Understanding DAC7- The EU's New Reporting Rules for Digital Platforms

The European Union has introduced a major new tax transparency regulation called DAC7 that will significantly impact how digital platforms operate. This far-reaching legislation aims to give EU tax authorities enhanced visibility into the activities of online sellers using platforms like Amazon, Airbnb, Uber, Etsy, Upwork and many more.

What is DAC7?

DAC7 refers to the 7th Directive on Administrative Cooperation adopted by the EU. It builds on the existing DAC framework for tax transparency that already requires financial institutions to report information under FATCA and CRS.

Now, DAC7 expands these reporting obligations to cover digital platforms facilitating certain business activities. The goal is to give EU tax authorities visibility into the earnings of platform sellers in order to properly tax their income.

|

| DAC7 Explained |

Which Platform Activities are Impacted?

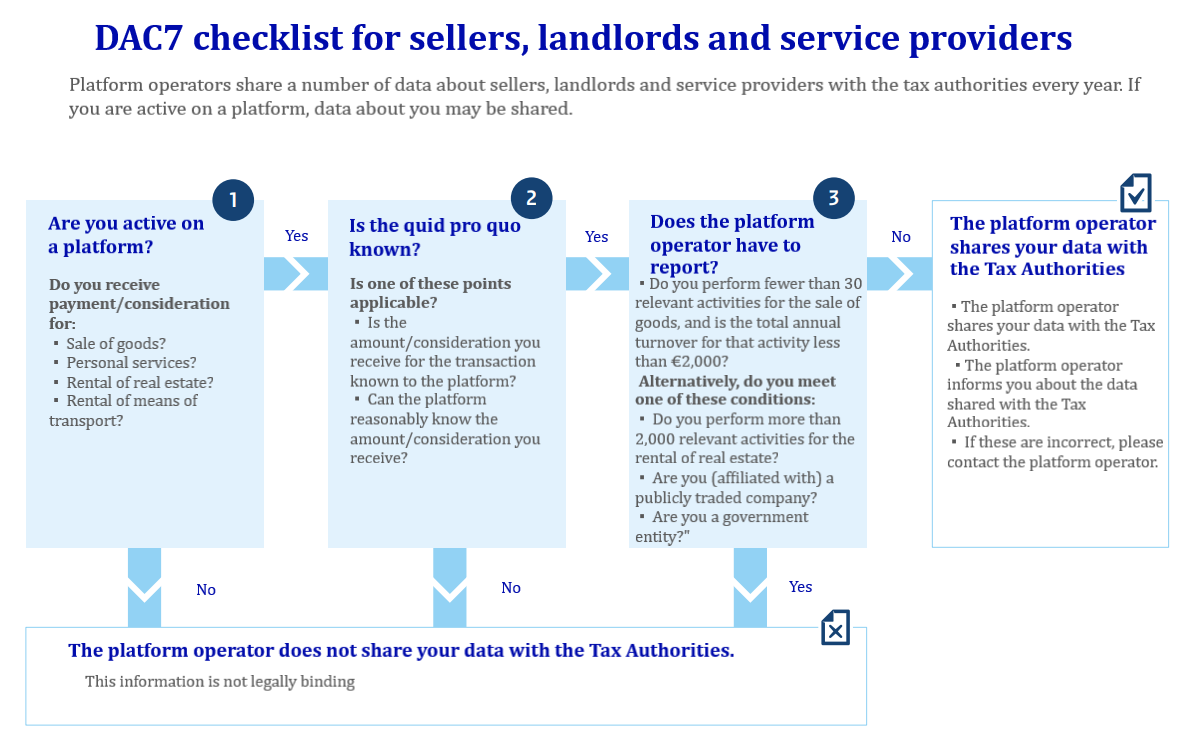

DAC7 applies to platforms that enable the following relevant activities:

- Rental of real estate property, both residential and commercial

- Provision of personal services

- Sale of goods

- Rental of any mode of transport

Platforms only involved in ancillary activities like payment processing, listing/ads or customer referrals are excluded.

Seller transaction thresholds also apply. Those with less than 30 reportable transactions for goods sales under €2,000 annually are excluded. Special rental property thresholds exist too.

Who Must Report Under DAC7?

The actual reporting obligation falls on the platform operator. This includes platforms based both inside and outside the EU if they facilitate relevant activities by EU-based sellers.

Specifically, reporting platforms include those:

- Tax resident in the EU

- Incorporated or managed in the EU

- With a permanent establishment in the EU

Non-EU platforms still need to report on EU sellers meeting the threshold criteria. However, they may be exempted if their home country already exchanges similar platform data with the EU.

|

| DAC7 checklist for Platforms |

|

| DAC7 checklist for sellers |

What Data is Reported Under DAC7?

