Understanding GoBD Compliance for Businesses in Germany

In Germany, all businesses are required to follow strict accounting and record-keeping principles laid out in the "GoBD" - the Generally Accepted Principles for Proper Accounting. Failure to adhere to GoBD can have serious consequences, like tax penalties and reassessments. This guide explains what GoBD compliance entails and how businesses can avoid common mistakes.

What is GoBD?

GoBD stands for "Grundsätze zur ordnungsmäßigen Führung und Aufbewahrung von Büchern, Aufzeichnungen und Unterlagen in elektronischer Form sowie zum Datenzugriff" (Generally Accepted Principles for Proper Accounting and Retention of Books, Records and Documents in Electronic Form as well as Data Access).

Introduced in 2014 and updated periodically, GoBD sets the standards for proper record-keeping and accounting for tax purposes when using electronic systems. It applies to all taxpayers in Germany, including small businesses, freelancers, corporations, non-profits and others required to retain business records for tax purposes.

Key Requirements of GoBD

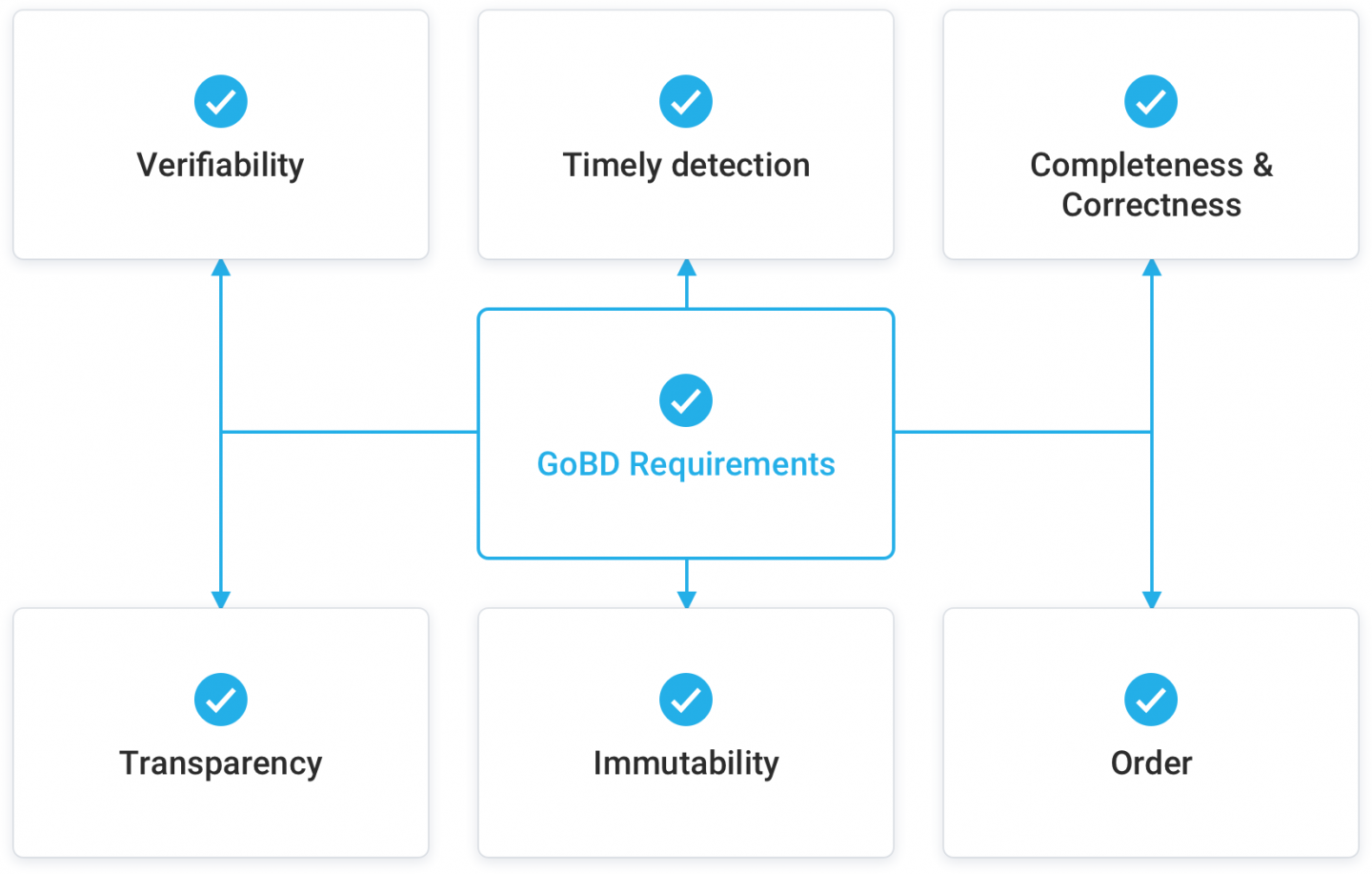

While GoBD compliance entails many specific rules, the core principles are:

- Records must be understandable and verifiable. All transactions must be documented clearly and comprehensibly.

- Records must be complete and accurate. No transactions can be omitted, falsified or misrepresented.

- Transactions must be booked promptly. Deadlines range from daily to 10 days.

- Records must be properly ordered and archived. Proper filing structure must be maintained.

- Records must be unalterable. No manipulation or changes to stored documents.

- Records must be accessible. Tax authorities can request data and organizations must provide access.

|

| GoBD requirements |

Scope of GoBD

GoBD covers all business transactions that have tax relevance. This includes documents from:

- Financial accounting

- Inventory management

- Payroll

- Invoicing

- Order processing

- Correspondence with tax implications

- Travel expenses

- Contracts

- Banking records

Basically any system, process or document with information relevant for taxes falls under GoBD rules.

GoBD for Digital Documents

GoBD was created in response to the shift from paper to electronic records in business. It aims to adapt existing principles for handling paper documents to the digital age. Key requirements for electronic documents per GoBD include:

- Digital reproduction of paper records must preserve content and completeness. Scanning guidelines must be documented.

