A Guide to the Import One Stop Shop (IOSS)

This post is also available in: Español|中文

This post is also available in: Español|中文

The Import One Stop Shop (IOSS) is a new scheme introduced as part of the EU’s eCommerce Package that came into effect on July 1, 2021. It allows suppliers selling goods from outside the EU to customers within the EU to collect and remit the VAT due at import through a simplified monthly return, instead of the VAT being collected at the time of importation.

The IOSS aims to simplify VAT collection on low-value imported goods and provides benefits for both suppliers and consumers. It enables suppliers to deal with VAT registration, collection, reporting and payment in the EU through a single point of registration. For consumers, it avoids unexpected additional VAT charges and delays on delivery that may occur if VAT is due at the point of importation.

Overview of the IOSS

Prior to July 1, 2021, goods imported into the EU with a value of less than €22 were exempt from VAT. On July 1, 2021, this low-value exemption was removed meaning VAT is now due on all goods imported into the EU regardless of their value.

To facilitate VAT collection and avoid delays for low-value goods, the eCommerce Package introduced the IOSS. This allows suppliers based outside the EU to collect, declare and pay import VAT for consignments not exceeding €150 in value through a monthly return in one EU Member State.

Use of the IOSS is optional. Suppliers not using the IOSS must pay import VAT at the time goods are imported as before.

Some key points about the IOSS:

- It can only be used for goods with a value of €150 or less, excluding excise goods

- VAT must be collected from the customer at the point of sale

- Suppliers or intermediaries acting on their behalf submit monthly VAT returns detailing VAT collected per EU Member State

- VAT is remitted to the Member State of Identification by the end of the month following the import

- Goods can pass through customs controls without payment of VAT if a valid IOSS VAT Identification Number is declared

Benefits of the IOSS

Use of the IOSS provides important benefits and simplifications for both suppliers and consumers.

For suppliers, the key benefits are:

- VAT registration in just one EU Member State to cover all EU distance sales of imported goods up to €150

- Single monthly return and payment to cover VAT due across the EU

- No payment of import VAT at the border which speeds up customs clearance

For consumers, the benefits are:

- VAT is paid at point of sale so no unexpected VAT charges or delays on delivery

- Simplified customs declaration references IOSS VAT ID instead of individual’s details

By declaring and paying VAT upfront through the IOSS, the process of importing low value goods is significantly streamlined.

Suppliers avoid having to register for VAT separately in all Member States into which they import goods. For consumers, delivery delays and administrative hassles are reduced as VAT has already been collected and customs simply have to confirm the validity of the IOSS VAT ID.

Supplies Covered by the IOSS

The IOSS can only be used for specific types of supplies of goods. To fall within the scope of the scheme, all of the following conditions must be met:

- Goods must be located outside the EU at the time of sale

- Goods must be sold via distance selling to non-taxable customers in the EU

- Goods must be physically transported or dispatched from outside the EU to customers in the EU

- Goods must be dispatched in consignments not exceeding €150 in intrinsic value

- Goods cannot be subject to excise duties

Distance selling refers to situations where the supplier is responsible for the transportation or dispatch of the goods from outside the EU. This includes where the supplier engages a third party to deliver the goods to the customer.

The intrinsic value refers to the value of the goods themselves excluding transport and insurance costs, unless those costs are included in the sales price and not itemized separately on the invoice.

Types of goods excluded from the IOSS besides excise goods are new transport vehicles and goods supplied after assembly or installation in the EU. Goods already stored in an EU warehouse cannot be sold under the distance selling arrangements of the IOSS.

Who Can Use the IOSS?

The IOSS can be used by suppliers established both within and outside the EU.

Suppliers established within the EU can register for the IOSS in their own Member State to account for VAT on eligible distance sales of imported goods from outside the EU.

Suppliers established outside the EU can also access the IOSS but through different mechanisms depending on where they are based:

- Suppliers based in third countries covered by a relevant mutual assistance agreement (currently only Norway) can register directly in any Member State

- Suppliers based in all other non-EU countries must appoint an intermediary established in the EU to fulfill IOSS obligations on their behalf

Electronic interfaces such as marketplaces can also use the IOSS as deemed suppliers if they facilitate sales by third country suppliers to EU consumers and those sales are distance sales of imported goods within the scope of the scheme.

VAT Registration for the IOSS

The process for registering for the IOSS depends on whether the supplier is based within or outside the EU.

Suppliers established in the EU (including electronic interfaces deemed to be suppliers):

- Register directly in their own Member State

- Provide name, address, VAT number and website

- Will be issued an IOSS VAT Identification Number

Suppliers established outside the EU:

- If based in Norway, can register directly in any Member State

- If based elsewhere, must appoint EU-established intermediary

- Provide name, address, VAT no (if registered outside EU), website

- Intermediary will be issued IOSS VAT ID Number to use

Member State of Identification:

- For EU and Norway suppliers - Member State of registration

- For other 3rd country suppliers - Member State where intermediary is established

Registration is done electronically through the VAT OSS portal for the Member State of Identification.