Platforms subject to DAC7 must gather and accurately report various identification and financial details on in-scope sellers such as:

- Full legal name and primary address

- Country of tax residence

- VAT/tax ID numbers

- Financial account details

- Total gross revenues per calendar quarter

- Any commissions, fees or taxes withheld

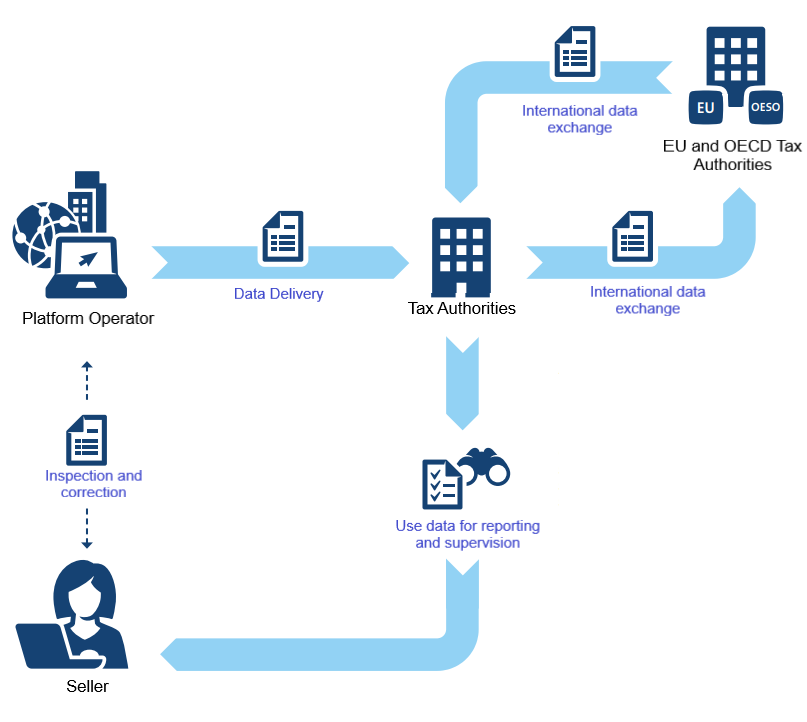

This data will then be automatically shared between EU tax authorities to properly monitor cross-border activity.

When Does DAC7 Reporting Start?

EU member states had to adopt DAC7 into national law by the end of 2022. The first reports containing 2023 data are due by January 31, 2024. After that, reporting will be on an annual basis.

Reporting deadlines are tight - platforms must report within one month of each calendar quarter ending. And the data gets exchanged between tax authorities two months after each reporting period.

How Will DAC7 Reporting Work?

Platform operators have to submit their DAC7 reports electronically to the tax authority in the EU member state where they meet the required nexus criteria. This is often the platform's country of tax residence.

If a platform has nexus in multiple member states, it can choose which one to report to. Non-EU platforms will need to register and report in one member state of their choice.

Standardized XML schemas and submission procedures are still being finalized. This information will be made available to allow seamless sharing of data between platforms and EU tax authorities.

What Are the DAC7 Penalties?

Penalties for non-compliance are left to each EU member state but must be "effective, proportionate and dissuasive". Additional measures can be enacted to enforce compliance if needed.

Platforms are also required to close non-responsive seller accounts after two reminder notices and 60 days lapse. Banning re-registration may also occur until the seller provides the required data.

How Should Platforms Prepare for DAC7?

To ensure compliance, platforms should take actions such as:

- Assess if DAC7 applies based on activities offered

- Identify what seller data needs collecting

- Update contracts to inform sellers of new data use

- Build/update IT systems and processes for reporting

- Register for reporting in an EU member state if required

- Test transmission of sample report data

- Update privacy policies to cover data reporting

Although complex, advanced preparation will help platforms smoothly adapt to DAC7 reporting while avoiding penalties.

Our take

DAC7 represents a major expansion of the EU's tax transparency framework to cover digital platforms. It's essential for platforms to urgently assess if they are impacted based on the business activities they facilitate.

Those in scope will need to build up processes for collecting and reporting detailed seller information starting in 2023. Careful planning and early engagement with tax authorities is crucial to meet the tight reporting deadlines while avoiding penalties.

With the appropriate measures in place, digital platforms should be able to successfully integrate DAC7 reporting into their operations. Although compliance may seem burdensome initially, this new standard will soon become business as usual.

The long term effects of DAC7 reporting remain to be seen. But the EU believes this data sharing represents a critical step toward properly taxing platform-enabled transactions. One definite result is much greater tax authority visibility into the inner workings of platforms and their sellers.