VIES and INTRASTAT - A Comprehensive Guide for EU Traders

This post is also available in: Español|中文

VIES and INTRASTAT are two important EU customs and statistical reporting systems that companies engaged in intra-EU trade need to fully understand. This in-depth guide explains everything businesses need to know to properly comply with VIES and INTRASTAT requirements.

Mastering VIES and INTRASTAT reporting is crucial for smooth EU trade.

Introduction to VIES

VIES stands for VAT Information Exchange System. It is a system of information sharing between EU tax authorities to monitor VAT-exempt intra-EU transactions.

Introduced in 1993, VIES places certain obligations on traders making intra-EU supplies to provide data to tax authorities on these transactions. The aim is to prevent VAT fraud like missing trader fraud in intra-EU trade.

Under VIES reporting, companies have to submit regular declarations with details of their intra-EU supplies of goods and services to VAT registered customers in other EU countries.

Each EU country stores VIES data in a national database accessible to other member state tax authorities for VAT control purposes.

Key Obligations Under VIES

If you are VAT registered and making intra-EU supplies, your main obligations under VIES include:

- Collecting intra-EU VAT numbers of your EU business customers

- Verifying these VAT numbers are valid

- Including both your and the customer's VAT number on sales invoices

- Reporting intra-EU supply values per customer VAT number in periodic VIES returns

- Retaining proof that goods were transported to the other EU country

VIES reporting applies only for supplies made to VAT registered business customers in other EU countries. Supplies to non-VAT registered customers do not get reported.

Sales invoices to EU business customers must contain both your VAT number and the customer's VAT number, properly formatted, for VAT zero-rating eligibility.

VIES Reporting Thresholds

There are no thresholds under VIES - all VAT registered intra-EU traders must file VIES returns regardless of the value or volume of transactions.

VIES reporting is mandatory on a monthly basis if intra-EU goods supply values exceed €50,000 during any month. Otherwise quarterly reporting can be used. For services, quarterly reporting is the default with the option to voluntarily file monthly instead.

If you make no intra-EU supplies in a period, you must still submit a "nil" VIES return to declare this.

When Do I Need to Start Filing VIES Returns?

You must start submitting VIES returns from the period in which you first make an intra-EU supply of goods or services after becoming VAT registered.

VAT registration applications after June 2019 have a specific "domestic-only" or "intra-EU" designation. Only intra-EU registrations trigger VIES return obligations.

If you already have a VAT number issued before June 2019, this is considered an intra-EU registration so VIES requirements apply if you make intra-EU supplies.

Filing Deadlines for Submitting VIES Returns

The deadline for filing your VIES return is the 23rd day of the month after the return period ends.

For example:

- The January VIES monthly return must be filed by 23rd February

- The January-March VIES quarterly return must be filed by 23rd April Late submission of VIES returns can lead to penalties so make sure to file by the deadline.

Completing and Filing VIES Returns

Now that we've covered the basics of VIES, let's look at the detailed steps involved in preparing and submitting your VIES returns correctly:

Information Required on VIES Returns

Your VIES return must include:

- Your VAT registration number

- Customer VAT registration number

- Total value of supplies made to each customer

- Indicator if the supply relates to goods or services

- Any other required supply details like triangulation

You only need to report total supply values per customer VAT number. Individual transaction details do not need to be reported.

If you issued any credit notes during the period, these would reduce the total values declared for the affected customers.

VIES Reporting Format

VIES returns must be submitted electronically in the required XML file format. Fortunately, tax authorities provide ways to easily create VIES returns in this format:

- Direct online filing via the tax agency portal

- Using downloadable spreadsheets or offline tools

- Uploading XML files via API for larger businesses

Paper VIES returns are no longer accepted. The proper VIES digital formats ensure fast and accurate processing of your return data by tax authorities.

Online Filing of VIES via Tax Authority Portal

The easiest way to file your VIES returns is to use the online form available on your tax agency's portal website.

For example, Ireland's tax authority Revenue provides an online VIES return form on its ROS portal. You log in to ROS using your digital certificate, select the VIES return and fill in your supply details per customer VAT number for the period.

