide e-invoicing standard and reporting schema

- Plan for modifications to invoice content, timing and digital transmission

- Test extracting and submitting required data to tax authorities

- Update contracts to inform customers of new data sharing with tax authorities

Although adapting will take time and investment, proactive preparation will ensure a smooth transition to real-time VAT reporting.

Benefits and Challenges of ViDA

The ViDA proposals promise several potential benefits:

- Greater visibility of cross-border transactions for tax authorities

- Increased VAT compliance across the EU

- Less need for separate VAT registrations in each member state

- Standardization of invoice formats and reporting approaches

However, significant challenges and concerns will need addressing:

- Tight timeframes for reporting may require major invoice process changes

- Adding data not normally included on invoices like payment details

- Disproportionate compliance burden for small and micro businesses

- Need for tax authorities to provide EU-standard reporting channels

- Data security and confidentiality questions with central repository

- Upfront transition costs for businesses to adapt their systems

Striking the right balance will be key as policies are finalized and implemented.

Is ViDA a Global Game-Changer?

The ViDA initiative represents possibly the most ambitious VAT reporting overhaul by a major economic bloc to date.

If implemented harmoniously, it could set a new global standard that others like the U.S. and China feel compelled to follow.

However, the sheer complexity of adapting 27 diverse VAT regimes to real-time reporting makes it far from an easy undertaking.

One thing is certain - the sweeping scope of ViDA marks a new era for VAT enforcement and data utilization by tax authorities in the growing digital economy.

The Path Ahead

The ViDA proposals are currently in public consultation. Extensive debate is expected given the far-reaching changes proposed.

If approved, the focus will shift to consistent adoption into national laws across EU members and gathering feedback as implementation progresses.

Businesses must monitor developments closely and become active stakeholders in the process. While the road ahead will have twists and turns, the destination is clear - modernized digital VAT reporting is coming!