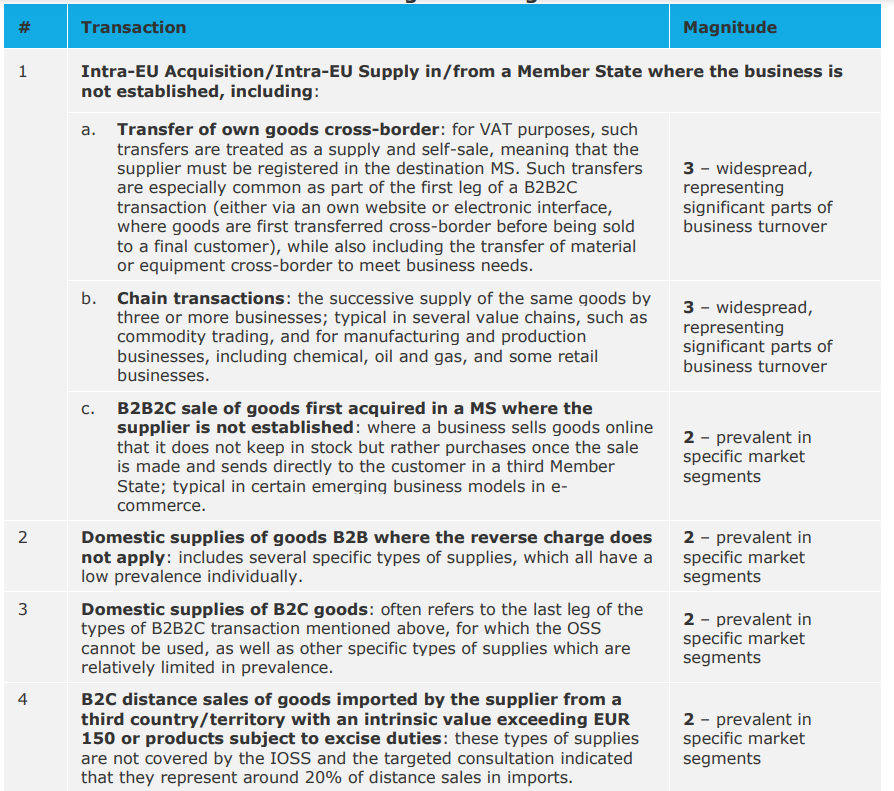

|

| Summary of transactions that require VAT registration by nonestablished businesses and their degree of magnitude |

The Role of Intermediaries

Suppliers based outside the EU, except those in Norway, must appoint an EU established intermediary to fulfill IOSS obligations on their behalf.

An intermediary is a taxable person established in the EU who registers and declares IOSS VAT on behalf of the third country supplier. The intermediary is responsible for:

- Registering the supplier for the IOSS

- Filing monthly IOSS VAT returns

- Paying the VAT due to the tax authorities

The VAT liability remains fully with the supplier. Intermediaries facilitate compliance and reporting.

Key points about IOSS intermediaries:

- Must have an establishment in the EU

- Does not need to be an IOSS specialist and can conduct other business activities

- Subject to normal VAT registration requirements in Member State of establishment

- Must register as an intermediary before acting on behalf of IOSS suppliers

- Will be issued a unique IOSS Identification Number

- Can represent multiple suppliers at the same time

While optional for EU suppliers, the use of intermediary is mandatory for imports under IOSS by suppliers based outside the EU and Norway.

Registering as an Intermediary

Persons established in Ireland who wish to act as intermediaries for IOSS suppliers must take the following steps:

- Obtain a Tax Advisory Identification Number (TAIN)

- Apply by post or email to the National TAIN Unit

- Register for VAT in Ireland if not already VAT registered

- Register as IOSS intermediary via Revenue Online Service (ROS)

- Will be issued a unique IOSS Identification Number (IN)

- For each supplier represented, submit IOSS Intermediary Link Notification Form

- Issued separate IOSS VAT ID for sales by each supplier

The registration process ensures the intermediary has been authorized to act on behalf of third country IOSS suppliers before an IOSS VAT Identification Number is issued.

When Registration Takes Effect

Registration for the IOSS takes effect from the date the VAT Identification Number is issued to the supplier or intermediary. This enables immediate use of the IOSS scheme.

For EU suppliers, this is the date of issue of their individual IOSS VAT ID after submitting VAT registration details.

For third country suppliers, it is the date the intermediary receives the IOSS VAT ID associated with that supplier, after submitting the Intermediary Link Notification Form.

No sales can be declared retroactively or before the issuance of the VAT Identification Number.

Using the IOSS

When making sales under the IOSS, the supplier must:

- Charge the applicable VAT rate to the customer at the point of sale

- Obtain evidence that VAT has been paid by the customer

- Ensure the correct IOSS VAT ID is provided to customs for import clearance

- Submit monthly IOSS VAT returns detailing sales and VAT collected

The VAT rate to be charged is that which applies in the EU Member State where the customer receives the goods. This is known as the Member State of Consumption.

The Taxes in Europe Database from the EU Commission has details of all VAT rates in force and can help identify the relevant VAT rate.

The VAT collected must be declared and remitted to the Member State of Identification via the monthly IOSS VAT return submitted electronically by the end of the next month.