Once submitted, the portal generates a PDF receipt as proof of your VIES filing.

This digital certificate login allows tax authorities to securely identify you as the VIES return filer.

Using Excel Templates for VIES Filing

For VIES returns with a larger number of intra-EU customers, online data entry on the portal may be cumbersome.

In this case, you can use spreadsheet templates provided by tax authorities to record details of all your VIES supply data offline.

For example, Revenue offers a VIES Excel template on ROS that can handle up to 6,000 supply lines. You fill this up offline then upload the completed template back onto ROS to file your return.

Again, your digital certificate is used to authenticate that you are submitting the uploaded VIES return spreadsheet.

Online portals may also have data validation checks before accepting your uploaded VIES return to spot any obvious errors for correction.

VIES Filing via XML Upload

Larger businesses with very high volume VIES reporting needs can choose to integrate directly with the tax authority's VIES filing API to automatically generate and submit VIES returns in the required standard XML format.

For example, Revenue offers a Secure File Transfer Protocol for high volume VIES return filers to transmit XML submission files. Access is provided after registering as a large filer.

Here, VIES return data extracted from the company's ERP system is mapped to the required XML file structure and pushed to Revenue's API endpoint using suitable connectors.

As before, digital certificates are used to authenticate the identity of the business submitting each VIES return via the API channel.

Making Corrections to Submitted VIES Returns

If you discover an error in a VIES return already filed, you must submit an amendment return to correct it.

Online portals provide an easy way to make corrections to your most recent VIES returns. You access the return for that period, amend the data as required, and submit the corrections.

For older VIES periods beyond the online correction window, you may need to submit a separate VIES correction return indicating the period, original data, and corrected information.

Corrections should be submitted as soon as errors are discovered to ensure tax authority records are updated with the right VIES data.

VIES Return Resources

Besides online filing, tax authorities offer various resources to assist with VIES reporting compliance:

- Guidance documents on VIES obligations and step-by-step filing instructions

- VIES filing manuals

- Downloadable reporting tools and templates

- Online VAT number verification tools

- Helpdesks to respond to VIES-related queries

These resources are extremely helpful for new VIES filers or when dealing with complex VIES reporting scenarios.

VIES Reporting Situations and Examples

Now that you have a broad overview of VIES reporting, let's examine some common scenarios you may encounter and how to handle VIES reporting in those cases:

Reporting Triangular Transactions Under VIES

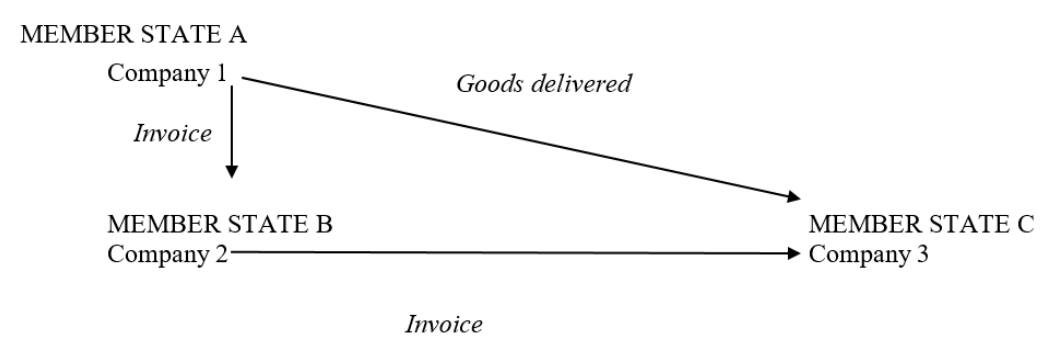

Triangular transactions involve a supply chain with 3 companies - A, B and C. Company A in France sells goods to Company B in Ireland. But Company B instructs Company A to ship the goods directly to Company C in Germany.

Here, Company A reports the supply on its French VIES return showing Germany as the destination country. Company C, the actual recipient of the goods, reports the arrival on its German VIES equivalent as an intra-EU acquisition from France.