- Digital natives like emails, electronic bank records etc. must be properly stored in original formats.

- Storage formats must be standardized, machine-readable and cannot be proprietary black boxes. PDF/A is recommended.

- Meta-information like record type, creation date, affiliations etc. must be retained.

- Electronic records must have proper access controls and encryption.

- Original files must be retained after any format conversion or migration.

- Changes and deletions must be protocolled. System must generate audit trail.

- Data must be backed up regularly to prevent loss. Archiving timeframes apply.

Consequences of Non-Compliance

Violations of GoBD during a tax audit gives authorities the right to dismiss all records and accounting documents. This forces them to estimate taxes owed, often leading to higher tax burdens.

In addition, lack of GoBD compliance can warrant immediate penalties of up to €25,000 by tax authorities. Other common consequences include:

- Disallowing deductions due to lack of documentation

- Paying back subsidies or credits taken

- Fines for late filing or errors

- Mandatory increased audit frequency

- Reputational damages and lack of investor trust

- Suspension of tax assessment if records deemed unusable

- Criminal proceedings in case of willful manipulation

Avoiding GoBD Mistakes

Many businesses struggle with full GoBD compliance. Common pitfalls include:

- Missing or inadequate process documentation

- Lack of structured filing systems

- Inconsistent booking intervals

- Saving records in non-compliant formats like Word documents

- Not retaining originals after digitization or conversion

- Failure to properly log changes, deletions and corrections

- Not securing data against manipulation

- Not backing up data adequately

- Not granting tax auditors proper data access

By avoiding these missteps and keeping up-to-date with evolving guidelines, businesses can reap the efficiency benefits of digital records while maintaining GoBD compliance.

GoBD Compliance Software

Dedicated GoBD audit-proof accounting and archiving systems can greatly simplify compliance. Features to look for include:

- Maintaining indexed document history and audit trails

- Encryption and access controls

- Regular automated backups

- Support for compliant formats like PDF/A

- Seamless handling of paper digitization

- Change logging at record and field level

- Workflow automation and reminders

- Role-based access and permissions

- Easy retrieval for tax audits

- Support for common tax-relevant data like invoices