The return breaks down the total VAT due into the amounts relating to each Member State of Consumption. The VAT is paid to the Member State of Identification along with the return submission.

VAT Return Filing and Payment Obligations

Suppliers or their intermediaries have obligations for reporting under the IOSS they must comply with.

The key obligations are:

Monthly VAT Return Submissions

- Must be submitted electronically by end of month following the return period

- Nil returns must also be submitted if no sales took place

- Returns submitted quarterly for suppliers with EU VAT registration

Return Details

- Breakdown of VAT collected per Member State of Consumption

- Total value of goods per Member State and applicable VAT rate

- Total VAT amount payable

Payment Deadlines

- Full VAT amount to be paid by deadline for return submission

- Paid electronically to bank account in Member State of Identification

Reminders are issued by the tax authority if returns are not submitted or VAT is unpaid. Persistent failures can result in exclusion from the IOSS.

Record Keeping Requirements

Suppliers must retain records of transactions covered by the IOSS for a period of 10 years. Sufficiently detailed records must be made available electronically on request.

The information to be recorded includes:

- Description, quantity, value of goods

- Customer details, invoices

- VAT rates applied and VAT amounts collected

- Evidence of payment

- Delivery details and proof of returns

- Unique order or transaction numbers

EU Member States can request access to these records to verify the accuracy of IOSS VAT returns.

Keeping proper electronic records enables suppliers to comply swiftly with information requests from tax authorities.

Correcting Submitted VAT Returns

Corrections to IOSS VAT returns already submitted must be done through an amendment on a subsequent VAT return.

Amendments are made as follows:

- Select amended return and the Member State of Consumption

- Enter additional or reduced VAT amount attributable to that Member State

- Provide details of the original VAT return period for the transaction

Direct amendments to previously submitted returns are not possible under the IOSS. The self-correction approach avoids the need to submit separate credit or debit notes.

VAT Recovery

Input VAT incurred in the course of IOSS activities cannot be recovered through the IOSS VAT return.

Suppliers must recover input VAT through the normal procedures applicable in each Member State, namely:

- The 13th Directive refund process for non-EU businesses

- The 8th Directive refund process for EU businesses not registered in that Member State

- Deduction through the normal VAT return if registered for domestic business there

The IOSS serves only as a simplified mechanism for collecting and declaring EU import VAT. It does not provide a means for recovering VAT.

Currency Conversion

Where IOSS sales have been made in currencies other than euro, the VAT return must convert amounts to euro using the European Central Bank exchange rate.

The applicable exchange rate is the rate published on the last day of the return period, or where unavailable, the next published rate.

Consistent use of European Central Bank rates ensures fairness and prevents distortions when translating foreign currency transactions into local VAT returns.

Alternatives to the IOSS

While it provides major benefits, use of the IOSS is not mandatory for suppliers.

Suppliers can opt to pay import VAT through normal customs clearance rules and procedures. In that case, VAT will be due at the time of import declaration along with any customs duties.

However, the special import schemes that allow deferred payment of import VAT are only available to IOSS registered suppliers. Suppliers not registered under IOSS must fully pay VAT when goods are declared to customs for importation.

De-registration and Removal from the IOSS

Suppliers or intermediaries can voluntarily de-register from the IOSS by informing the tax authority in the Member State of Identification at least 15 days before the end of the month.

Involuntary removal from the IOSS can occur if:

For suppliers:

- Cease trading or no longer carrying out relevant activity

- No longer meet IOSS eligibility conditions

- Persistent non-compliance with rules e.g. late filing/payment

For intermediaries:

- Do not act on behalf of IOSS supplier for 2 consecutive quarters

- No longer meet conditions for acting as intermediary

- Persistent non-compliance e.g. late filing/payment

Tax authorities can monitor compliance and remove persistently non-compliant businesses for up to 2 years following notice of removal.

Existing MOSS Registrations

Prior to the IOSS, the VAT MOSS scheme applied to cross-border digital services.

MOSS registrations have been automatically migrated over to the new VAT OSS scheme covering digital services.

Suppliers registered under MOSS or the current OSS who also want to use the IOSS must specifically register for it separately. IOSS registration does not happen automatically.

Key Concepts

Some key concepts and terms used in relation to the IOSS are:

- Distance sales of imported goods – goods transported from outside the EU where supplier is responsible for that transportation

- Consignment – goods dispatched simultaneously in same commercial shipment

- Intermediary – EU based taxable person who handles IOSS compliance on behalf of supplier

- Intrinsic value – price of the imported goods excluding transport or insurance costs

- Member State of consumption – where buyer receives imported goods

- Member State of identification – where IOSS registration held

- Taxable person not established in EU – business without fixed establishment in EU

- Third country – non-EU state or territory

Conclusion

The IOSS opens up a simplified, single point VAT compliance regime across the EU for suppliers selling low value goods from outside the bloc. Making registration, reporting and payment easier should increase compliance rates among sellers of imported goods.

For consumers, the upfront collection of VAT through the IOSS prevents unwanted surprises or delays at customs. However, use of the IOSS is optional and normal import VAT rules continue applying for suppliers who decide not to use it.