Company B does not report this supply on its Irish VIES return since the goods never entered or left Ireland. But any other intra-EU supplies that B makes get reported normally.

|

| Triangulation |

Reporting Call-Off Stock Arrangements Under VIES

Call-off stock refers to goods shipped by the supplier to the customer's location but held in stock. The customer subsequently takes ownership only when calling off those goods from the stock as needed.

Here, the supplier reports the goods movement in its VIES return for the period when the goods were first shipped. The customer reports its intra-EU acquisition on its VIES only when ownership is taken by calling off those goods from the stock.

VIES Reporting for Distance Sales

For intra-EU distance sales to non-VAT registered individuals, the general VIES reporting rules apply. If you exceed the distance selling registration threshold for another EU country, you must register for VAT there and report intra-EU supplies to that country in your VIES return.

VIES Reporting If Goods Installed or Assembled in Another EU Country

If you are shipping goods to another EU country for installation or assembly there, you must include the value of these goods in your VIES return. The customer would report the arrival as an intra-EU acquisition on its local VIES equivalent.

If you are installing goods shipped from another EU country, you report the arrival in your VIES once the installation is complete and you take ownership of those installed goods.

VIES Reporting of Returned Goods

Goods returned from customers in another EU country should be reported in your VIES return for the period in which they are returned. You can offset the value against your total supplies to that customer VAT number during that VIES period.

Reporting Credits and Rebates Under VIES

Credits, rebates or discounts granted to EU customers get reported as negative amounts in your VIES return reducing the total supplies for that customer VAT number. Ideally in the same period but if not, then in a subsequent period.

Reporting Intercompany Transfers on VIES

The transfer of goods between group companies in different EU countries are deemed intra-EU supplies and must be reported on VIES. The value to declare for intercompany transfers is the market value of the goods transferred.

This reporting helps prevent abuse of VAT-free movements within a single company.

VIES Numbers Verification

A critical part of VIES reporting is verifying your EU business customers' VAT registration numbers quoted on purchases.

You can validate VAT numbers via the EU's official VIES VAT Number Validation site.

Key things to note:

- Always confirm VAT numbers at the start of trading with new EU customers

- Re-verify numbers periodically in case of changes

- For regular business customers, prior periodic checks may suffice

- The VIES verification site only confirms if a number is valid or not

- It does not provide supplier details for data privacy reasons

- Maintain documentation evidencing your VAT number checks

- Only report verified VAT numbers on your VIES returns

Invalid customer VAT numbers may get flagged during tax authority VIES return validation leading to queries or penalties if not corrected.

Providing VIES Information to Customers

As part of the interlinked nature of VIES reporting, you also need to provide certain information related to your VIES declarations to business customers when requested:

Information to Provide:

- Your VAT number submitted on their country's VIES return

- Total value of your intra-EU supplies to them

- Relevant periods covered

Provide this to help customers verify and reconcile your VIES declarations to those they need to submit in their country.

Format for Providing Information:

- Printout from your accounting system

- Screenshot of your VIES return filed

- Copy of VIES confirmation from your tax authority

Be sure to only share details of supplies made to that specific customer. Other customer data must remain confidential.

Timeframe for Providing Data:

- As soon as possible after filing the VIES return

- Within 1 month from customer's request at latest

Keep documentation of information requests received and your responses provided to customers for audit purposes.

VIES Compliance Visits and Penalties

As part of enforcing VIES reporting obligations, tax authorities may conduct compliance visits to review your records, systems and processes.

Some key areas they can examine include:

- Valid VAT registration certificates for EU customers

- Copies of sales invoices issued with VAT numbers

- Transport evidence proving goods movement

- Accounting system VIES return extraction and filing workflow

- VIES declarations submitted for prior periods

- Information provided to customers related to your VIES declarations

Make sure your documentation clearly supports the intra-EU transactions declared on your VIES returns.

Penalties can apply for breach of VIES reporting obligations such as:

- Not registering for VIES despite required to do so

- Failure to file VIES returns by the deadlines

- Repeated errors or omissions on VIES declarations

- Significant shortfalls in values declared versus actuals

- Not providing VIES data to customers upon request

Appoint someone to monitor VIES compliance requirements and take corrective action promptly if issues arise. Maintaining robust VIES compliance helps avoid penalties.

Brexit Impact on VIES Reporting

Brexit has significantly impacted VIES reporting requirements for trade with the UK.

Since January 2021, the UK is no longer part of the EU VAT territory. This means:

- UK VAT numbers cannot be reported on your VIES returns

- Services provided to UK VAT registered businesses are no longer reported

- Goods sales to UK business customers are now exports

However, Northern Ireland remains aligned to EU VAT rules under the Northern Ireland Protocol. Therefore:

- Northern Irish VAT numbers starting with XI continue to be reported on VIES

- Services provided to Northern Irish VAT registered customers must still be declared on VIES

If you were previously reporting UK VAT numbers, be sure to remove these from January 2021 onwards and instead treat UK transactions as exports on your VAT returns.

Introduction to INTRASTAT

Let's now shift gears to look at INTRASTAT - the EU system for collecting statistics on intra-EU trade in goods.

INTRASTAT replaced customs documentation from 1993 once physical borders were abolished between EU countries.

Under INTRASTAT, companies provide detailed statistical data to customs authorities on goods:

- Dispatched to other EU countries

- Received from other EU countries

This data enables compilation of EU trade statistics needed by customs, tax authorities, statistical offices, businesses, economists and other stakeholders.

Standard INTRASTAT Thresholds

INTRASTAT applies to VAT registered entities with goods trade above set annual thresholds:

- Dispatches > €635,000

- Arrivals > €500,000

If your trade exceeds the thresholds, you must file detailed INTRASTAT declarations - even for "nil" periods.

Thresholds are based on previous year trade levels and determined annually.

When Do INTRASTAT Obligations Start?

You must start filing INTRASTAT declarations in the period your EU trade first exceeds the relevant dispatch or arrival threshold.

For example, if you exceed the €500,000 arrival threshold in October 2023, you must start submitting detailed INTRASTAT arrival declarations from October 2023 onwards.

You continue filing for the rest of that calendar year and the year after unless your EU trade falls back below the thresholds.

Reporting Requirements Under INTRASTAT

INTRASTAT requires various data fields to be reported in your declarations:

For Dispatches:

- Commodity code - 8-digit CN code

- Customer VAT number

- Invoice value

- Delivery terms

- Country of origin

- Nature of transaction

For Arrivals:

- Commodity code - 8-digit CN code

- Country of consignment

- Invoice value

- Delivery terms

- Country of origin

- Nature of transaction

- VAT exclusive value

Statistical value and net weight also required if above high value thresholds. You must report transactions when ownership or physical movement occurs - whichever is earliest based on VAT rules.

The INTRASTAT Reportable Period

INTRASTAT declarations must be submitted monthly and received by the 23rd day after month end.

For example, the January INTRASTAT return is due by 23rd February.

Quarterly reporting is not permitted even for businesses below the dispatch and arrival thresholds.

Commodity Codes for INTRASTAT

An important step in INTRASTAT reporting is classifying goods using the correct commodity code:

- The 8-digit commodity code is from the EU Combined Nomenclature (CN)

- It categorizes goods by product type for customs and statistical purposes

- The first 6 CN digits cover the Harmonized System (HS) global classifications

- The last 2 digits are EU-specific classifications

Finding the Right Commodity Codes

Classifying goods correctly requires understanding what each CN code represents.

Tax authorities provide extensive online guidance and tariff databases to assist with identifying suitable commodity codes.

For example, Ireland's Revenue offers a free Tariff Classification Search tool.

Their classifiers can also help if unable to determine a suitable code yourself.

Commodity code databases are updated annually so always use the current version applicable to your INTRASTAT filing period.

INTRASTAT Data Filing Approaches

Now let's explore the main approaches for submitting your INTRASTAT declarations:

Online INTRASTAT Portals

Most tax authorities provide online INTRASTAT portals allowing manual data entry or file uploads.

For example, Ireland's ROS portal allows:

- Online creation of INTRASTAT arrivals and dispatches

- Uploading Excel templates pre-populated with INTRASTAT data

- XML filing for larger businesses

The portal uses your digital certificate for secure login and submission.

Spreadsheet INTRASTAT Declarations

Tax authorities provide Excel templates enabling offline preparation of INTRASTAT data for upload.

For example, Ireland offers the ROS Offline Application for populating INTRASTAT Excel templates.

Once completed, these can be uploaded to the online portal for submission.

This avoids manual online entry but still allows some structured data checks before filing.

API-Based INTRASTAT Automation

Larger companies can invest in automating INTRASTAT filing by:

- Extracting required data from ERP and accounting systems

- Transforming into the official INTRANSTAT XML schema

- Submitting declarations via APIs provided by tax authorities

For example, Ireland offers a Secure File Transfer Protocol API for automated INTRASTAT filing.

This requires IT effort but reduces manual processes and improves data accuracy.

INTRASTAT Return Resources

Useful resources offered for INTRASTAT filing include:

- Online threshold checkers

- Classification databases

- CN commodity code search engines

- INTRASTAT declaration manuals

- Reporting tools and Excel templates

- XML schemas and API documentation

- Online helpdesks and contact information

These help ensure complete and accurate INTRASTAT declarations.

Special INTRASTAT Reporting Situations

INTRASTAT reporting has specific rules for certain transactions:

Reporting Goods Sent for Processing

Goods sent to another EU country for processing are declared on dispatch at their value when sent. After processing, the return movement is reported on arrival at the new enhanced value after processing.

Reporting Repair and Replacement Goods

Goods sent to another EU country for repair are reported on dispatch at their value when sent. Return movements after repair are reported on arrival at the repaired value.

Replacement goods sent free of charge to another EU country are excluded from INTRASTAT. However, return of defective goods being replaced are reported.

Reporting Installations and Assemblies

The value of goods shipped for installation or assembly in another EU country is reported on dispatch. The recipient reports the arrival after successful installation when ownership transfers.

Conversely, arrivals of goods from the EU for local installation are reported on the INTRASTAT arrival after installation when ownership changes.

Reporting Goods in Triangular Trade

In triangular trade, goods move directly from country A to C though sold by B to C. Here, A reports dispatch to C and C reports arrival from A only. B does not declare a dispatch since the goods never enter or leave there.

INTRASTAT Compliance and Penalties

Like with VIES, INTRASTAT compliance visits aim to verify your reporting workflows match actual intra-EU goods movements:

Areas Checked During INTRASTAT Audits:

- Processes for collecting and extracting INTRASTAT data

- Commodity classification and coding approaches

- Declaration creation, verification and filing procedures

- Alignment of reported data with customs and commercial documentation

- Submission of complete, accurate and timely INTRASTAT declarations

- Record keeping related to INTRASTAT reporting

The penalties for breaching INTRASTAT obligations can include:

- Failure to register despite being over the thresholds

- Not submitting declarations by the deadlines

- Persistent reporting errors or omissions

- Significant shortfalls in values declared versus actuals

- Missing or inadequate INTRASTAT records

Having robust INTRASTAT compliance controls will help avoid penalties during audits.

Brexit Impact on INTRASTAT

Brexit has also affected INTRASTAT reporting requirements:

- Since January 2021, trade with Great Britain is excluded from INTRASTAT

- GB-related declarations now use customs export/import processes

- Trade with Northern Ireland remains reported under INTRASTAT using country code XI

Ensure previous GB transactions are removed from declarations and customs procedures used for trade with Great Britain.

Final Thoughts

VIES and INTRASTAT reporting are mandatory for all VAT registered EU businesses engaged in intra-EU trade of goods and services. With strong compliance processes, your business can avoid penalties and reap the benefits of smooth intra-EU trade!